Focus on yuzu, a platform that allows you to generate attractive returns with your euros or cryptocurrencies while actively supporting eco-friendly projects. This totally free application offers flexible, transparent and simplified savings through the use of stablecoins and decentralised finance (DeFi).

Get started with simplified savings with yuzu

Simplified savings, accessible at any time and actively working for the ecology: this is what sums up yuzu, a French startup that offers an innovative investment account.

yuzu was created by Clément Coeurdeuil and Stanislas de Quénetain, two entrepreneurs with extensive experience in finance and innovative technologies.

Clément Coeurdeuil ran the fintech Budget Insight for ten years before becoming president of Mango 3D, a leading 3D printing company. Stanislas de Quétenain spent 13 years at leading financial institutions such as Goldman Sachs, Crédit Agricole and J.P Morgan, where he was vice president in charge of legal.

Based on their respective past experiences, they came up with the idea of creating a unique savings account: profitable, sustainable, liquid and secure. yuzu makes your money work for you. yuzu offers a target interest rate of 6% (held from February to November 2022), with funds available at any time. However, this target return is not guaranteed.

What makes yuzu even more different from the classic Livret A is that your interest is paid out from day one and from the first euro deposited, with no maximum payment limit.

In addition, your funds can be withdrawn at any time during a transfer. And to reassure its clients, yuzu has set up a solvency ratio of 8% to guarantee clients’ funds in case of possible losses, as stated in the general terms of use. In addition, yuzu is registered as a digital asset service provider (DASP) with the Autorité des marchés financiers (AMF).

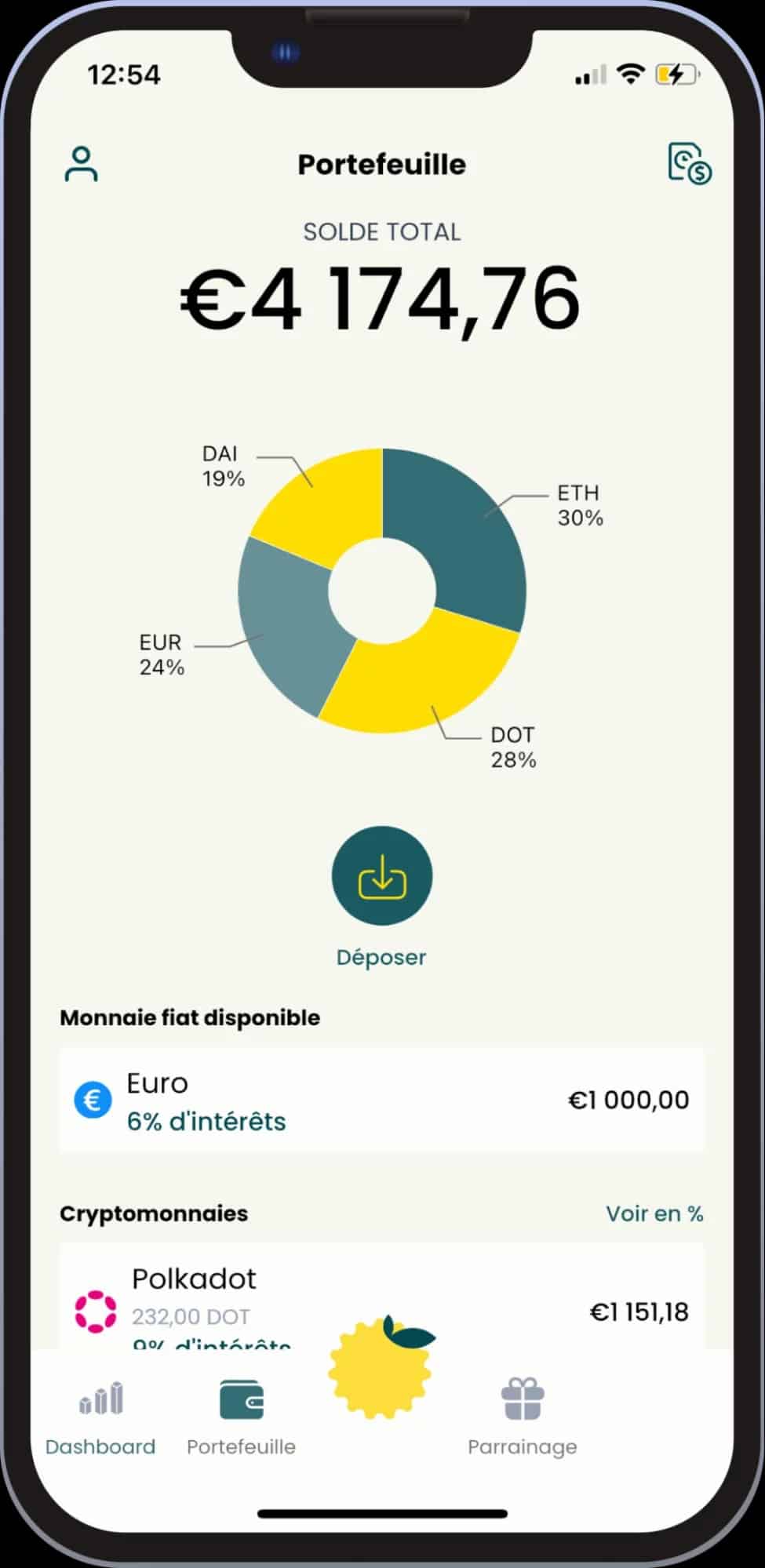

yuzu operates through a mobile application, which has the merit of being very fluid and easy to use.

Overview of the yuzu mobile application interface

As the only crypto company to sign the UN Global Compact, yuzu is actively invested in the ecological transition, and has implemented a methodology to measure, avoid and offset its emissions. It is therefore carbon neutral in that it fully offsets its emissions. In addition, yuzu offers its customers the opportunity to use their own yields to offset their own carbon footprint.

In order to select and monitor these ecological projects, yuzu has teamed up with Stock CO2, a French startup that helps companies offset their carbon footprint. The projects financed (reforestation, methanisation) are all located in France and have been awarded the low-carbon label by the Ministry of Ecological Transition.

You want to buy Bitcoin (BTC), but you are worried about the pollution generated by the mining process? According to calculations, yuzu estimates that 1 BTC emits between 1.5 and 3 tons of CO2 per year. Placing 1 BTC with yuzu means that 8 to 12 tons of CO2 are captured every year! Because yes, you can deposit euros at yuzu, but also some crypto-currencies such as Ether (ETH), BTC or DOT from Polkadot.

How does yuzu promise transparent and fee-free returns?

First of all, it should be noted that yuzu offers compound interest on its passbook. This means that the earnings you generate (again, on a daily basis) are continually added to the amount you initially invested.

Simply put, if you decide to invest €100 with yuzu, you will earn €6.18 per year, not just €6: after the second day of your first deposit, yuzu’s 6% investment will take into account not only your initial investment, but also the previous day’s earnings. In other words, with yuzu you can claim 6.18% APY (Annual Percentage Yield) and 6% APR (Annual Percentage Rate). And for the sake of transparency, the company discloses all of its past daily yields, which may go up or down depending on the market. In 2022, the rate of return is 6.48%.

In order to meet its target of 6% returns, yuzu converts the funds you deposit into stablecoins to make them work for you. There are 2 advantages to using stablecoins here: firstly, this type of cryptocurrency is far less volatile than others, as it is by definition supposed to remain stable by tracking the price of a real asset. And since most stablecoins are in dollars, yuzu manages the EUR/USD hedge for you.

These stablecoins are mainly invested in liquidity pools. To put it simply, a liquidity pool, in DeFi, consists of 2 separate cryptocurrencies serving as an exchange pool for users wishing to switch between them. If we were to transpose this to a fiat currency model, you could, for example, tie up 100 euros and 100 dollars in a EUR/USD liquidity pool, which would serve as an exchange pool for users wishing to exchange dollars for euros and vice versa.

The decentralised platforms in question, such as Uniswap (UNI) or Compound (COMP), reward users who deposit funds in these liquidity pools. This is one of the models on which yuzu generates returns.

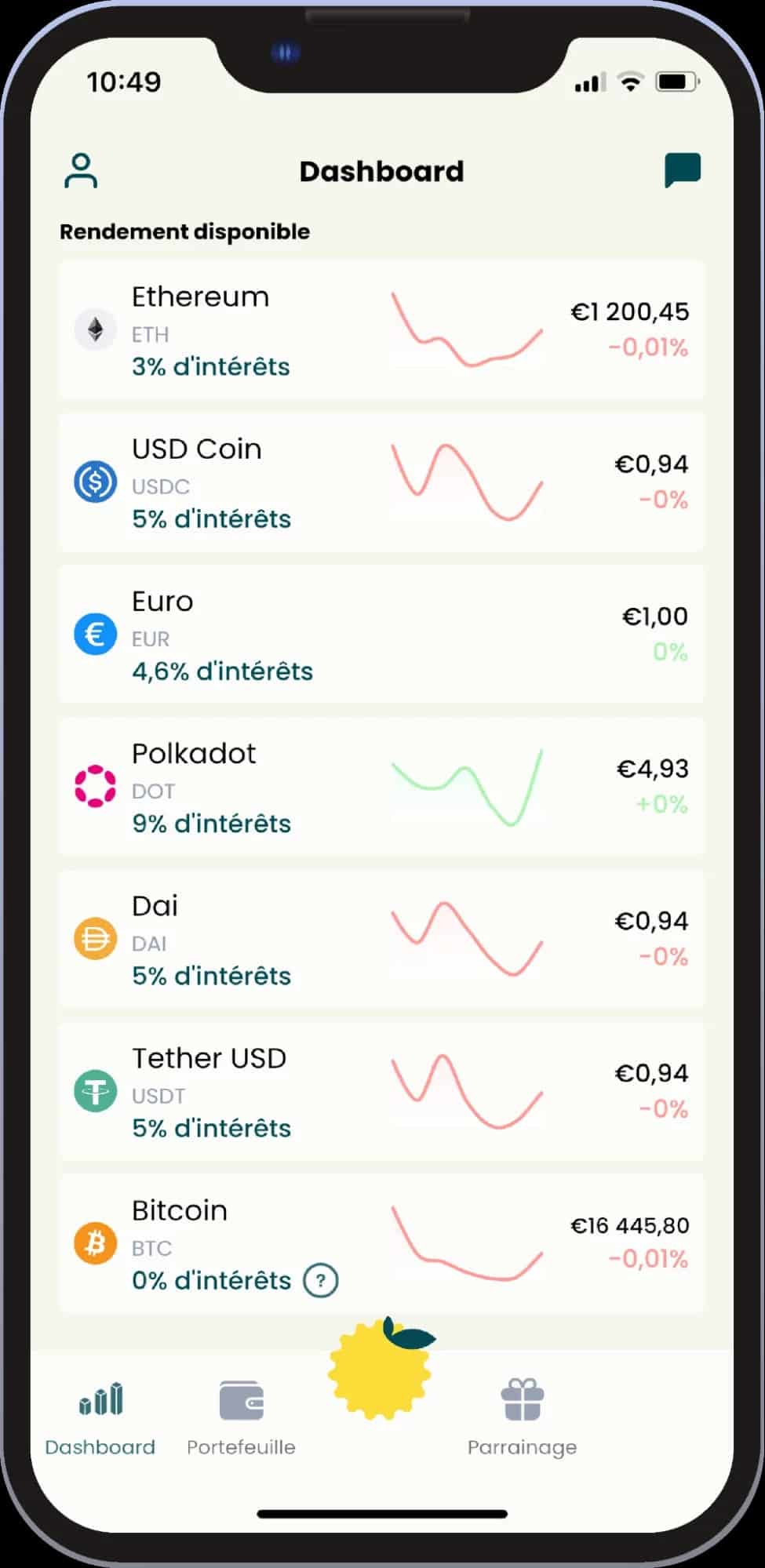

Overview of the different returns offered by yuzu at the time of writing

As you know, decentralised finance (DeFi) is not risk-free by its very nature. This is precisely why yuzu invests in several different protocols and especially with several stablecoins, in order to limit its exposure.

Also, yuzu’s investments are continuously monitored to prevent any risk induced by the cryptocurrency market: if a stablecoin loses its parity or the total locked value (TVL) of a pool drops to a level that is deemed dangerous, yuzu will immediately exit its exposure to the stablecoin or the pool concerned.

The potential loss from these emergencies is covered by yuzu’s own funds, as they did during the UST collapse or the FTX crisis.

Our conclusion on yuzu’s green savings

“Combining business with pleasure” as the saying goes. With yuzu, it is now possible to generate attractive and secure returns while effectively working for the ecology. Thanks to its collaboration with Stock CO2, yuzu makes it possible to invest in a carbon-neutral passbook, but also allows everyone to finance eco-responsible and sustainable projects thanks to its returns.

Its various investments based on liquid staking ensure continuous liquidity for users, allowing them to withdraw their funds whenever they wish. This already high level of flexibility is supported by the passbook’s compound interest mechanism, which generates returns from the first day of investment, starting with the first euro.

Moreover, yuzu is completely free to use: the company does not charge any deposit, management or custody fees on the returns it generates. yuzu’s goal is to generate a 9% return and to give its clients a 6% return.