OpenSea, the largest marketplace dedicated to non-fungible tokens (NFTs), is going to have to let go of 20% of its staff, or more than 200 people. According to its CEO, the company has no choice if it wants to go through the next 5 years without having to lay off again.

OpenSea platform in trouble

The bear market continues its work: today, it’s the non-fungible token (NFT) platform OpenSea that seems to be affected, with the consequence of having to lay off 20% of its staff. The announcement was made via Twitter by Devin Finzer, co-founder and CEO of the company

Today is a hard day for OpenSea, as we’re letting go of ~20% of our team. Here’s the note I shared with our team earlier this morning: pic.twitter.com/E5k6gIegH7

– Devin Finzer (dfinzer.eth) (@dfinzer) July 14, 2022

The exact number of employees affected by this wave of layoffs was not explicitly mentioned, but according to TechCrunch, it would concern 230 people. As stated in the press release, this is an “incredibly sad and difficult” decision for the company, which also said that the individuals affected would be treated “with great care”.

As a result, the dismissed employees will receive 12 weeks’ compensation, six months’ medical cover, an outplacement service and other benefits. According to the company’s CEO, this separation is necessary in order to go through the next 5 years without having to make a similar decision.

Unsurprisingly, OpenSea is primarily interested in protecting itself and its back in an uncertain environment, both in the cryptocurrency market and the “mainstream” economic market:

“The reality is that we have entered an unprecedented combination of crypto winter and broad macroeconomic instability, and we need to prepare the business for the possibility of a prolonged downturn. “

OpenSea thus joins the ranks of the many large companies in the crypto ecosystem that have had to shed some of their staff, following the example of Crypto.com, Gemini or Coinbase.

A brutal fall for OpenSea and for NFTs

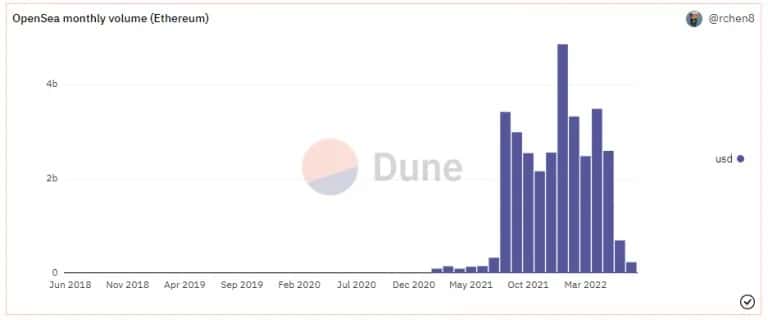

The bear market is far from sparing the NFT sector: according to Dune’s data, June was by far the worst month for OpenSea in a year, posting -73% compared to the previous month.

Indeed, while it had been recording over $2.5 billion in monthly volume since August 2021, OpenSea saw that volume drop to just under $700 million last month.

Monthly volume on OpenSea – Ethereum blockchain (ETH)

The company’s main source of revenue comes from transactions, on which it earns a commission of around 2.5%. As such, it is likely that the platform expects to see similar volume in the long term.

Looksrare, one of OpenSea’s main competitors, did not fail to respond to Devin Finzer’s tweet, indicating that it is currently recruiting in several areas.

However, OpenSea remains the leader in NFT marketplaces, and has the support of many investors, as demonstrated by its latest fundraising earlier this year, which brought the company’s valuation to $13.3 billion, even though it has only been in existence for 4 years.