The pressure is mounting for Binance, which has seen the SEC ban the issuance of its stablecoin BUSD. This continues to worry investors, who were already withdrawing their cryptocurrencies from online platforms. Indeed, there have been massive withdrawals of cryptocurrencies from Binance and Kraken since yesterday. Here’s the latest on the subject.

$1 billion of stablecoins fly out of Binance

According to data shared by a Nansen researcher, the exodus of users was particularly noticeable on Kraken, which was forced to halt its staking services, as well as on Binance, which saw a suspension of the issuance of its BUSD stablecoin. The $1 billion of stablecoins that were withdrawn from Binance corresponds to 6% of its reserves. That’s a significant chunk, even for Changpeng Zhao’s empire.

Another notable point is that $144 million worth of BUSD was “burned” by a user. This means that they have been converted into dollars, which are presumably considered more secure than stablecoin. On the other hand, Paxos’ depository addresses have seen massive inflows of funds, which also suggests that many stablecoins will continue to be exchanged for USD.

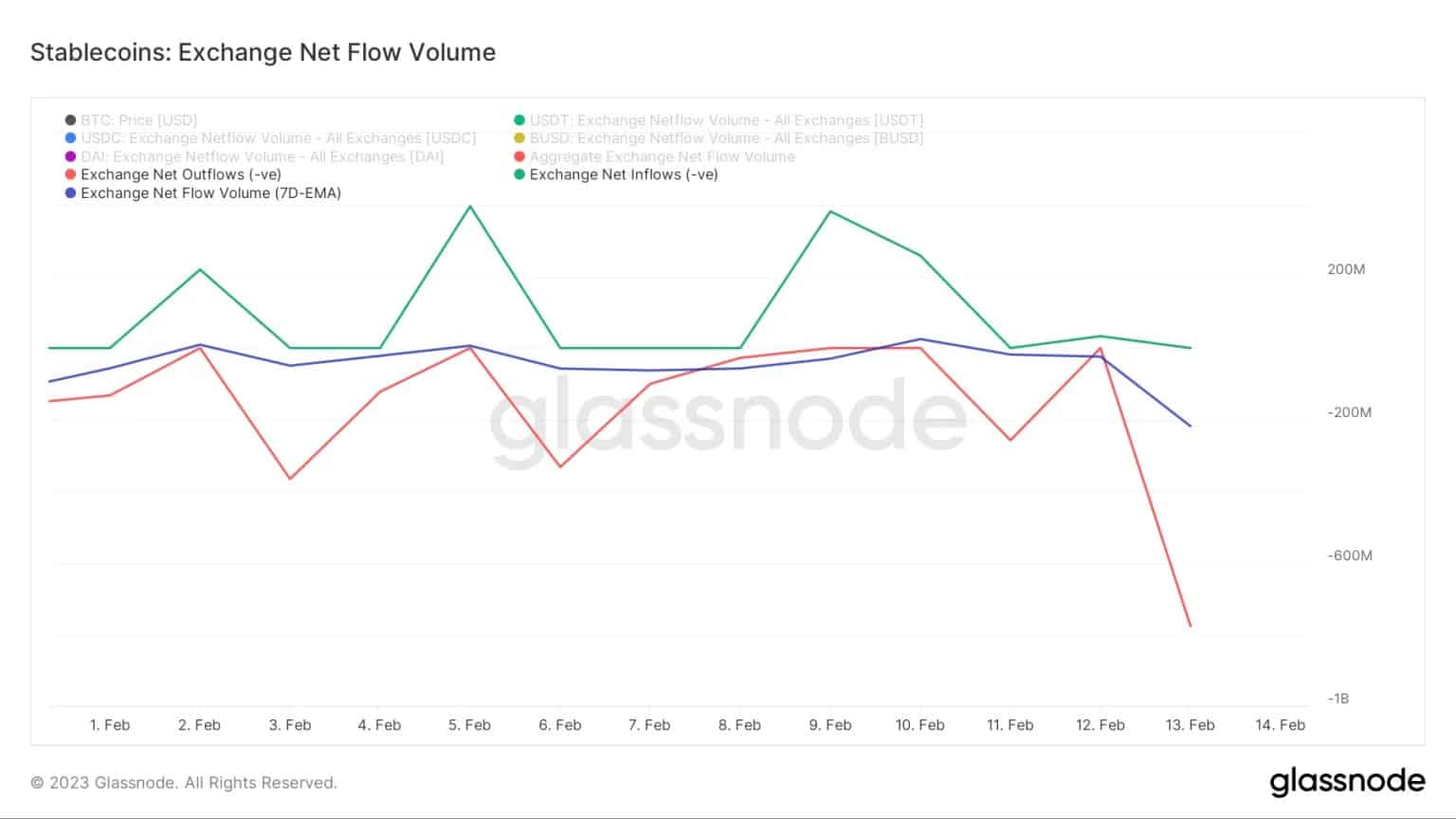

The same is true of Kraken, which is seeing an even larger share of its reserves being withdrawn. Glassnode data also confirms this exodus over the past two days:

Total stablecoin withdrawals on exchange platforms (in red)

So it’s clear that users are suddenly feeling skittish about these crypto-currencies that have historically been considered “stable”.

The ambivalence towards stablecoins

At present, however, there are opposing trends with regard to stablecoins. Although the SEC is shaking up the US ecosystem, enthusiasm for this type of asset does not seem to be dampened – yet. We continue to see the emergence of stablecoins in a more institutional setting, for example among commercial banks. In Europe, the arrival of the EUROe shows a willingness to play the appeasement card with regulators.

Another proof of this strong interest is that the rating agency Moody’s is reportedly working on a system for evaluating stablecoins, a particularly clear indication of the predominant place they now occupy. However, the SEC’s crusade could be damaging, so we will continue to monitor this area carefully.