Following the collapse of the UST, the decentralised insurance protocol InsurAce (INSUR) presents its action plan to compensate the victims who had subscribed to a cover.

InsurAce to compensate for loss of UST anchor

The InsurAce decentralised insurance protocol (INSUR), confirms that its users will receive compensation following the collapse of the UST, which has shaken our ecosystem in recent weeks. However, they must meet the criteria set out when taking out cover

1/ UST De-Peg Update: Terra Revival Plan

Following the release of the Terra Ecosystem Revival Plan (https://t.co/irf6uIMwPl), claimants who decide to, are permitted to transfer back UST tokens to their impacted Terra wallet to participate in the Terra snapshot.

– InsurAce.io Protocol (@InsurAce_io) May 25, 2022

According to DefiLlama, InsurAce is the third decentralised protocol in the insurance sector. It supports multiple blockchains and can cover risks ranging from a flaw in a smart contract to the loss of a stablecoin anchor.

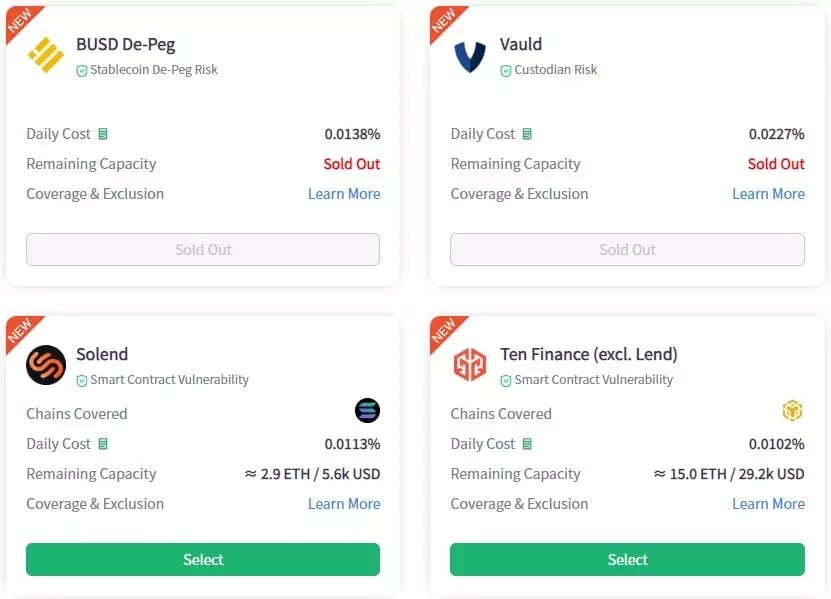

Example of hedges on the InsurAce protocol

In the case of the UST earthquake, 173 claims were submitted to InsurAce for compensation. This brings the total value of the file to more than 12 million dollars and the protocol assures that it has examined the majority of the claims. Currently, nearly $10 million is waiting to be paid out to policyholders.

Controversial shortening of time limits

Despite this, InsurAce has come under fire for cutting the maximum claim period from 15 days to seven in the case of UST peg loss. However, Dan Thomson, InsurAce’s marketing director, insists that this decision is motivated by the public interest:

It is within our terms of service to make such changes. We felt it was unnecessary to delay the process on behalf of those who have lost money and the stakers, who should pay the claims. “

Moreover, it touts the responsiveness of its decentralised protocol, compared to traditional insurance, which would drag out such a dispute for months or even years.

InsurAce also specifies that people who have subscribed to coverage can also participate in the snapshot to be eligible for compensation from Terra (LUNA), during the fork of the blockchain. However, the said compensation will be deducted from that to which the users of the protocol are entitled, and InsurAce is clearing itself of any potential loss of tokens.

It is true that decentralised insurance is a relevant coverage option in order to limit its risk. But it is advisable to calculate the cost, in order to keep an acceptable profitability and to examine carefully all the clauses of the contract.