For the past few days, cryptocurrency platform Huobi has been the subject of numerous rumors. Arrests, insolvency and the use of customer funds, we try to clear it all up.

Huobi faces rumors of arrests

For the past few days, cryptocurrency exchange Huobi has been at the center of rumors. First, Hong Kong media outlet Techub News reported that at least 3 of the platform’s executives had been arrested by Chinese authorities:

Techub News8月5日訊,Techub News從两位不同的知情人士處獲悉,加密交易所火必至少三名高管被中国警方带走调查,涉及人力、研發、財務。有員工稱接到緊急通知,要求盡快出境。此前有消息稱,某交易所的多位CTO、CHO等高管遭到中国警方调查,罪名為開設賭場罪。 pic. twitter.com/pwZ8icvwqo

– Techub NEWS (@News_Techub) August 5, 2023

At the same time, employees have reportedly been alerted to leave the country as a matter of urgency.

While it’s important to take all this information with great caution, the motive behind these supposed arrests is said to be the fact that Huobi facilitates cryptocurrency transfers to online casinos.

Rumors of insolvency

For his part, Adam Cochran has fueled rumors that Huobi may be insolvent. Here again, caution is called for, but there are several interesting points in the analyst’s argument.

For example, the platform’s USDT balance has been falling steadily since the end of June. It has fallen from $610 million to $48 million :

3/16

And its after weeks of steady USDT decline in Huobi pic.twitter.com/MpVeA23Rhm

– Adam Cochran (adamscochran.eth) (@adamscochran) August 5, 2023

In addition, according to DefiLlama data, almost all wETH would have been converted to stETH by the end of July, i.e. ETH deposited in staking

Figure 1 – Balance of wETH and stETH on Huobi

From the point of view of value alone, this changes nothing for the user, as 1 stETH = 1 ETH, but there are at least two elements to take into account. Firstly, by operating in this way, Huobi generates staking profits on Ethereum, which a priori are not passed on to customers. Secondly, a massive withdrawal could cause friction, forcing the platform to sell stETH at a loss.

In this regard, Adam Cochran accuses Justin Sun of using customer funds for his own personal gain:

15/16

Just like he did with Poloniex, Sun has been using Huobi as a personal piggy bank to earn from user deposits – and he can’t honor the balances there on ETH or USDT if users try and withdraw or sell in bulk.

– Adam Cochran (adamscochran.eth) (@adamscochran) August 5, 2023

Customers withdraw funds

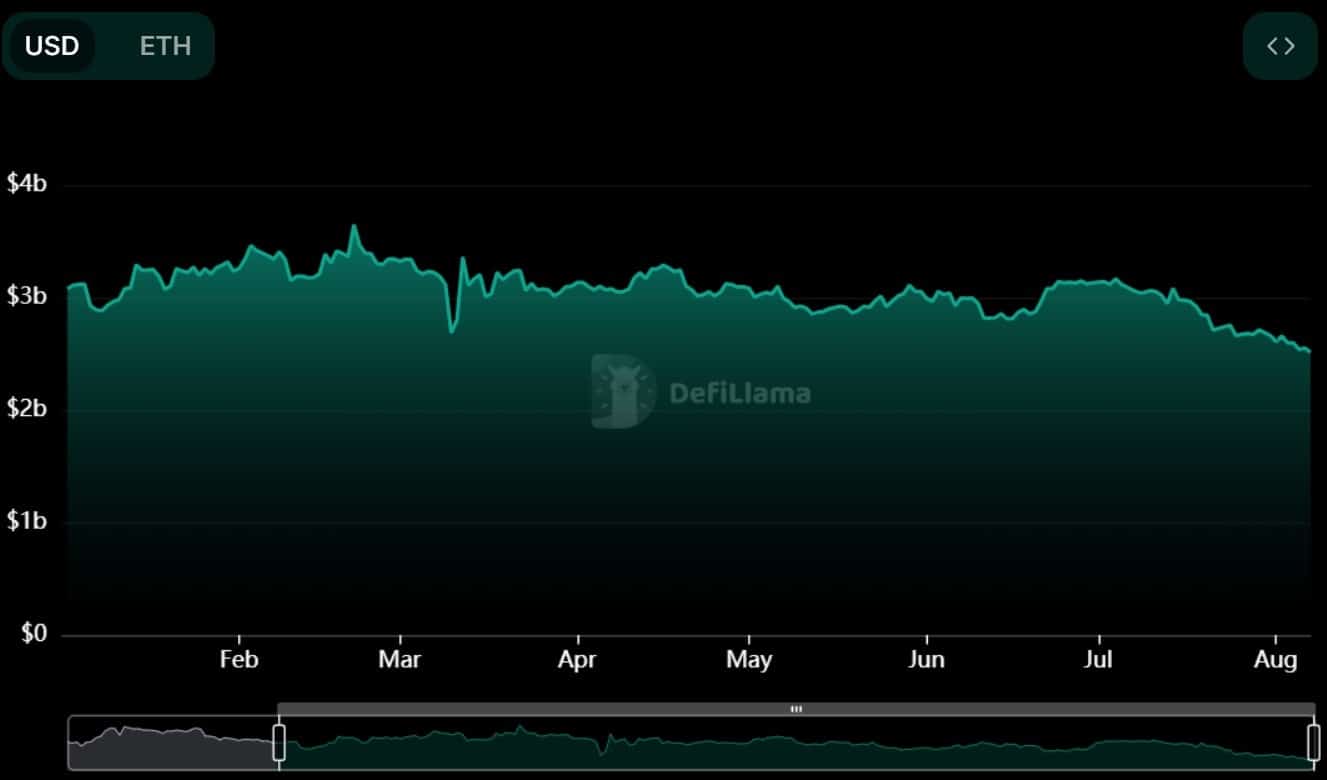

Over the weekend, Huobi saw over $60 million in outflows on its platform, and customer holdings now reportedly stand at just over $2.5 billion.

In reality, this total locked value (TVL) underlines the lack of activity on the exchange, as it shows a decline since the beginning of the year, while the cryptocurrency market has nonetheless seen a resurgence of energy. Indeed, Huobi’s TVL was $3.65 billion in February:

Figure 2 – Huobi TVL

Faced with all these rumors, Huobi has not communicated, but Justin Sun merely tweeted a “4”, copying Changpeng Zhao (CZ) as usual, when the latter calls for FUD to be ignored:

4

– H.E. Justin Sun 孙宇晨 (@justinsuntron) August 6, 2023

While we can’t confirm or deny the community’s concerns, the ecosystem has taught us over the past year that it’s sometimes better to be too cautious, as with FTX or Celsius. So, even giving Huobi the benefit of the doubt, the best way to secure your cryptocurrencies is to do so outside centralized platforms.