According to a Galaxy study, the introduction of spot Bitcoin ETFs in the U.S. could attract around $14.4 billion in their first year of trading, with a potential 74% increase in Bitcoin’s price over the course of that year. We take a tour of this study, which is based on statistics from already existing gold ETFs.

$14.4 billion for Bitcoin ETFs

While the narrative surrounding Bitcoin ETFs is in full swing, notably with a never-ending batch of twists and turns concerning BlackRock’s iShares ETF, crypto analysis firm Galaxy has published a study giving an idea of the impact that the arrival of this type of investment vehicle could have.

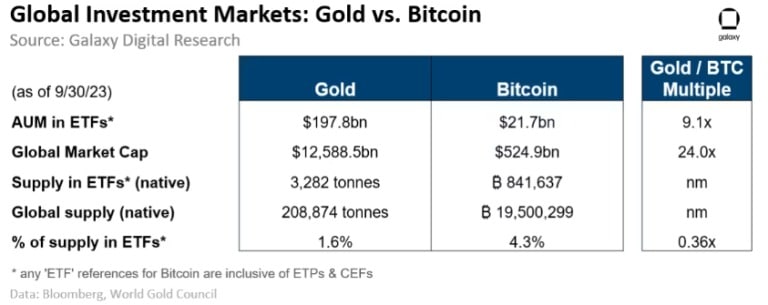

Galaxy’s study shows that, as of September 30, 2023, gold-based ETFs collectively held just under 3,300 tonnes of gold (around $198 billion), or roughly 1.7% of the world’s gold supply. At the same date, the various investment vehicles offering Bitcoin totalled 842,000 BTC, or around $21.7 billion and 4.3% of the total supply issued.

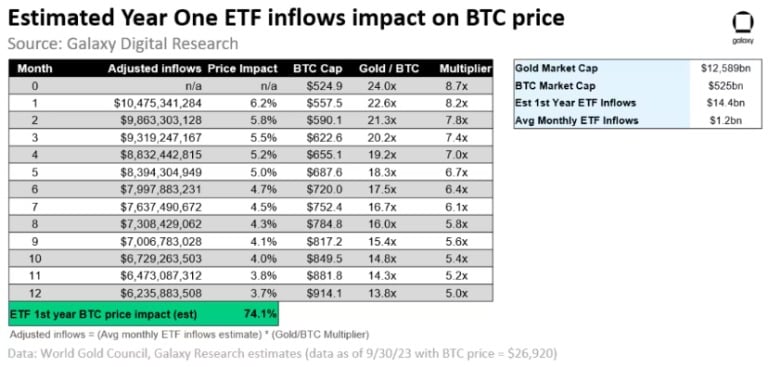

According to Galaxy’s calculations, if we consider the difference in market capitalization between gold and Bitcoin (dubbed digital gold, by the way), and if the arrival of spot BTC ETFs meets with the same success as we’ve seen with gold in the past, then spot Bitcoin ETFs should bring in around $14.4 billion in their first year of trading, or $1.2 billion per month.

Taking this a step further, the model predicts an increase in the Bitcoin price (hypothetical, of course) of around 6.2% in the month following the deployment of the first cash BTC ETF(s) in the US. According to Galaxy, and again based on what has been observed on gold ETFs, monthly returns should then gradually taper off to 3.7% by month 12.

In other words, the Bitcoin price is expected to grow by 74% throughout the 12 months following the arrival of Bitcoin cash ETFs in the U.S.

Why are spot BTC ETFs likely to appeal to investors?

Firstly, the advantage of ETFs is that they inherently allow investors to gain exposure to Bitcoin without having to hold any themselves. What’s more, this allows institutional investors to invest in BTC in a safe and regulated way, without having to worry about mood swings from the Securities and Exchange Commission (SEC).

At the same time, ETFs have the advantage of offering trading for lower fees than those usually offered by hedge funds or closed-end funds. In addition, given the likelihood of numerous cash-based Bitcoin ETFs being approved simultaneously, these ETFs will need to be competitive if they are to stand out from the crowd.

In addition, it should be noted that unlike the investment routes currently on offer to gain exposure to Bitcoin (which require wealth advisors or institutional platforms for large portfolios), ETFs are far more accessible, and could also be suitable for high-net-worth individuals.

According to Galaxy’s study, the wealth management sector would benefit most from the arrival of Bitcoin spot ETFs. Overall, as the last 10 days have shown, investors seem to be motivated by the narrative of spot BTC ETFs. The long-awaited start of the next bull market ?