Advertisements for Bitcoin ETFs could soon appear on Facebook and Instagram, following in the footsteps of Google. This move by Meta, the parent company of these platforms, could potentially affect millions of users, most of whom probably wouldn’t have shown any interest in cryptocurrencies before.

Soon ads for Bitcoin ETFs on Facebook and Instagram?

It came as a bit of a shock a few days ago: the giant Google has changed its policy on cryptocurrency-related advertising to allow content relating to Bitcoin ETFs to be featured.

A major turning point for these investment vehicles, as Google handles some 8.5 billion searches daily via its eponymous search engine. In other words, the giant belonging to the Alphabet conglomerate holds over 91.6% of the market share in this field.

In a similar vein, we’ve just learned that Meta, the parent company of Facebook and Instagram headed by Mark Zuckerberg, could follow in Google’s footsteps. At least, that’s what the Wall Street Journal recently wrote:

” Facebook and Instagram could soon follow suit. Parent company Meta Platforms is updating its U.S. policies in light of the SEC ruling, a spokesperson said. “

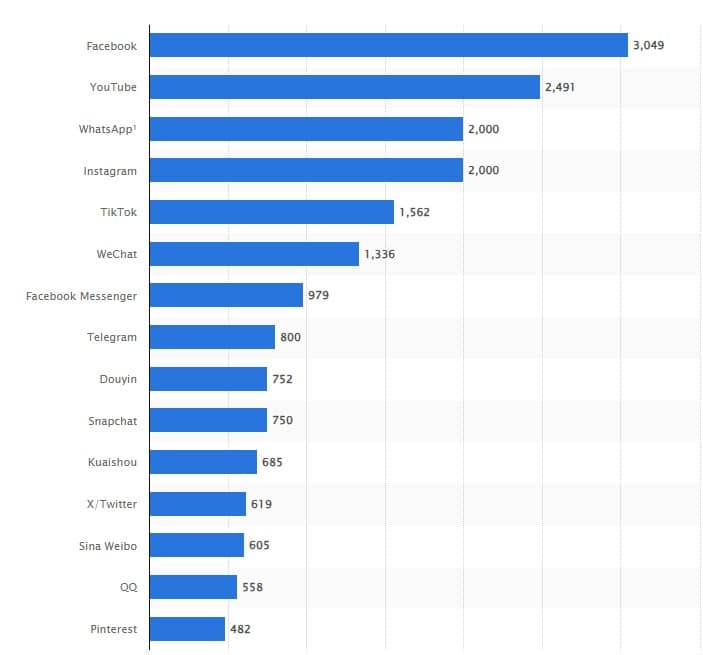

If this information were to become reality, Bitcoin ETF-related ads could well appear in the news feeds of millions and millions of individuals. Indeed, according to data from Statista, Facebook and Instagram feature in the top 4 most-used social networks in the world, alongside YouTube and WhatsApp:

Number of monthly active users on the main social networks (in millions, January 2024)

Together, the 2 platforms total over 5 billion active users. Of course, this includes people using both at the same time.

Boomers, the heart of advertisers’ target audience?

As Eric Balchunas, ETF analyst at Bloomberg Intelligence, points out, the Bitcoin ETFs all offer the same product, with a few exceptions, notably the fees they charge for each one. This is why, apart from the prestige of one or the other, the marketing aspect of these investment vehicles is already and will be quite decisive for the future.

“They’re all doing the same thing. That puts a lot of pressure on marketing, because, all things being equal, that’s how you stand out.”

Eric Balchunas, ETF analyst

In fact, companies offering Bitcoin ETFs, from BlackRock to Bitwise and VanEck to Ark Invest, have clearly understood that they need to appeal to the public who wouldn’t go into cryptocurrencies on their own. Indeed, let’s not forget that, by definition, ETFs enable exposure to an asset without actually owning it.

Since holding Bitcoin is sometimes a barrier for some potential investors, ETFs are an obvious solution.

In a VanEck advertising video published on January 10 on X, for example, we can see a conversation between a mother and her child, who explains that ETFs are now an “easy” way to gain exposure to Bitcoin.

Giant Grayscale, meanwhile, has seen things through, and is displaying its flagship product, the GBTC, on airport screens and even in Times Square, New York’s must-see district.