Tether’s CTO Paolo Ardoino predicts that the company will generate about $700 million in profits for the first quarter of 2023, which would bring the company’s surplus to $1.6 billion in its reserves. A record, partly due to some problems encountered by its rival Circle following the collapse of Silicon Valley Bank.

Tether, big winner of the banking crisis

Paolo Ardoino, Tether’s CTO, expects the company to generate about $700 million in profits for this first quarter of 2023. In other words, if Tether managed to reach this figure, which is the same as the one noted for the last quarter of the year 2022, the USDT issuing company would observe a surplus of $1.6 billion in its reserves.

One reason for this is the setbacks experienced by its main competitor Circle, the issuer of the stablecoin USDC, whose peg to the dollar was momentarily lost over the weekend of March 11. As most investors have not forgotten the difficulties faced by Terra’s UST, they have turned to the USDT.

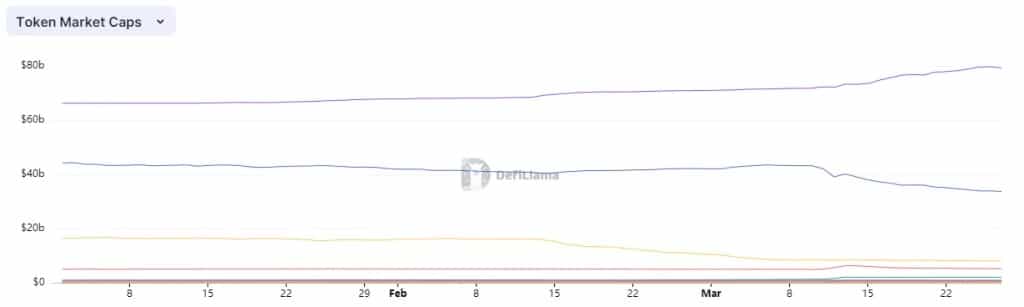

This shift in value can be clearly seen on the chart below:

Figure 1 – Evolution of the market capitalization of the USDT (in purple) and the USDC (in blue)

According to Bloomberg, Paolo Ardoino was quoted as saying that most of Tether’s reserves are now invested in short-term U.S. Treasuries, sometime after the company decided to abandon commercial paper, an effectively riskier investment.

Thus, after having been distrusted by investors for several years due to a lack of transparency regarding the management of its reserves, Tether seems to have come out of this crisis a winner. In addition, the company had also opted for a monthly audit of its reserves last summer, abandoning the quarterly audit it had been using until now.

Tether’s CTO also ended his statement by drawing parallels between Tether and the ongoing banking crisis:

“First of all, seriously, after Credit Suisse and all the other banks failed, you’re interested in Tether again? Tether is making money and the banks are failing. If you have to put money somewhere, I think Tether is the safest of all possible choices.”