MicroStrategy, the company holding the largest amount of Bitcoins in the world, has added 14,620 BTC to its portfolio, making the purchase at an average price of $42,110. This transaction, the second largest of 2023 for the company, represents an overall investment of approximately $615.7 million. MicroStrategy’s latest investment before the arrival of spot Bitcoin ETFs ?

MicroStrategy continues to buy Bitcoin massively

MicroStrategy, Michael Saylor’s company, has just announced that it has acquired 14,620 Bitcoins at an average purchase price of $42,110, for a total of approximately $615.7 million for this transaction:

MicroStrategy has acquired an additional 14,620 BTC for ~$615.7 million at an average price of $42,110 per bitcoin As of 12/26/23, @MicroStrategy now hodls 189,150 $BTC acquired for ~$5.9 billion at an average price of $31,168 per bitcoin. $MSTR https://t.co/PKfYY59sTW

– Michael Saylor⚡️ (@saylor) December 27, 2023

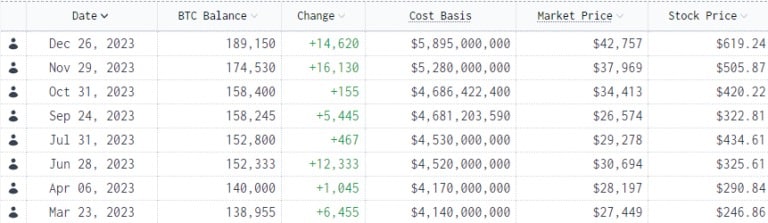

As a result, MicroStrategy, the company with the most Bitcoins in the world, now has a total of 189,150 BTC in its wallet, purchased at an average price of $31,168. This investment is its second largest of 2023, behind its acquisition of 16,130 Bitcoins last month and ahead of its purchase of 12,333 BTC last June.

Calendar of BTC purchases made by MicroStrategy over the year 2023

Like most investors, Michael Saylor seems to be betting on the approval of one or more Bitcoin ETFs between January 8 and 10. On this subject, the CEO of MicroStrategy recently declared that these Bitcoin ETFs represented “the biggest news on Wall Street in 30 years”.

He said that Bitcoin ETFs offer an entry point for many investors who, until now, would not necessarily have been interested in buying crypto-currencies. He drew parallels with the creation of the S&P500 index, which makes it easy to invest in the 500 companies listed on that index.

Others, however, are more skeptical about Bitcoin ETFs, such as Arthur Hayes, co-founder of crypto exchange BitMEX, who sees a future calamity in that ETF issuers will have to store very large quantities of Bitcoin, which is the opposite of the philosophy of BTC, intended to be traded.

MicroStrategy shares explode on 2023

MicroStrategy’s Nasdaq-listed MSTR stock has soared more than 360% over 2023, and is currently trading above $670:

Evolution of MicroStrategy’s MSTR share over the year 2023

Although MicroStrategy is investing heavily in Bitcoin, the company initially had nothing to do with this digital asset, as it is a software publisher. And yet, as we can see below, its share price is closely correlated to the evolution of the BTC price:

Evolution of the quantity of BTC held by MicroStrategy (orange), the price of BTC (cyan) and its share price (blue)

The chart also shows that MSTR’s share price is linked to the number of BTC held by MicroStrategy. The probable forthcoming approval of several Bitcoin cash ETFs could also motivate some investors to acquire MSTR shares in the hope that their price will continue to rise alongside Bitcoin.