Long criticised for mismanaging its investments, Celsius has once again reassured its investors. The platform has repaid $120 million of stablecoin DAI on its Bitcoin (BTC) borrowing position, lowering the liquidation price to $4967.

Celsius pays off its debt

This is a case that has been animating the cryptocurrency ecosystem for several weeks now. As a reminder, the platform was accused of mismanagement of its customers’ funds and overexposure to risky assets. Worse, some experts threatened a potential insolvency in case of too strong a fall of the Bitcoin (BTC) price.

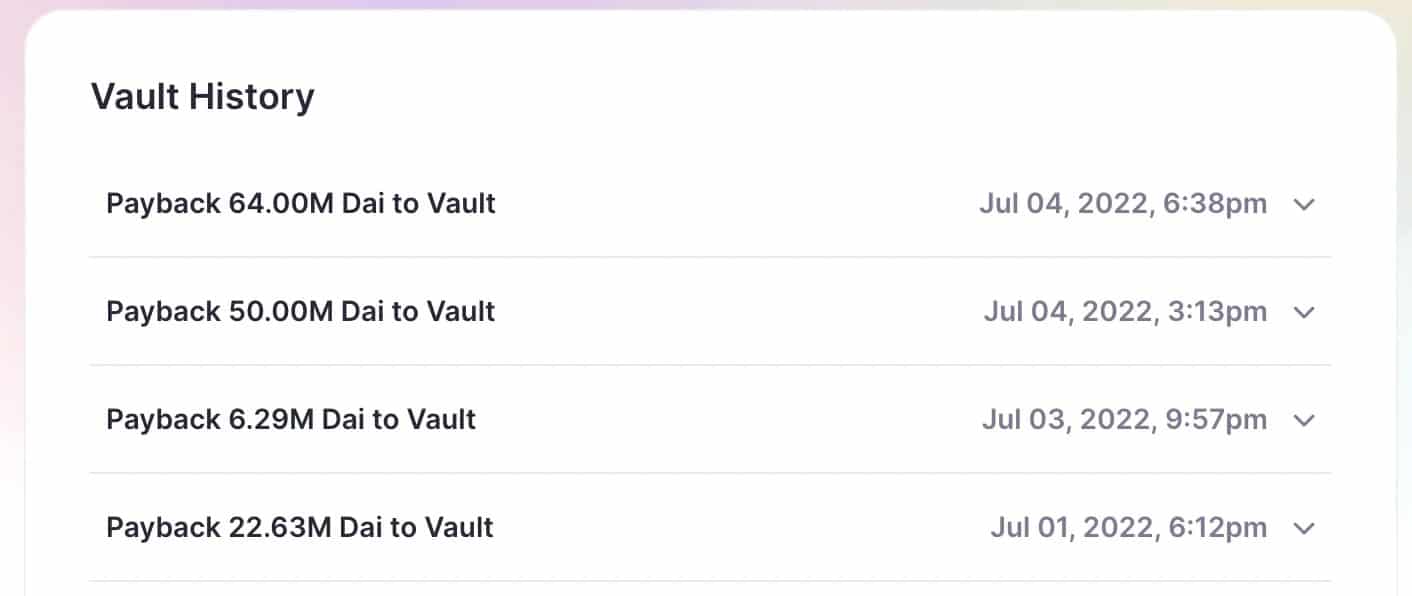

Within a few days, Celsius paid off most of its debt to the decentralised borrowing protocol Maker DAO. More than $120 million of DAI stablecoin has been repaid, as shown in the movement history:

History of Celsius’ movements on its Maker DAO position

By repaying its debt to Maker DAO, Celsius has reduced the risk of potential liquidation of its position. In decentralised finance, liquidations occur when the value of the collateral deposited as security (in this case Bitcoin) falls below the value of the loan.

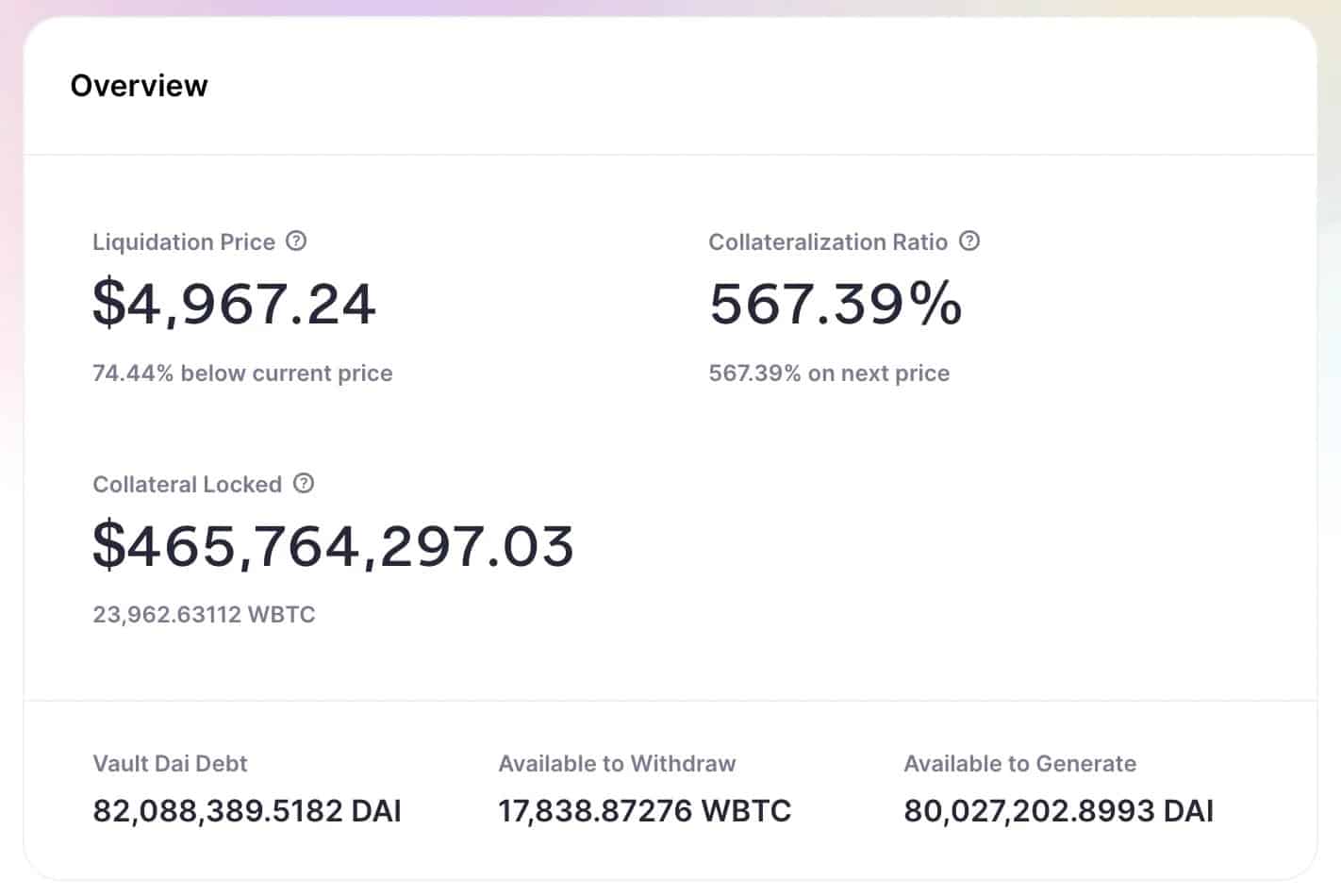

Information on Celsius positions on Maker DAO

Faced with the recent drop in cryptocurrency prices, Celsius has taken the lead in anticipating a potential drop in Bitcoin well below the $10,000 mark. Indeed, the refund lowered the position’s liquidation threshold to $4967 per Bitcoin.

Celsius fund management

These moves by Celsius are notable given concerns about the platform’s solvency amid a decline in major cryptocurrency market assets. Moreover, these fears had been exacerbated when Celsius announced the suspension of transfers and withdrawals from its platform.

To offer attractive returns to its customers, the lending platform has resorted to leveraged borrowing from standalone market makers, including Maker DAO. When a user buys Bitcoin, Celsius converts it into Wrapped Bitcoin (wBTC) and deposits it as collateral on the Maker protocol to borrow stablecoin DAI.

On 13 June, Celsius had over 17,000 wBTC leveraged on Maker. This position risked liquidation if Bitcoin fell below $22,500. In anticipation, the platform deposited almost 7,000 additional wBTC to re-collateralise its position.

A few days later, the Bitcoin fell again and stabilised at the levels it is currently known at, namely close to $19,000. Still, for now, Celsius seems to be navigating this storm relatively well.