Conducted by JP Morgan, a study reveals that the number of cryptocurrency buyers in the US has increased fourfold since the Covid-19 crisis. During this period, increased growth in household savings has led to an explosion in the number of new cryptocurrency initiates.

Cryptocurrencies are becoming more democratic

JP Morgan, the world’s largest investment bank, recently released a report on the adoption and popularity of cryptocurrencies among US households.

In its study, the financial group estimates that the number of people who have invested in this type of asset has increased fourfold between 2020 and June 2022, from 3% to 13% of the US population.

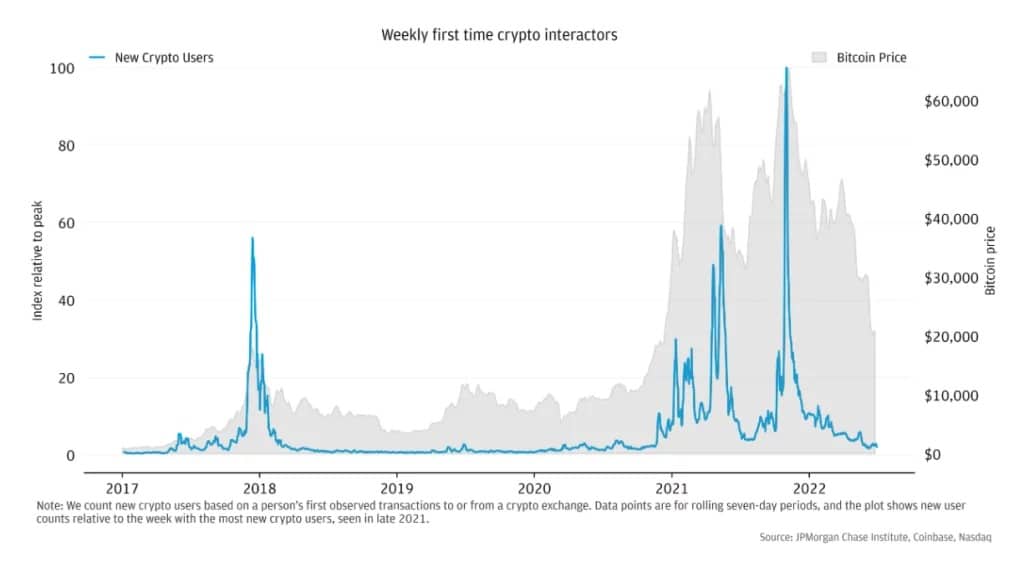

Moreover, the vast majority of newcomers to the cryptocurrency market began investing when Bitcoin (BTC) was hitting its record highs in the spring and fall of 2021:

Figure 1 – Graph representing a person’s first interaction with a cryptocurrency exchange, on a weekly scale.

As a result, while these new entrants quickly found themselves at a loss, the more seasoned investors were able to seize the opportunity to make profits.

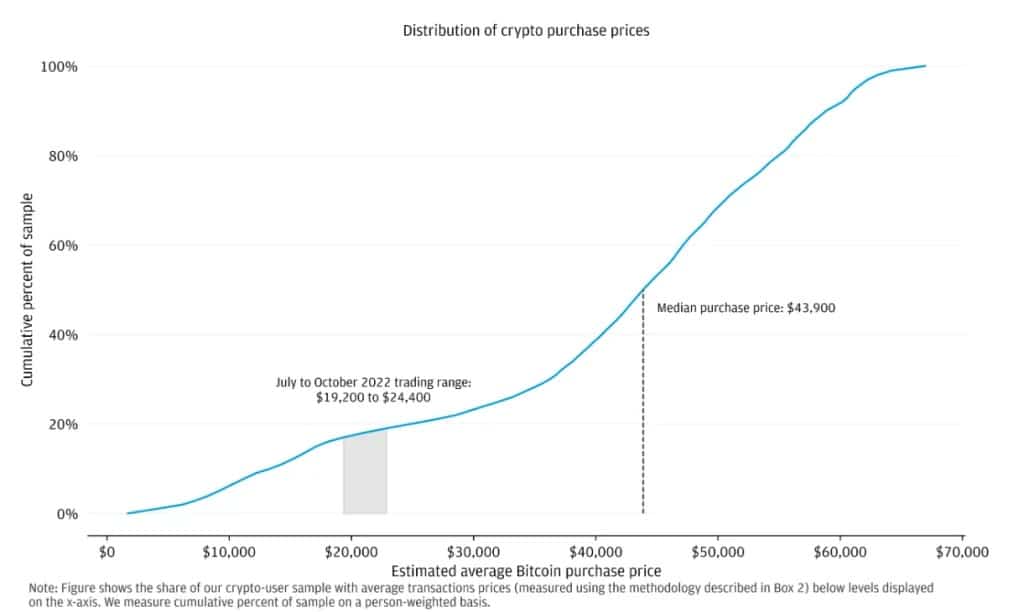

In its study, JP Morgan estimates that the average purchase price of Bitcoin is between $42,000 and $45,000. Furthermore, more than 80% of investors are currently making a loss, according to data released in collaboration with Coinbase and Nasdaq:

Figure 2 – Estimated average purchase price of Bitcoin.

According to the chart, with the price of Bitcoin currently stagnating at around $17,000, we can estimate that 5 out of 6 people are losing on their investments.

To make this chart, JP Morgan looked at the timing of various liquidity transfers from its Chase banking subsidiary to cryptocurrency exchanges, based on the closing price of BTC.

However, this data should be considered as general trends: the methodology used by the study does not allow for a high enough level of precision to ensure percentage accuracy.

Why the cryptocurrency craze?

While critics of the sector cry speculative bubble, there are several tangible factors that can explain this craze for investing in cryptocurrencies.

Firstly, the Covid-19 pandemic has created a substantial savings surplus among a number of households. Caught between a brutal economic crisis and a confused outlook for the future, households turned to cryptocurrencies, as the study highlights:

“US household engagement in cryptocurrencies rose sharply during the COVID-19 pandemic, alongside a substantial increase in the overall personal savings rate. “

From a macroeconomic perspective, to support struggling industries, central banks around the world created massive amounts of money. Before resulting in the current inflation, these money flows fed the financial markets, creating prices that were divorced from any economic reality.

In this way, citizens and institutions turned to cryptocurrencies with the idea of making a profit. According to a report by the Association for Digital Asset Development (ADAN), nearly half of investors see cryptocurrencies as an opportunity to grow their investments.

Today, in the context of the global economic and financial crisis, the cryptocurrency craze seems to be waning. However, the biggest players in traditional finance are stepping up their actions in this sector, starting with JP Morgan which recently filed a trademark for a future digital wallet.