On Monday, Coinbase announced that it had acquired a stake in Circle, the issuer of the USDC. In addition, stablecoin will soon be deployed on 6 new blockchains.

Coinbase takes a stake in Circle, the issuer of the USDC

On Monday, Coinbase and Circle made a joint announcement that the exchange had invested in the stablecoin issuer USDC.

While the exact amount of the investment was not disclosed, it nevertheless strengthens the ties between the two companies. The governance of USDC was initially awarded to the Centre consortium, created by Circle and Coinbase. Today, these two companies have indicated that this separate body is no longer necessary in view of regulatory developments in the United States. As a result, Centre’s activities will now be attached internally to Circle:

“The new structure will streamline operations and governance, and strengthen Circle’s direct responsibility as an issuer, including holding all smart contract keys, complying with reserve governance regulations and enabling USDC on new blockchains. “

As part of the equity investment, Coinbase and Circle will continue to share revenues generated by USDC interest based on the amounts held by each platform. In addition, revenues from other stablecoin use cases will now be shared equally.

6 new blockchains coming soon

While the USDC is now officially present on 9 blockchains, 6 new networks will soon be added. However, the names of these blockchains have not yet been announced.

While it is technically possible for each network to create its own bridged version of a stablecoin like the USDC, it is nevertheless important to turn to its “official versions” to benefit fully from its guarantees. Circle’s reserves only protect USDCs on blockchains where stablecoin is officially recognised.

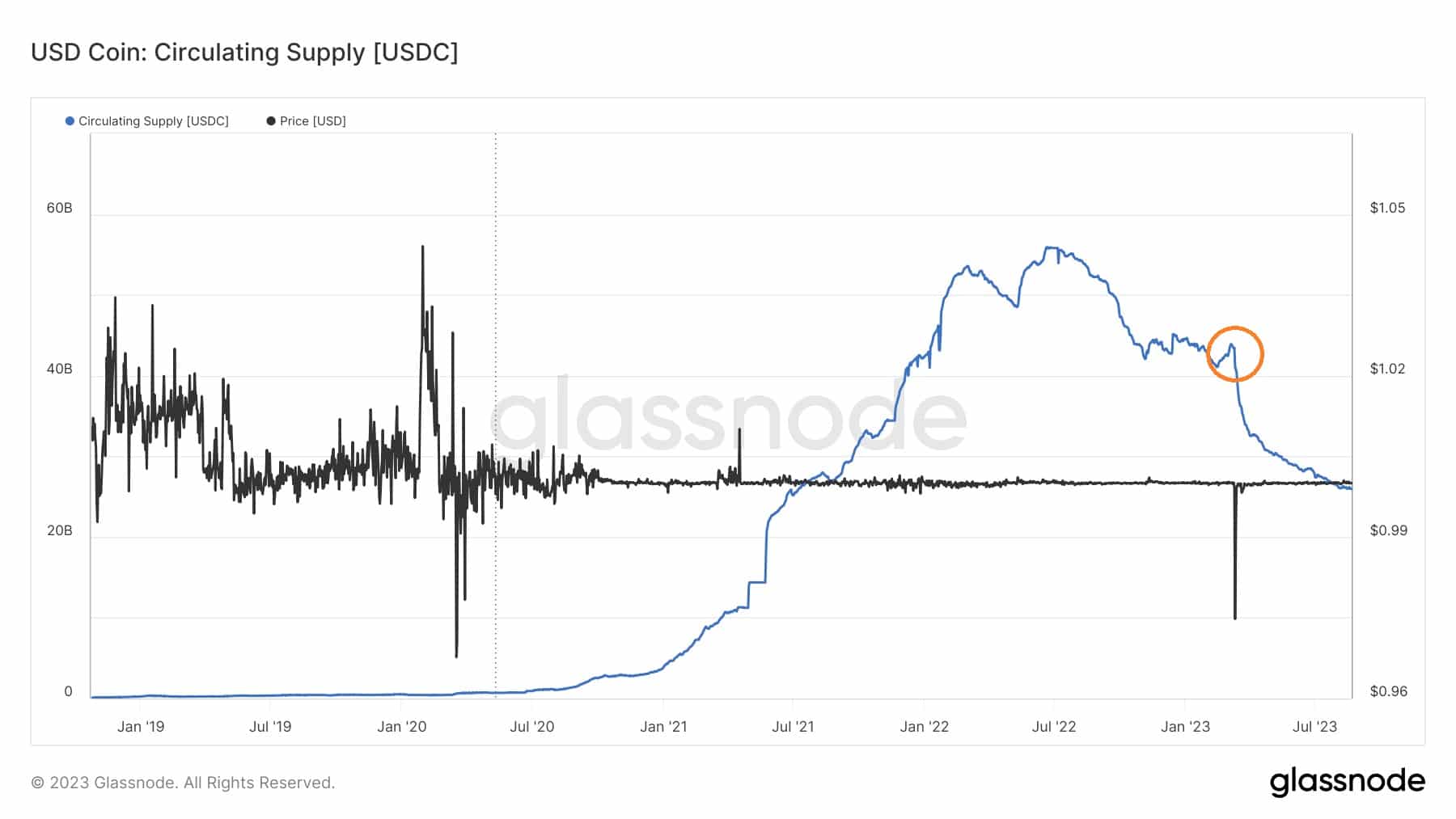

To date, the USDC is the second most capitalised stablecoin on the market, with more than $25.9 billion, compared with nearly $82.8 billion for Tether’s USDT, its direct competitor. At its all-time high (ATH) on 29 June 2022, the USDC was capitalised at $55.8 billion.

As the illustration below shows, the banking crisis in March, which led to the freezing of part of the reserves at Silicon Valley Bank (SVB), dealt stablecoin a major blow. On 12 March, stablecoin still totalled $43.7 billion:

History of USDC capitalisation

While Circle has since shown that it has fully managed the situation, this recent investment by Coinbase could breathe new life into the USDC in the centralised stablecoin market.