A major player in the ecosystem, Ripple has just published a report detailing the main trends in the world of blockchain and cryptocurrencies. To save you a tedious read, we have compiled for you the key lessons to be learned from this document.

As technologies mature

According to a survey conducted by Ripple, blockchain technology and cryptocurrencies are slowly maturing. This can be seen in businesses, where they are increasingly used, but also among consumers, who are increasingly understanding and owning crypto-currencies and non-fungible tokens (NFTs).

The explosion of NFTs

It has surely not escaped your attention… NFTs have been experiencing a galloping democratization since last year. Ripple notes that the volume of non-fungible tokens exchanged will increase by 38,000% between 2020 and 2021. And in the third quarter of 2021 alone, over $10 billion worth of NFTs were traded.

This trend is not likely to fade away, as this new tool allows celebrities and brands alike to engage their communities in innovative, fun and effective ways. NFTs are also tapping into the growing popularity of metaverses, in which they allow the notion of ownership to be introduced.

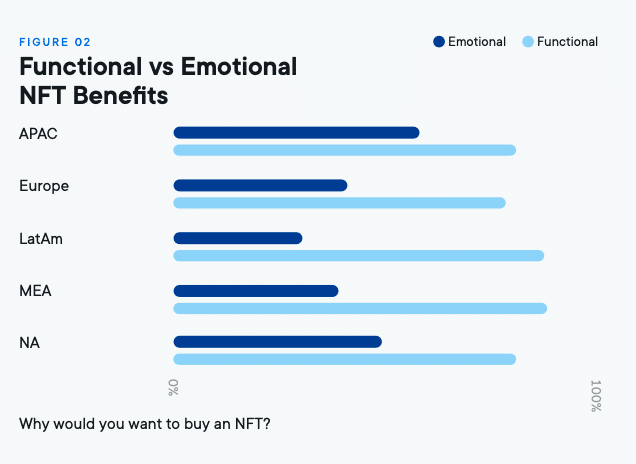

Ripple’s report looks at why the general public is turning to NFTs, highlighting that the main motivation is their function, not the emotional aspect surrounding them.

Why do people buy NFTs? (Source: Ripple)

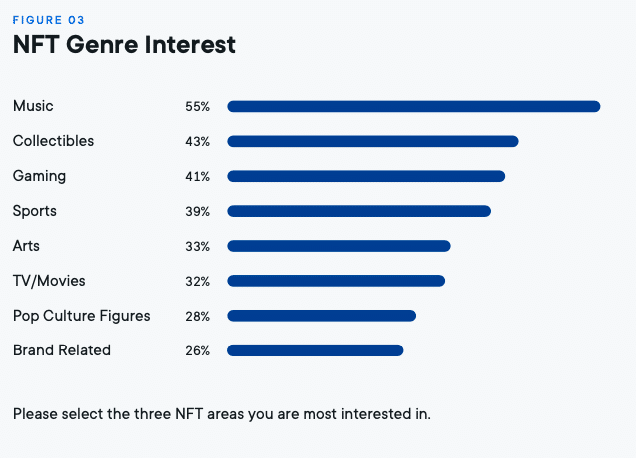

The company also asked the consumers surveyed what they found most interesting in terms of NFT usage. Surprisingly, music came out on top, ahead of collectibles and video games.

What types of NFTs are consumers most interested in? (Source: Ripple)

Ripple also points to the barriers to mass adoption of NFTs, including their complexity as the main obstacle to their democratisation. The company also points to their high price, which discourages many people. But Ripple qualifies these difficulties, stressing that they should be overcome quickly.

The sustainability hurdle for NFTs

The company also mentions the problem of the durability of NFTs. It uses the example of the mint of an NFT on the Ethereum blockchain, which consumes as much energy as an American household for a week. Of course, Ripple takes the opportunity to highlight its in-house solution, the XRP Ledger, which is notably carbon neutral, but also the Flow and Solana blockchains, which consume much less energy than Ethereum.

If the question of the sustainability of NFTs is not currently at the heart of concerns, this could quickly change. Indeed, Ripple surveyed consumers and developers to find out their position on the matter. And the results are clear. Three out of four consumers prefer sustainable NFTs, while 20% of them say they would never buy anything else. As for developers, 66% think that the organisation they work for is more likely to opt for a sustainable blockchain, and that this is what their customers want.

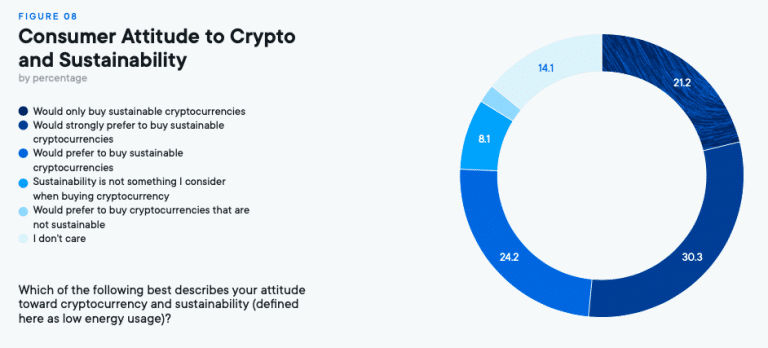

The report looks more broadly at consumer attitudes to the sustainability of cryptos in general. And here again, we see that 75% would prefer to buy a sustainable crypto, while one in five consumers say they would never want to buy anything else.

What are consumers’ attitudes towards the sustainability of cryptocurrencies? (Source: Ripple)

Central bank digital currencies (CBDCs) are about to take over the world

According to Ripple’s report, while only a few countries have already launched their digital currencies, 80% of the world’s central banks are currently exploring the use of what are called MNBCs. As a reminder, these are nothing more and nothing less than blockchain-based tokens that aim to transform fiat currencies (dollar, euro, yuan, etc.) into digital assets.

Whether they are financial institutions or not, an overwhelming majority of companies consider that CBMs will have a significant impact in the years to come. When asked by Ripple about the benefits they expect from the introduction of this technology, financial institutions ranked improving national competitiveness in the global economy as the most important, just ahead of payment system efficiency. Other types of businesses put the efficiency of the payment system in first place, ahead of the strengthening of monetary policy.

The use of cryptos by financial institutions and businesses

According to the survey conducted by Ripple, 76% of financial institutions plan to use cryptos in the next three years. A figure that rises to 71% for other types of businesses. And contrary to popular belief, they are not motivated solely by their speculative aspect. The primary reason they hold crypto-currencies is for payment purposes. They also point to their value in managing their portfolios, especially as a hedge against inflation and other types of assets.

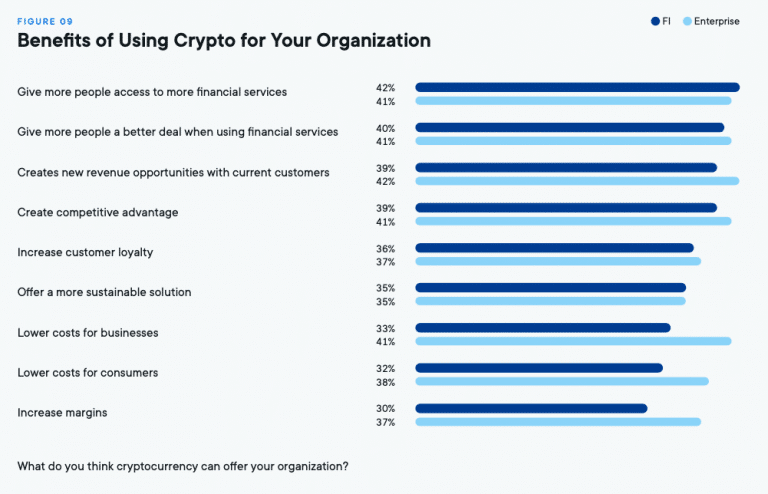

Even more so than for MNBCs, the vast majority of companies and financial institutions surveyed believe that cryptocurrencies will have a significant impact in the near future. The report details the benefits that these companies expect to see with mass adoption of cryptos. At the top two spots is improved inclusiveness and fairness for consumers. This translates into wider access to financial services on terms that are more beneficial to their customers.

What can cryptocurrencies do for business? (Source: Ripple)

Looking at these answers, one wonders what is preventing businesses and financial institutions alike from adopting cryptocurrencies en masse. As always, fraud and scams top the list of barriers to their democratization, ahead of unclear regulations and price volatility. Yet banks would be well advised to get on board. Indeed, 65% of consumers surveyed say they are interested in buying cryptocurrencies directly from them. This figure rises to 81% among the most experienced users.

If you want to know the latest assessment of the French crypto ecosystem, we encourage you to read our summary of the findings of the Adan / KPMG France survey. In this survey, which has just been published, we learn that 8% of French people have already acquired cryptocurrencies, and that 30% are considering taking the plunge. The revolution is underway!