In collaboration with TCN, an Adan / KPMG France study takes stock of the crypto-currency ecosystem in France. Today, 8% of French people have already acquired cryptocurrencies, to which can be added 30% of French people who are considering taking the plunge. But what is the true level of knowledge of the French about crypto-currencies and their uses? How is the blockchain industry doing in France? What is the importance of cryptocurrencies in the electoral choice? Discover our summary of the study.

A comprehensive study on cryptocurrencies in France

The Association for the Development of Digital Assets (Adan) lifts the veil on a groundbreaking study, led by KPMG France, which takes stock of the cryptocurrency sector in France.

Carried out in collaboration with Cryptoast, this study has two complementary parts. The first part presents the stature of the cryptocurrency industry in France as well as its possible growth and job creation potential. The second part outlines the degree of democratization of cryptocurrencies in France, based on a survey conducted by the IPSOS institute and its analysis by KPMG France.

This study was presented on 14 February at the Ministry of Economy and Finance, with the presence of government members, including Cédric O, Secretary of State for the Digital Economy. Here is an exclusive broadcast of the event:

Cryptocurrency adoption in France accelerates

IPSOS survey of a representative panel of 2,003 French people reveals a lot of data on the progress of cryptocurrencies in the country:

- 8% of them already own cryptocurrencies;

- In addition, 30% of French people have not yet taken the plunge, but are considering acquiring them.

This statistic should be put into perspective with the number of French people who own shares: about 6.7% of them according to the Autorité des marchés financiers (AMF). Crypto-currencies therefore occupy an important place in the investment portfolio of the French.

” This large proportion of French people, holding assets that have only been around for less than fifteen years, demonstrates a strong craze and prospects for rapid adoption. In light of this study, cryptos are no longer a niche topic, but an exploding sector. It is important for financial players to grasp it, at the risk of losing a generation of clients,” says Alexandre Stachtchenko, director of blockchain and crypto at KPMG France.

Another relevant data, 22% of French people are thinking of turning to a bank offering services related to cryptocurrencies. This proportion reaches 71% among the 8% of French holders and 43% among those who plan to invest in the near future.

The stakes are therefore high for French banks, which are well behind in their adoption of cryptocurrencies compared to some of our neighbours, notably Switzerland.

More globally, 76% of respondents have already heard of crypto-currencies while 15% of French people have heard of non-fungible tokens (NFTS).

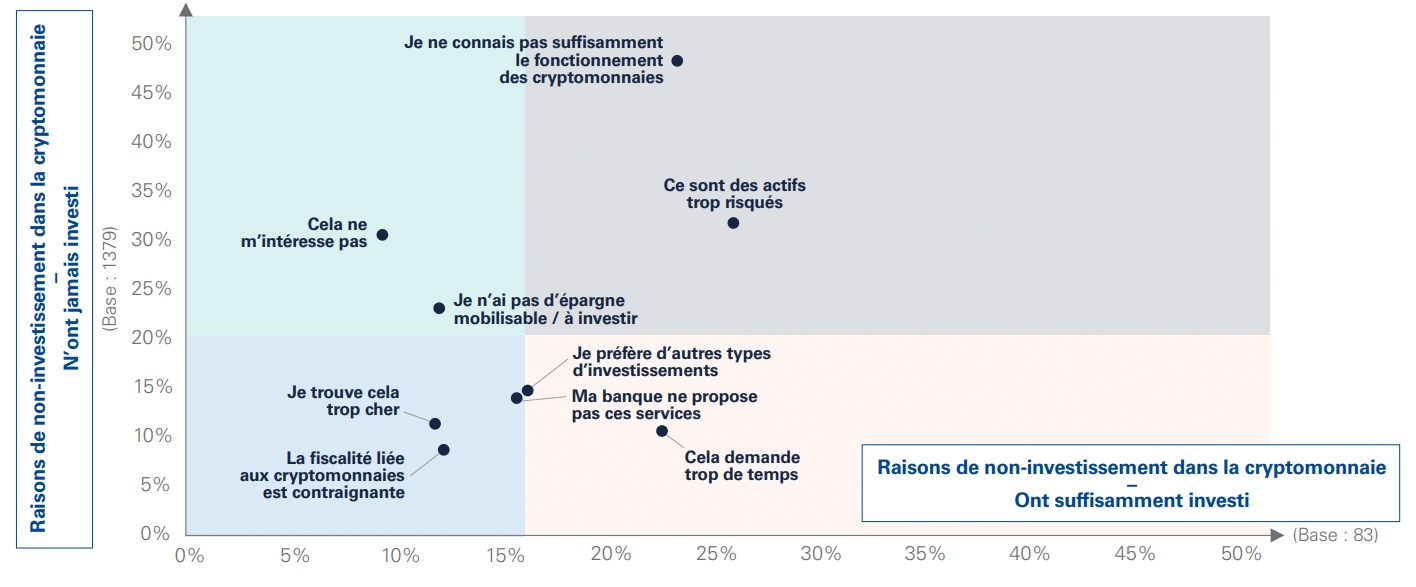

So what are the main barriers to greater public adoption of cryptocurrencies? The study notes several reasons for not investing in cryptocurrency:

- 48% of French people who have never invested in cryptocurrencies mainly point to insufficient knowledge of how they work;

- 30% of respondents also consider these assets to be too risky;

- Only 28% say they are not really interested;

And finally, 20% do not have savings that could be mobilised to make the investment.

In addition to these already diverse reasons for not acquiring crypto-currencies, we must add the lack of access to purchase services that would be offered by traditional players such as banks (for 10% of respondents).

Reasons for not investing in cryptocurrency (Source: IPSOS survey)

A thriving and dynamic industry

In 2021, the total market capitalisation of cryptocurrencies exceeded €2 trillion for the first time, and this does not take into account the value generated by companies in the industry.

Across the world, the growth of the sector since mid-2020 has been exponential. Record-breaking fundraisings are taking place and the list of unicorns (startups valued at more than $1 billion) continues to grow.

The emergence of the cryptocurrency market is a source of many opportunities for France, particularly in terms of job creation, but also in terms of the country’s economic and strategic positioning.

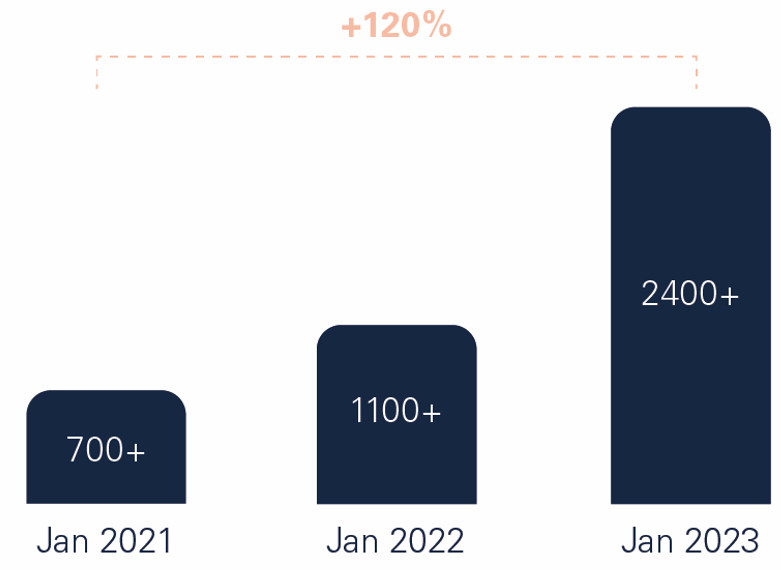

KPMG France’s research conducted on a sample of thirty companies representative of the sector shows that in January 2022:

- The crypto sector in France is worth more than €1.2 billion in terms of fundraising;

- It also claims to have created more than 1,100 direct jobs (i.e. a growth of nearly 60% over one year), 80% of which are in France;

- 97% of companies surveyed are currently recruiting and realistic projections would take this base to over 2,400 direct jobs by January 2023 (i.e. 120% growth).

Number of direct jobs created by the panel of companies surveyed (Source: KPMG France)

Furthermore, KPMG France estimates that the entire cryptocurrency industry, which currently has around 600 projects, should generate more than 100,000 direct jobs within 10 years.

The French ecosystem is therefore booming, which has already led to the creation of globally recognised players, such as Sorare and Ledger, French unicorns valued at €3.8 billion and €1.2 billion respectively.

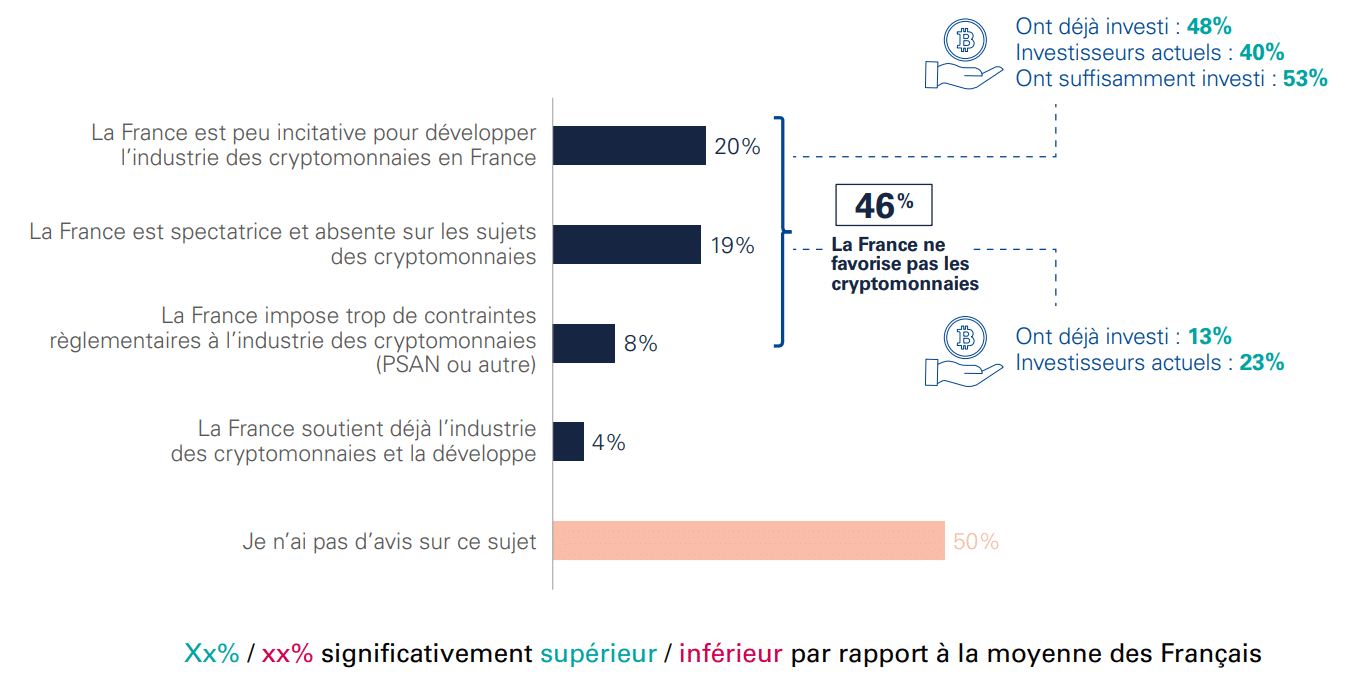

The importance of cryptocurrencies in the electoral choice

As the 2022 presidential election approaches, the vast majority of candidates have completely ignored the cryptocurrency sector. Yet 18% of French people say they will be influenced in their electoral choice by the candidates’ positioning towards cryptocurrencies. And more specifically, this topic will be decisive for 4% of them.

If we narrow the analysis to the 8% of cryptocurrency holders to date, we find that 26% of them consider the topic to be a decisive element in their voting choice for the 2022 presidential election, which represents 2% of the French population. Such a reserve of votes is far from negligible in the light of the latest surveys.

It is thus undeniable that the theme of cryptocurrencies can be a strong argument to convince new voters.

Here are the reasons why the French think that cryptocurrencies are an opportunity for France, with an approval level of around 20-25%:

- Have more weight in the world;

- Gain digital sovereignty over other world powers;

- To become a greater economic power;

- Create jobs.

Perception of French policy on cryptocurrencies (Source: IPSOS poll)

Conclusion of the Adan / KPMG France study

Despite a rapid acceleration in the adoption of cryptocurrencies in France, both among retail investors and businesses, many hurdles still need to be overcome to ensure the population becomes increasingly crypto-friendly.

With nearly one in two French people citing a lack of knowledge of the subject as holding back their potential investment, there is a relatively large amount of room for improvement if the adoption of crypto-currencies is to continue on this path.

At the same time, let’s hope that some of the traditional media outlets that are highly critical of cryptocurrencies will make the effort to catch up with the times.

Either way, the sector is evolving rapidly, and professionals don’t intend to miss such an opportunity. The French industry is growing exponentially and is already home to giants like Ledger and Sorare.

The next challenge for the ecosystem will certainly be to comply with the various regulations that are beginning to emerge in France, and more particularly at the European Union level. New regulations which, we hope, will not curb the desires of local players, at the risk of seeing France repeat its mistakes with the early days of the Internet.

Other summaries of this type will soon be published on Cryptoast, zooming in on particular points raised by the Adan / KPMG France study.