In an effort to rescue the US banking sector, the US Federal Reserve (FED) has re-started the printing press: nearly $300 billion has been borrowed in a week. Bitcoin’s fundamentals have been strengthened, and the BTC price has risen 30% since the beginning of the week.

The FED starts printing money again

Earlier this week, the US Federal Reserve (FED) announced a new rescue plan for the banking sector. To put it simply, the money printing press is back in business. The first effects were soon felt: almost 300 billion dollars were borrowed from the US central bank between 9 March and 15 March.

https://twitter.com/GRDecter/status/1636497531050901504

To put it in two words, these two banks owned billions of dollars of low-interest US Treasury bonds. However, the FED’s policy of raising benchmark interest rates for over a year has not only pushed up the yields on long-term Treasuries, but also reduced the value of the bonds held by the banks.

As a result, banks could not obtain sufficient liquidity from the sale of their treasury bills. Thus, they were unable to pay the many customers who tried to withdraw their money from the banks. This is known as a bankrun.

Bitcoin (BTC) is taking advantage of this and climbing

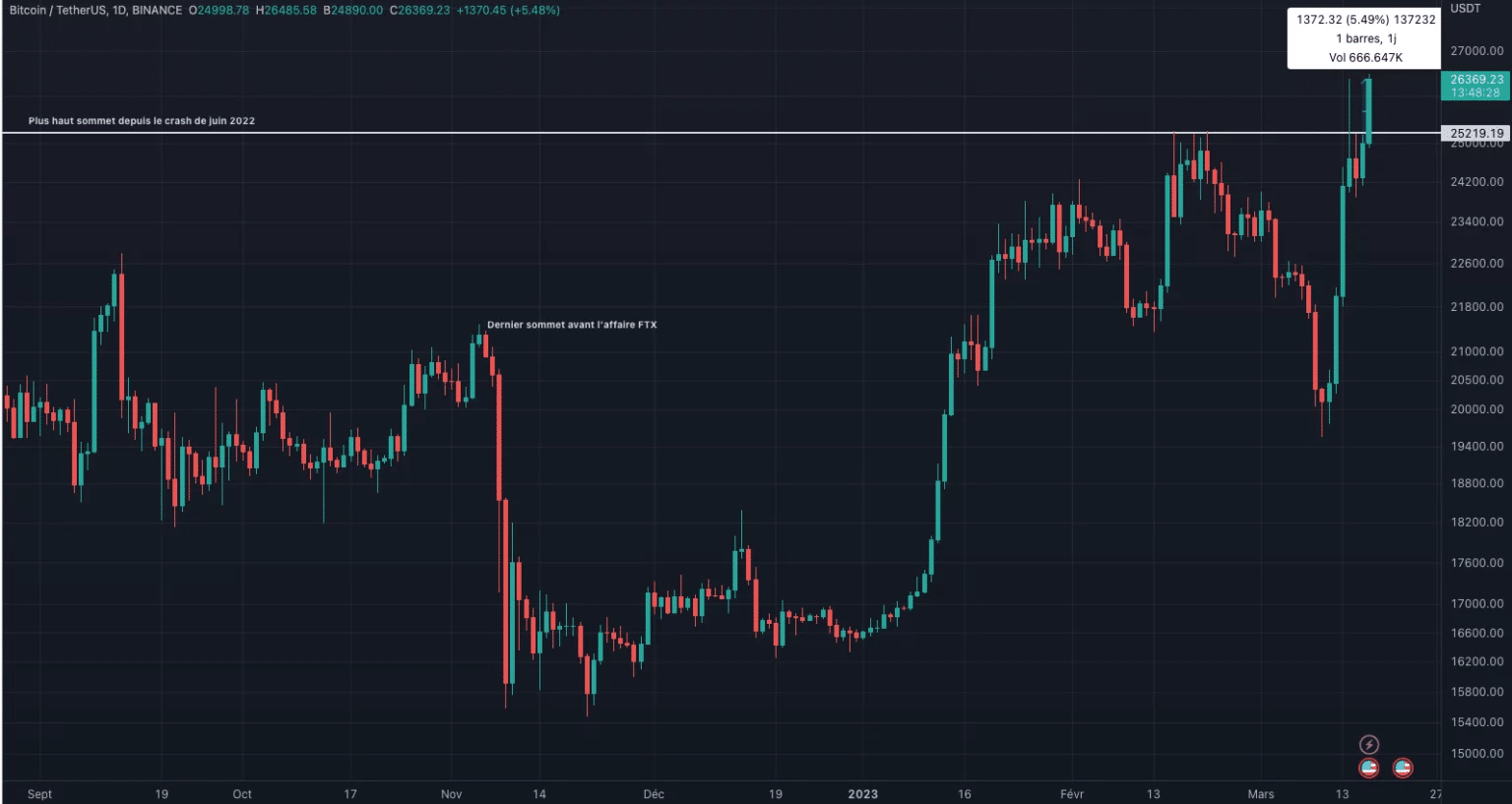

What about the impact on the cryptocurrency market? Somewhat unexpectedly – but still explainable – the Bitcoin (BTC) price has benefited from this climate of concern to restart its bullish rally. At the time of writing, it is again working the $25,000 resistance and may well break through it:

Bitcoin (BTC) price trend in daily scale

The Fed’s much maligned “money printing” is also what artificially boosted the risk markets, including cryptocurrencies, after the Covid crisis. Investors are aware of this and are anticipating the coming situation by increasing their exposure to risky assets, directly benefiting Bitcoin.

In addition to the sweeping risk of a fall in the USDC, this move is also explained by investors’ belief that Bitcoin could have its role to play in the major financial crisis ahead, the one that Satoshi Nakamoto gave it.

Triggered in a panic by policymakers who know they are at the end of a depleted financial system, this coming recession only reinforces Bitcoin’s fundamentals and the importance of holding a stateless currency. Will Bitcoin emerge from this first real financial crisis it has faced

?