Supplies running out? According to Bybit, centralized exchange platforms could run out of Bitcoin (BTC) in the coming months. The trend could, however, push the BTC price higher. How?

Exchange platforms running out of Bitcoin?

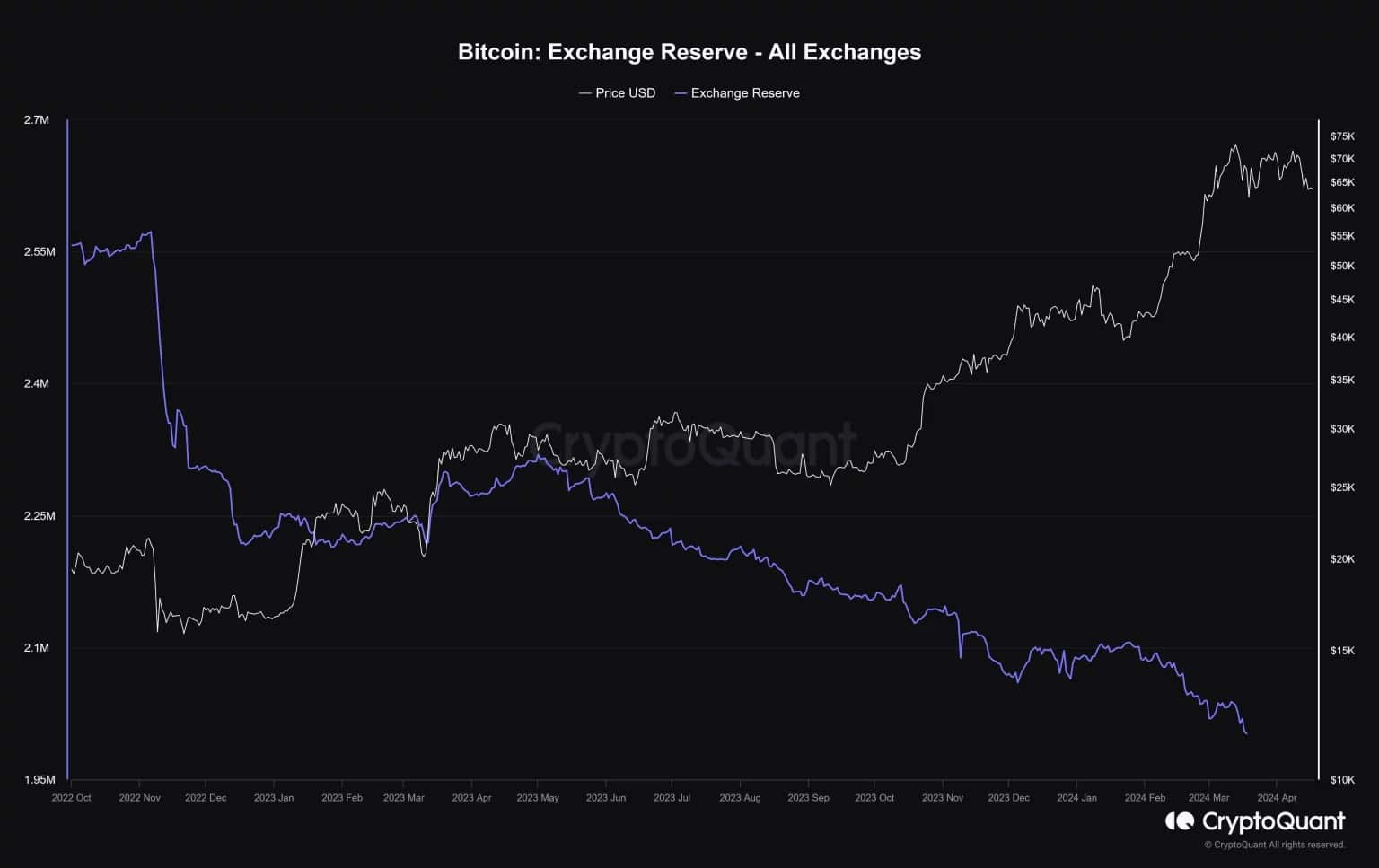

While Bitcoin (BTC) struggles to recover from its weekend plunge, interest in the largest cryptocurrency doesn’t seem to be dented. As halving approaches, exchange platforms are seeing BTC leaving their vaults. This is widely seen as a positive sign: it suggests that investors are repatriating their funds in order to store them in cold wallets, and therefore waiting for a rise.

But, of course, exchange reserves are not infinite. And at the current rate, they could run out. According to a Bybit report published this week, based on current trends, exchanges could run out of Bitcoin in 9 months:

“With only 2 million Bitcoins, if we assume a daily inflow of $500 million to spot Bitcoin ETFs, the equivalent of 7,142 BTC will leave exchange reserves every day. “

If we set exchange reserves against BTC price trends over about 2 years, the trend is very visible:

Exchange reserves fall as BTC price rises

That’s a big “if”, but it does show that Bitcoin is not an infinitely replicable asset, and that the effect of halving on supply is clear. It also shows that the “disinflation” process works for this asset.

Will the price rise after Bitcoin halves?

What’s likely is that the shock of diminishing supply is affecting BTC’s appeal. We’re already seeing the beginnings of a “short squeeze”, according to Bybit, but this would only amplify after the Bitcoin halving of 2024 :

“After halving, the supply shock is going to be much worse. […] A key question will be: how high will the Bitcoin price rise, and what will be the new peak in this cycle? “

Historically, buyers who positioned themselves in the six months leading up to a halving and held their BTC for at least a year came out ahead. However, there’s no guarantee that Bitcoin will follow the same scenario this time around, with macro conditions having a greater impact than before.