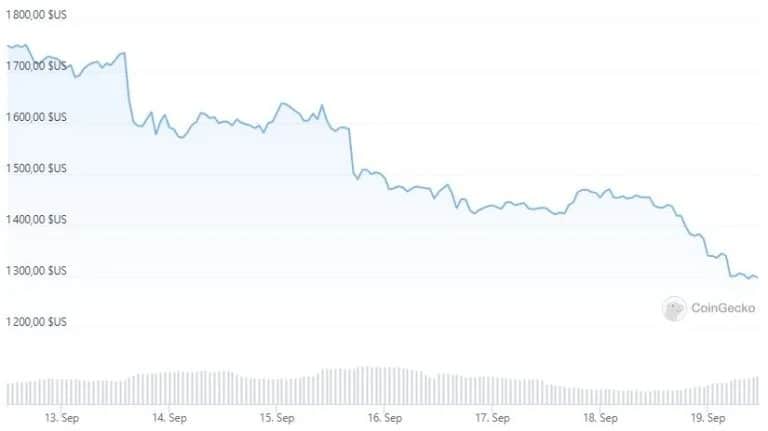

While Ethereum’s update, The Merge, went off without a hitch, the price of Ether (ETH) keeps falling. It has lost 10% in the last 24 hours and almost 25% in the last 7 days. Is there any particular reason for this

?

On September 15, 2022 at 8:42am, the Ethereum blockchain switched to proof of stake. The price of Ether remains stable for a few hours after the Merge and then starts to fall as many thought that this update would send Ether above $2,000. Why does the Ethereum token price keep falling?

On September 15, 2022 at 8:42am, the Ethereum blockchain switched to proof of stake. The price of Ether remains stable for a few hours after the Merge and then starts to fall as many thought that this update would send Ether above $2,000. Why does the Ethereum token price continue to fall?

” Sell the news “

As a well-known adage to stock market and crypto investors it may well be that the shift from Proof of Work (PoW) to Proof of Stake (PoS) was in fact “priceless” long ago. That is, investors had factored the future update of Ethereum into their purchase prices.

Indeed, market participants and investors have been anticipating this update and its impact on the Ethereum network for months. So, now that the update has gone well, these investors are selling their ETH because they have benefited from the price increase before this update.

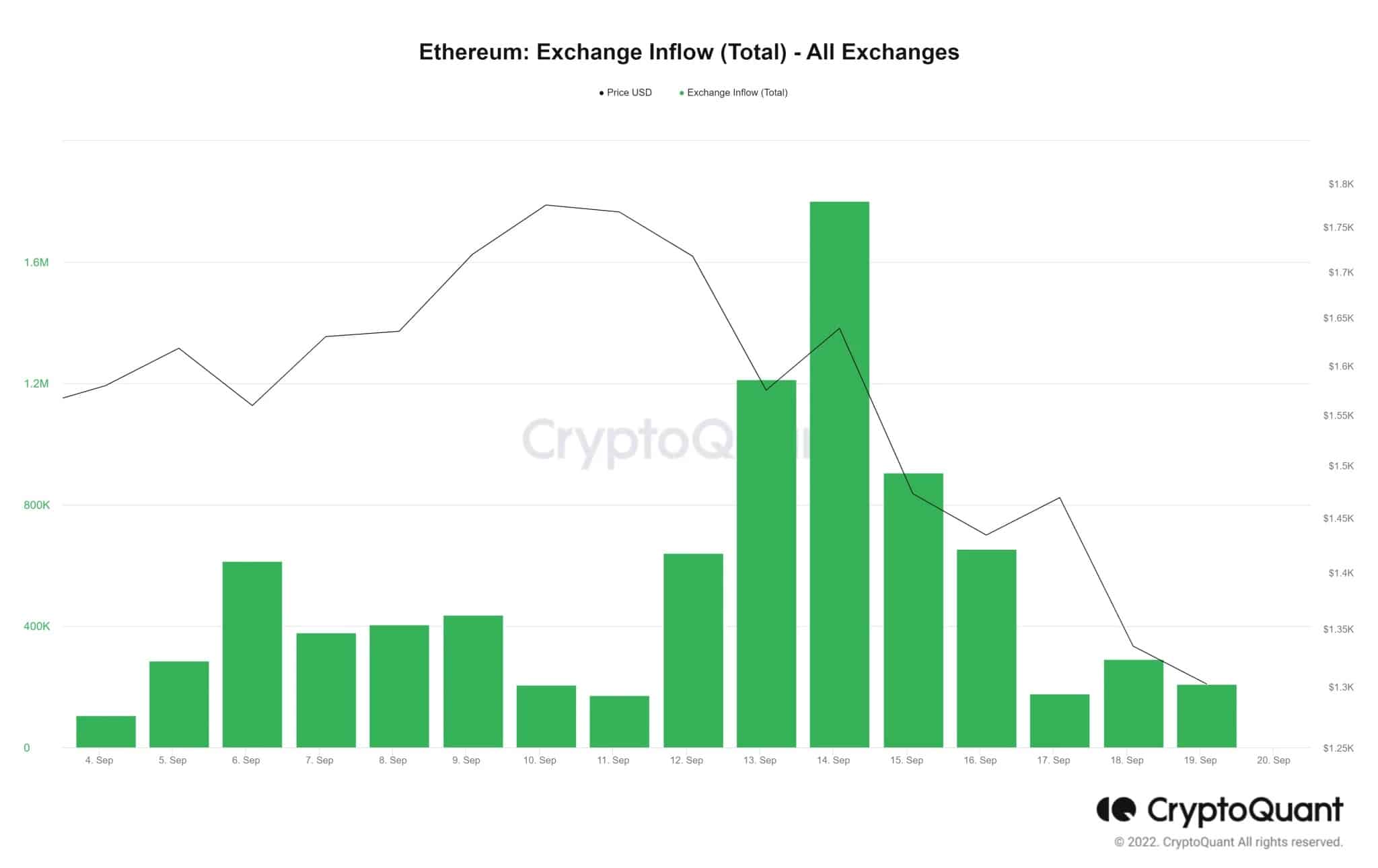

A warning sign is the number of ETH that have recently been deposited on the exchanges. However, this could have been to take advantage of the EthPOW fork and sell it immediately after receiving it. Indeed, each ETH token has been duplicated into an EthPOW token in the users’ wallet.

You can sell the Ethereum fork (EthPOW) on FTX.

A risk of Ethereum being reclassified as a security token

Gary Gensler, Chairman of the Securities and Exchange Commission (SEC) announced that Ethereum’s move to Proof of Stake could result in ETH falling into the security token category. Indeed, people who own ethers can obtain financial rewards through staking. This is not the case with Bitcoin, which is not considered a security token.

If Ethereum, or rather its currency Ether, is considered a security token, this would imply numerous obligations for companies operating on this network, such as investor protection. This could prove complex with the risk of hacking of smart contracts and the like.

Institutional investors not yet won over

Although many investment funds, banks and other entities already own Ether, the market expects this trend to continue over the next few months.

The fact that Ethereum is now “green” with an almost 99.95% reduction in power consumption could make it an ESG investment.