Launchpad, staking, farming, liquidity locking and other token vesting services are all offered by the very complete decentralised platform UniCrypt. Let’s discover this decentralised finance protocol (DeFi) whose objective is to solve one of the major problems of the sector: trust in new projects.

UniCrypt, restoring investor confidence

If you’ve been around the decentralised finance (DeFi) ecosystem for a while, then you’ve probably already encountered this problem. Many new cryptocurrencies are listed daily on decentralized trading platforms such as Uniswap. Unfortunately, not all of them have good intentions.

On the contrary, it has become increasingly common to see projects suddenly withdraw their liquidity, leaving you with worthless tokens and running away with your money. These “rug pulls” are the dread of investors and are one of the major risks of DeFi.

The primary objective of the UniCrypt platform is to solve this very problem by restoring investor confidence in new emerging projects. How can it do this? Through one of its many services, “liquidity locking”, which allows projects to lock their liquidity for a certain period of time and thus prove their good faith to potential investors.

That said, liquidity locking is just one of a wide range of services offered by UniCrypt. Launched in June 2020, UniCrypt is a multi-chain protocol developed by a French team and aims to bring value to the DeFi ecosystem by providing “flexible, disruptive and audited technology”. Here is a quick overview of the various services offered by UniCrypt, which we will detail next:

- Liquidity locking ;

- Initial Liquidity Offering (ILO);

- Auditors and KYC ;

- Token vesting ;

- Token minter ;

- Staking-as-a-Service (FaaS);

- Farm-as-a-Service (FaaS).

Initially deployed on the queen of smart contract blockchains, Ethereum (ETH), UniCrypt has rapidly expanded to other networks. The protocol is now accessible on the BNB Chain (formerly Binance Smart Chain), the Gnosis Chain, Avalanche (AVAX) and finally the Polygon network (MATIC).

At the time of writing, UniCrypt has over 14,000 projects, $540 million in total value locked up (TVL) and, most importantly, 1.2 million monthly users.

A two-token ecosystem (UNCX and UNCL)

UniCrypt is a so-called “dual token” protocol, meaning that it has two tokens: UNCX and UNCL. The first, UNCX, was introduced at UniCrypt’s inception in June 2020 (previously called UNC and swapped in November 2020 to UNCX) as a governance token with a deflationary character. The second, UNCL, was added in November 2020 and has the role of a utility token and counterbalance by its inflationary nature.

Indeed, UniCrypt is a complex ecosystem with many features and services. Therefore, paying the full protocol fee and receiving rewards only in UNCX would have made the ecosystem too deflationary and quickly unaffordable for a new investor.

Thus, by including a second token, the UNCL, for payment of certain services (e.g. participation in the launch of a new cryptocurrency) or for rewards related to staking or farming, a healthier balance is naturally established between the two tokens.

When fees are mentioned, it is important to understand that they are only for projects that want to be listed on the platform. Indeed, there are no fees on UNCL and UNCX for users of the protocol. The UniCrypt ecosystem operates for free and gets paid on the fees paid by other projects.

All about UNCX, its tokenomics and burns

Let’s go into a little more detail about the roles of each of the two tokens in the UniCrypt ecosystem, starting with UNCX. The token is available on 5 different blockchains: Ethereum, Gnosis Chain, Avalanche, Polygon and the NBB Chain. UNCX is listed on Uniswap, Gate.io and PancakeSwap, among others.

The total amount of UNCX is relatively small: only 50,000 tokens were initially issued. At the time of writing, there are only 47,650 tokens actually in circulation.

This is because UniCrypt performs a one-off burn of UNCX. In simple terms, some of the tokens collected through the platform’s fees are “burned”, i.e. taken out of circulation for good. This keeps upward pressure on the UNCX price and rewards the holders.

Approximately 12,000 UNCX (24% of the total supply) are held at an address owned by the project team. These funds will be used to finance the long-term development and growth of UniCrypt, including marketing, allocations for future advisors, and liquidity management on the various trading platforms.

It should be noted that the payment of the team, the service providers and more generally all the actors gravitating around the protocol has never taken place in UNCX, given that the protocol has been profitable since its creation.

All about UNCL, its tokenomics and inflation

Similar to UNCX, the UNCL token is available on 4 blockchains, namely Ethereum via Uniswap, Gnosis Chain via Honeyswap, Avalanche via Trader Joe and the BNB Chain via PancakeSwap.

The UNCL is a utility token, rewarding participants in the UNCX protocol (more exactly UNCX stakers, see below in this article). Indeed, “burning” UNCLs will allow users to participate in cryptocurrency launches on the platform and boost their staking or farming earnings. Moreover, the latter two features offer UNCL earnings to their contributors.

As you can see, the UNCL token has a “mint” function. The rewards provided to users are created and added to the initial total amount of tokens (120,000 UNCL). Therefore, before investing, it is important to keep in mind that UNCL is inflationary and the number of tokens increases over time.

However, this inflation is programmed and controlled by UniCrypt. It will be reduced by a factor of 2 each year, to follow the following pattern:

- 2021: 60% maximum inflation – not yet reached (240,384 UNCL);

- 2022: 30% maximum inflation (312,499 UNCL);

- 2023: 15% maximum inflation (359 374 UNCL);

- 2024: 7.5% maximum inflation (386,327 UNCL).

Stack your UNCX to participate in the UniCrypt ecosystem

Discover the UNCX staking program

In this section, we’ll take a look at UNCX Staking, a feature that allows you to generate returns by directly participating in the UniCrypt ecosystem. For those who are interested in UniCrypt’s technology, but don’t want to be exposed to the projects launching on the platform, this option should appeal to you.

The aim is to reward holders by redistributing a substantial portion of what is generated by the platform’s service fees. Initiated in early March 2022 by the UniCrypt team, this option has already allowed users to share 200,000 USDC.

The second phase of this staking programme offered by UniCrypt will start on 9 April 2022. Users can already stake their UNCX tokens and select the liquidity pool they are interested in. Don’t worry, even if you miss the startup, you’ll still be able to get on the train in the middle of the program.

There are three different offers in place depending on how many UNCX tokens you lock into the contract:

- Level 1: from 100 locked UNCX, no maximum;

- Level 2: between 20 and 100 UNCX locked;

- Level 3: between 3 and 20 UNCX locked.

In contrast to the first phase, the April phase now allows you to receive your rewards in UNCL in addition to USDC. In both cases, approximately $150,000 will be distributed to participants, for a total of $300,000. They will be distributed as follows: 50% for third party 1, 30% for third party 2 and 20% for third party 3.

Please note that the UniCrypt team will refill these rewards on a monthly basis to the same amount as those already allocated for the current month.

Tutorial – How to store your UNCX and generate returns

Are you interested in UniCrypt and want to know how to participate in its ecosystem while generating rewards? We explain it all in this quick and easy tutorial.

1. First of all, you will need to get some UNCX. Since the staking system is currently only available on the Ethereum blockchain, we recommend that you go through the Uniswap DEX.

2. Once this first step is completed, you must go to the UniCrypt website and more particularly to the tab dedicated to staking. Choose the option that corresponds to you (tier 1, tier 2 or tier 3) depending on the UNCX you wish to lock in the framework of this April program. For this example, we have chosen Tier 3.

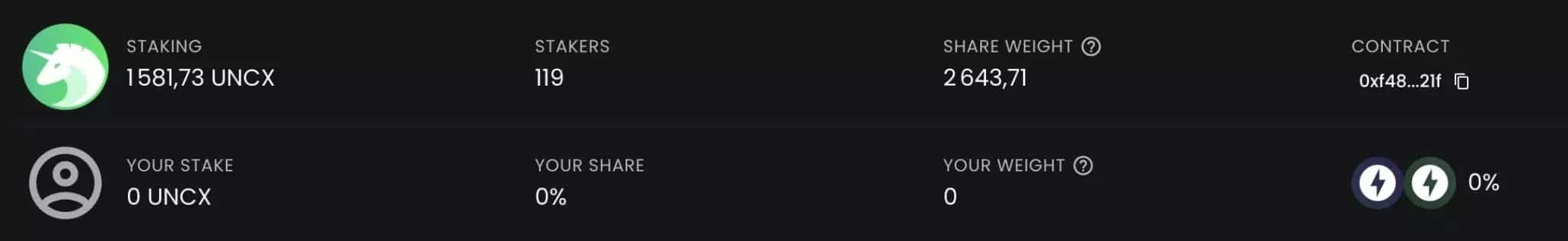

The page that appears is divided into several parts. The top banner informs you about the main data of the liquidity pool (the number of locked UNCX, the number of participants, etc.) and your position in it (the number of UNCX you have locked, your share of the pool, etc.):

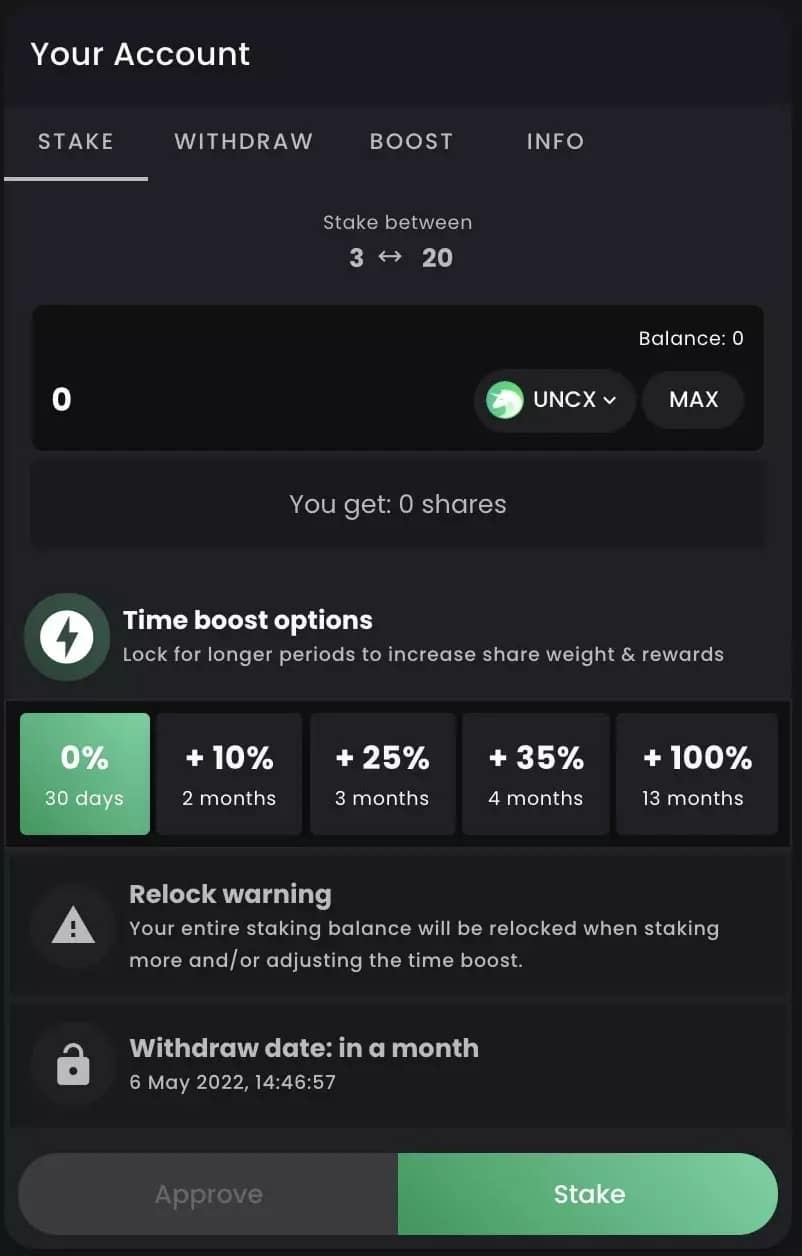

3. At the moment, the amount of UNCX staked is of course zero, but we will remedy this. In the block on the left of your screen, click on the stake window. Select the amount of UNCX you wish to lock (between 3 and 20, since we have chosen third party 3).

Once you have selected the amount, you will see your share on the line just below. Please note that before validating, you still have to select the duration for which you wish to lock your tokens.

This is decisive for the calculation of the rewards you will generate. Indeed, the longer you decide to lock your UNCX, the more you will benefit from a significant boost in your return. This ranges from 0% for a period of one month to 100% for a period of 1 year and 1 month.

Keep an eye on the withdrawal date on the bottom line and make sure you are ready to commit to that term before you click. Also be aware that this boost option can be increased, but never decreased.

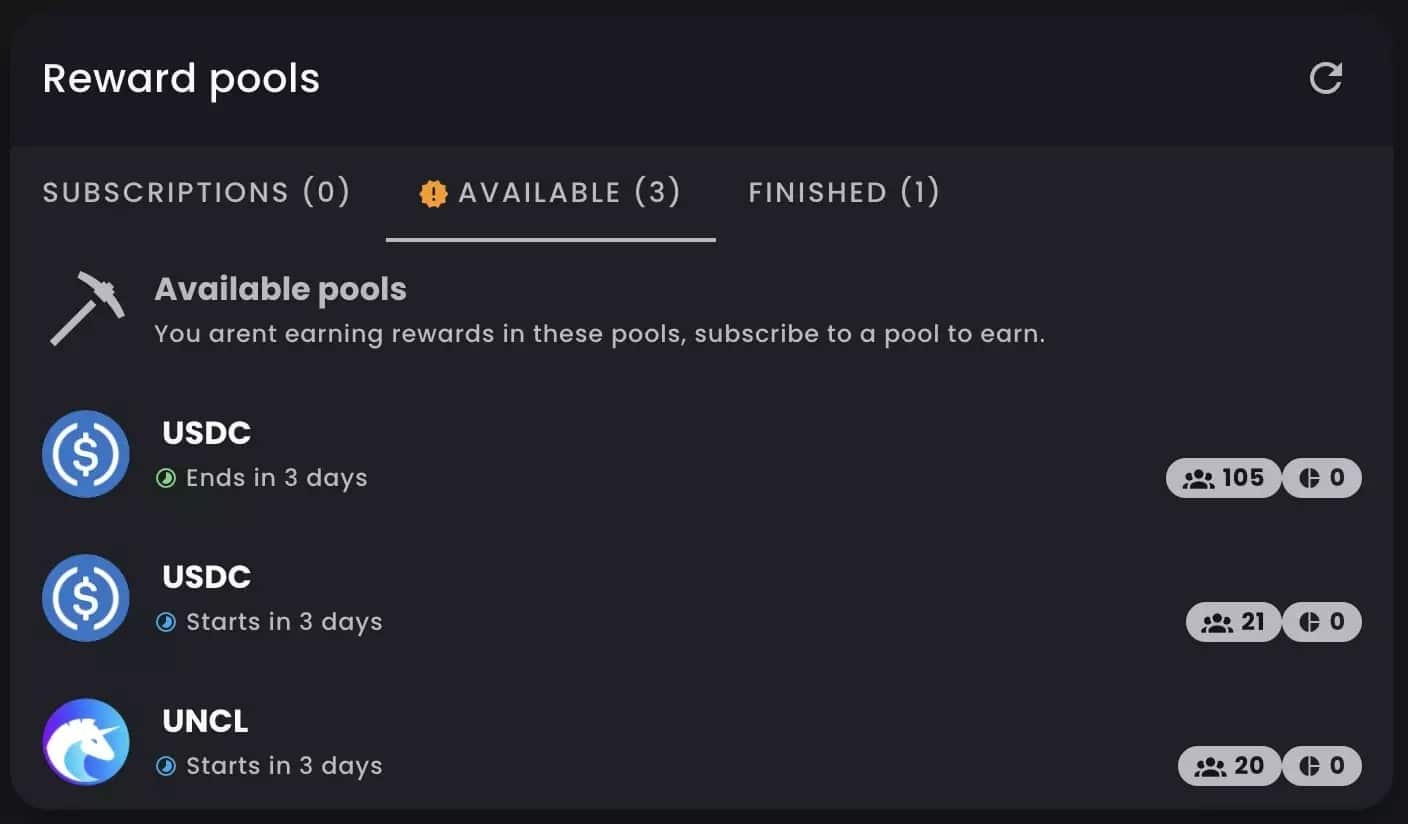

4. Finally, once you have locked in your UNCX, all you have to do is select the reward programme that interests you. You will find all the information about this in the box on the right of the screen. In the first window, you will find a list of those you have already participated in. In the second window, you will find the ones that are currently available. In the third window, you will find the ones that are finished.

As you can see, at the time of writing, the March USDC programme is still accessible and almost at the end. However, the next two pools have not yet started, but it is already possible to invest in them.

You don’t have to worry about choosing one of them, you can select up to ten different pools and allocate your locked-in funds as you wish. Once you have positioned yourself on these programmes, you are ready to receive your rewards.

That said, there are still ways to boost your returns, as well as increasing the lock-in time. Indeed, UniCrypt offers to burn UNCL tokens to increase your weight in the pool compared to others. This allows you to improve your rewards on a program by up to 100%, provided you meet these conditions:

- Tier 1: Burn up to 300 UNCL to reach +100%;

- Tier 2: burn up to 200 UNCL to reach +100%;

- Tier 3: burn up to 150 UNCL to reach +100%.

Overview of other UniCrypt services

Liquidity lockers

Of the long list of services offered by UniCrypt, “Liquidity Locking” is probably one of the most important. To understand this, it is important to remember that any project that launches – whether on Uniswap, PancakeSwap or elsewhere – needs liquidity.

This liquidity is usually provided by investors. However, investors are sometimes reluctant to put their money into projects without the security of ever seeing it again.

UniCrypt’s “Liquidity Lockers” are smart contracts in which developers store their LP tokens (Liquidity Providers tokens) and revoke their permissions to access them. In other words, they lock their cash in vaults to prove their good faith.

At the time of writing, more than $540 million is locked up on the various automated market makers using UniCrypt’s services,

UniCrypt’s business model is largely based on the fees developers pay to submit their projects. Either they decide to pay a flat tax (in ETH, GNO, AVAX, MATIC or BNB, depending on the blockchain) plus a percentage of the amount of locked tokens. Or, for large projects, it is possible to decrease this share by burning UNCX.

The Token Vesting

While Liquidity Lockers allow developers to lock their LP tokens (i.e. liquidity pool token pairs) they do not offer this option to all other types of tokens. This is why UniCrypt has introduced Token Vesting, or token lock.

In short, this service allows the developer to lock a certain amount of tokens for a certain period of time in order to prove their involvement in the project. Once the developer has locked his tokens, he can no longer access them or go back and must simply wait until the end of the contract to get them back.

As with Liquidity Lockers, Token Vesting is an additional security service for investors to reassure them of the intentions of a project’s developers. This undoubtedly helps to gain the trust of the community and make it grow faster.

Initial Liquidity Offering (ILO)

Similar to a launchpad (a platform dedicated to launching new cryptocurrencies), UniCrypt’s Initial Liquidity Offering service allows users to bring their liquidity directly from liquidity pools to receive token rewards from a new project that launches.

UniCrypt has deployed a fully decentralised and automated platform connected to Liquidity Lockers. In the vein of the first two services presented above, this one also aims to reassure investors. Each project wishing to launch via an ILO on UniCrypt will have to lock between 60% and 100% of the liquidity that will have been raised.

However, if projects catch your eye and you wish to participate in ILOs on UniCrypt, it is important to keep a few details in mind. Firstly, the tokens you buy will be held in the smart contract until the end of the pre-sale period.

Secondly, when the liquidity cap is reached (i.e. the ILO target), anyone can manually end the token lock-in period, create a pair on a DEX and start trading. Finally, note that the UniCrypt launchpad is decentralised. In other words, they have no control over which tokens are launched and it is up to each investor to do their own research before placing funds.

If you’d like to follow the UniCrypt launchpad projects more closely, join the UniCrypt Lockers Telegram group dedicated to this purpose

A DeFi hub role to be filled

As you can see, UniCrypt is one of the most complete platforms in decentralised finance. As the protocol is compatible with the main existing blockchains, the services offered are very diversified and adapted to both investors and developers.

One of the most relevant features is Liquidity Locking. By offering projects to lock in their liquidity prior to launch, UniCrypt allows them to prove their good faith and reassure potential investors. This option obviously goes hand in hand with Initial Liquidity Offering, UniCrypt’s decentralised launchpad.

The UniCrypt ecosystem is based on a two-token economy, UNCX and UNCL, with very specific tokenomics and roles. In particular, UniCrypt offers UNCX staking to generate returns and participate in the operation of its platform. A new rewards programme is underway for the month of April, allowing participants to share $300,000.

In conclusion, UniCrypt is positioning itself as a true hub for decentralised finance. To maintain this position, the platform is planning many more improvements and the addition of ever more interesting and disruptive features.