In order to focus on MicroStrategy’s Bitcoin (BTC) business, Michael Saylor is stepping down as CEO in favour of Phong Le. He will remain chairman of the board, but will now focus on acquiring new bitcoins and using them in his company.

Michael Saylor passes the torch to focus on Bitcoin

MicroStrategy is famous in the ecosystem for its CEO Michael Saylor, a strong advocate of Bitcoin (BTC). As part of its quarterly earnings release, the company announced that Phong Le, who had previously held executive positions, will take over the CEO role. Michael Saylor will remain as chairman of the board.

The move will take effect from 8 August.

The aim of this move is to delegate the management of the company’s day-to-day operations. This will allow Michael Saylor to focus on MicroStrategy’s Bitcoin operations

I believe that separating the roles of President and CEO will allow us to better pursue our two corporate strategies of acquiring and holding Bitcoins and growing our enterprise analytics software business. As executive chairman, I will be able to focus more on our bitcoin acquisition strategy […] while Phong will be empowered as CEO to manage the overall operations of the company. “

A strong appetite for BTC

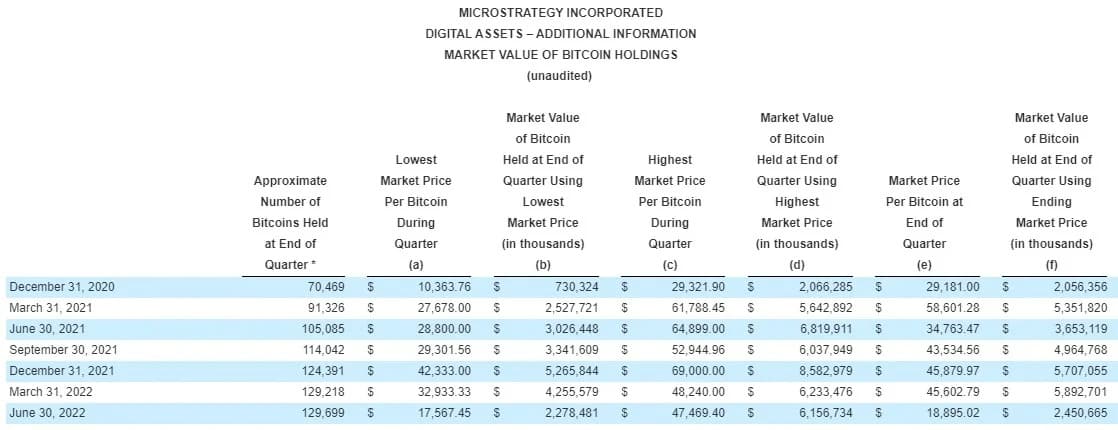

While some players like Tesla have failed to deliver despite their promises, MicroStrategy is showing resilience to the market. Indeed, since the last quarter of 2020, the company has been steadily increasing its Bitcoin reserves and does not seem to be willing to back down:

MicroStrategy BTC holdings summary

While the amount of bitcoins purchased seems to be slowing down since Q1 2022, MicroStrategy still owns 129,699 BTC. Valued at $2.45 billion at the close of Q2, they are now worth roughly $3 billion.

With an average acquisition cost of $30,650 per unit, MicroStrategy is making losses on its investments. However, Michael Saylor gives us some perspective on the situation with a chart, which shows that since his company turned to Bitcoin, its shares have risen in value by 123% and BTC by 94%. At the same time, other well-known assets are performing less well:

Since @MicroStrategy adopted a Bitcoin Strategy, its enterprise value is up +730% (+$5 billion) and $MSTR is up +123%. Performance of BTC is +94%, S&P 500 +23%, Nasdaq +13%, Gold -13%, Bonds -14%, Silver -29%. GOOG +54%, AAPL +43%, MSFT +34%, AMZN -14%, META -39%, NFLX -53%. pic.twitter.com/BWHPhbOg0d

– Michael Saylor⚡️ (@saylor) August 3, 2022

Of course, one should not make hasty shortcuts between these comparisons either. On the other hand, it puts the long-term dynamics of cryptocurrencies into perspective. While current prices can still go for lows, sometimes it’s good to be reminded of the fundamentals of our ecosystem’s leader to strengthen one’s belief in the future.