It’s no secret that NFTs have fallen dramatically in popularity since last year as a result of the bear market. Let’s take a closer look at this drop in volumes and the impact it’s having on the ecosystem

The decline in popularity of NFTs is weighing on the main collections

Like what we’ve seen recently on the metaverse, the non-fungible token (NFT) sector is taking a beating. A quick look at the Google Trends query ‘NFT’ shows that we’re on a 12-month low, with a score of 30 last week:

If we look at several collections in the top 10 of the largest capitalisations, we can see that all of them have seen their average selling price fall dramatically on the secondary market. NFTs from the famous Bored Ape Yatch Club (BAYC), for example, went from an average price of 158 ETH for 186 sales on 25 April 2022 to 230 sales at nearly 24 ETH per unit on 21 August. Expressed in dollars, this gives an average of around 458,000 compared with 40,400 dollars.

The same applies to other collections:

- Azuki: ETH 30.55 on 4 April 2022 compared with ETH 3.45 on 21 August, or $106,900 compared with $5,800;

- CLONE X: ETH 23.83 compared with ETH 1.41 on the same dates, i.e. $83,000 compared with $2,375;

- Moonbirds: ETH 31.53 on 25 April 2022 compared with ETH 1.21 on 21 August, i.e. $91,400 compared with $2,040.

Volumes in freefall and professionals suffering

Beyond the case-by-case nature of the various collections, this downward trend is reflected in volumes in general. Data from The Block, for example, shows 90.35 million dollars in volumes on the main blockchains over the past week, compared with almost 358 million for the week of 19 to 26 February.

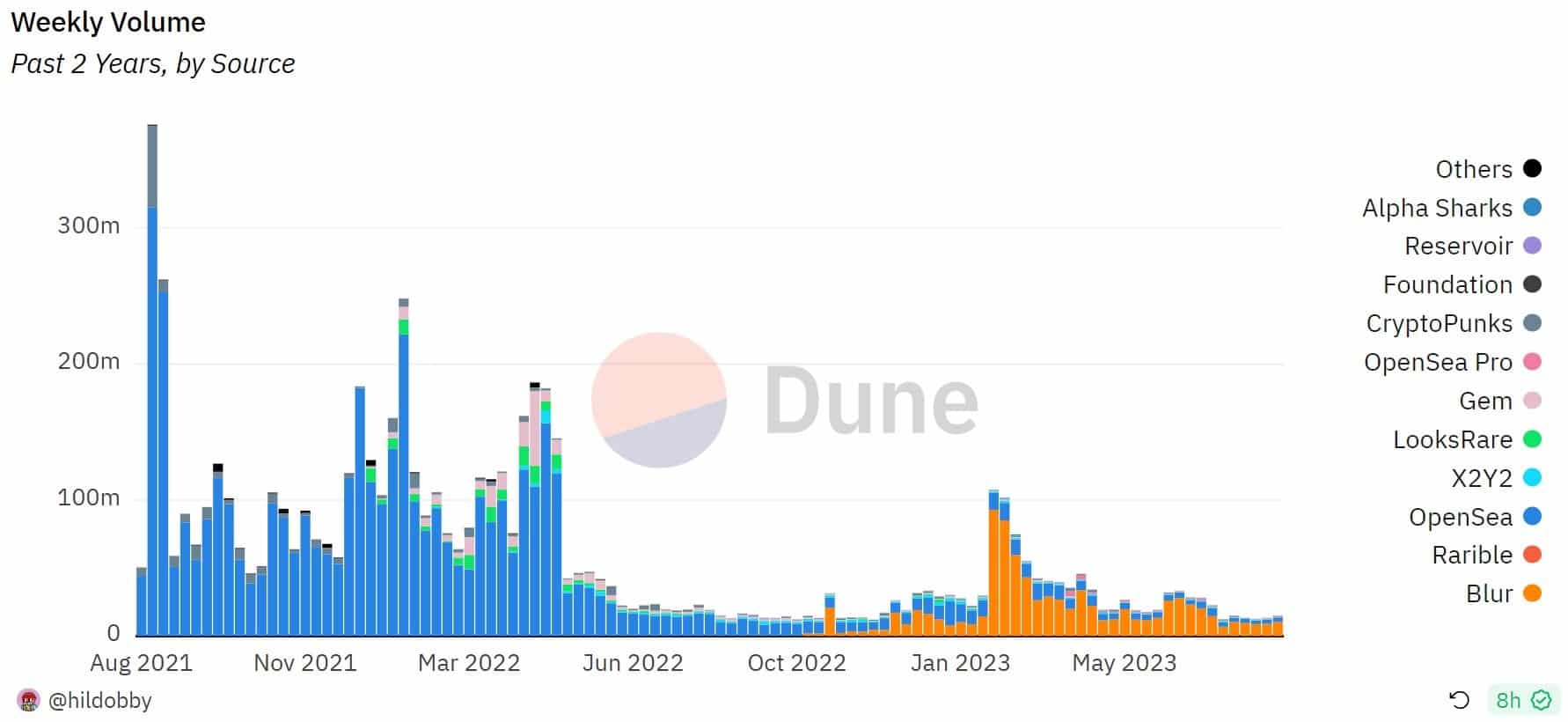

Nevertheless, the volumes at the start of the year may be considered to be partly distorted due to wash trading by some users trying to make themselves eligible for Blur’s airdrop. Applying a filter to these volumes, the NFT market has shown a sharp slowdown since May 2022:

Figure 2 – Weekly volumes of NFT marketplaces on Ethereum over the past 2 years

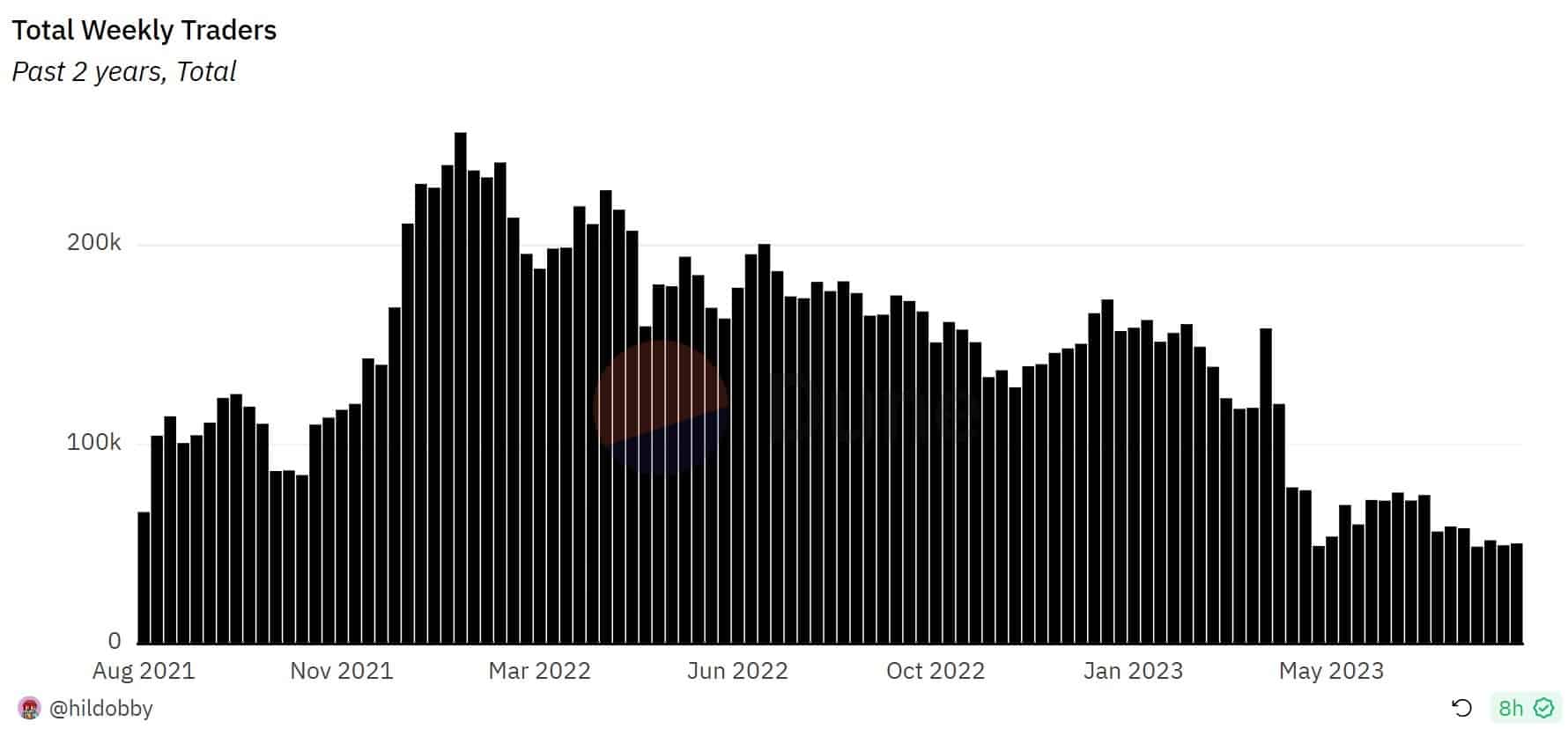

This drop in volumes is also characterised by the number of players on the market. The number of Ethereum traders is struggling to stay above 50,000 for any length of time, whereas the number of traders reached over 255,000 in January 2022:

Figure 3 – Number of weekly NFT traders on Ethereum

This decline is not without consequences for professionals in the sector. Indirectly, OpenSea announced changes to its creator fee policy last week in an attempt to recapture some of its volume, while marketplace RECUR will cease trading in November. Earlier this month, it was the Nifty’s platform that also drew the curtain :

Nifty’s Update

Earlier this year, mindful of our limited resources in a difficult market, we pivoted to developing a platform for Web3 creators. Since then, we’ve been heads down building our new product and working on opportunities to access the capital required to keep…– Nifty’s (@Niftys) August 3, 2023

Of course, we also need to take a more global view of the market, as Michael Bouhanna of Sotheby’s recently explained. The NFT ecosystem has seen a lot of excesses between 2021 and 2022, and this slowdown is in a way cleaning up the ecosystem to allow it to catch its breath.