According to data compiled by Arkham Intelligence, the liquidators of Alameda Research, who are supposed to be collecting the available funds, are themselves being liquidated in the decentralised financial system (DeFi). On Friday night alone, the liquidators lost over a million dollars by having their positions liquidated in the amount of 731 Ethers (ETH).

Liquidators get liquidated

Alameda Research’s liquidators are, by definition, responsible for gathering the company’s available funds as part of its bankruptcy in order to eventually pay off its various creditors. Alameda Research, which is the sister company of FTX, itself in bankruptcy since the beginning of November.

But Alameda Research, which is an investment company, still has open positions in decentralised finance (DeFi), and for significant amounts. Thus, the liquidators of Alameda Research wanted to recover the funds deposited in various protocols, but this did not happen as they probably would have liked.

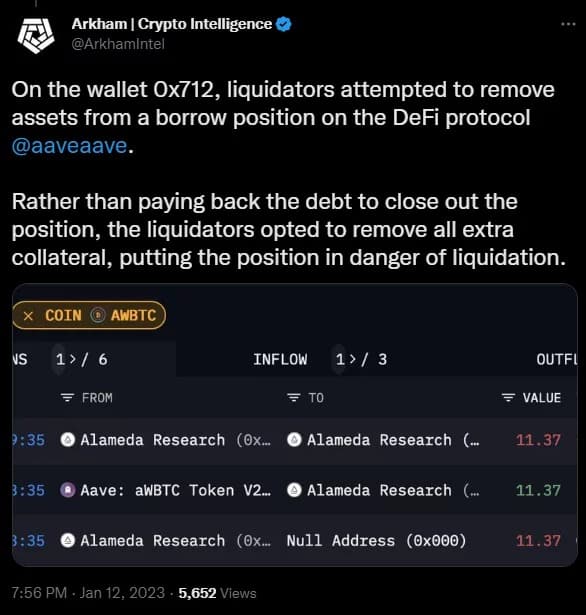

As Arkham Intelligence reported, the liquidators got confused when trying to close a position in the Aave protocol. They withdrew all their collateral on a loan position, resulting in the liquidation of 4 wrapped Bitcoin (wBTC), or over $80,000 at the current price.

Arkham also explains that liquidators attempted to make large trades on multiple occasions without success, including trying to withdraw $1.75 million in LDO tokens, which were still in the vesting period. This led to about 10 unsuccessful trades.

Over $1 million lost Friday night

But according to an exclusive report obtained by The Block, the liquidators of Alameda Research lost more than a million dollars on Friday night alone this weekend. The data was reportedly traced by Arkham Intelligence through an as yet undisclosed report.

The wallet in question held 9,000 Ethers (ETH), or more than $13.7 million at the current price, supported by $20 million in USDC and $4 million in DAI, both as collateral.

But according to on-chain data, the account in question was ‘forcibly reduced’, resulting in the liquidation of positions equivalent to 731 ETH, or more than $1.1 million at the current market price.

According to Arkham, the liquidations involving this portfolio could be the result of a voluntary transaction:

“Surprisingly, there were trades outside the portfolio before and during the liquidation, indicating that the person who controlled the portfolio was unable or unwilling to understand how to liquidate the positions. “

Also, some Twitter watchers were quick to point out the few trades the liquidators made for just a few fractions of cryptocurrencies.

the FTX bankruptcy estate is paying liquidators $1300 an hour to spend $2.99 on gas to move $0.02 worth of sushi tokens into a multisig pic.twitter.com/iQJfBFAKFf

– foobar (@0xfoobar) January 7, 2023

“FTX bankruptcy group pays liquidators $1,300 an hour to spend $2.99 in transaction fees to move $0.02 of SUSHI tokens into a multi-sig. “

Although some individuals have noted that a few of the addresses that have recently moved funds may have belonged to Sam Bankman-Fried, he has denied any involvement on his part.