U.S. authorities are launching a privacy offensive, targeting apps that promote user privacy. This week, the arrest of the co-founders of Samurai Wallet, accused of laundering $2 billion, and an FBI warning against certain apps that don’t require KYC, mark a critical turning point.

The United States begins a battle against privacy

The U.S. authorities seem to have started a legal battle against apps that allow their users to protect their privacy. Earlier this week, the co-founders of Samurai Wallet, a wallet equipped with a Bitcoin mixer, were arrested, accused of laundering $2 billion.

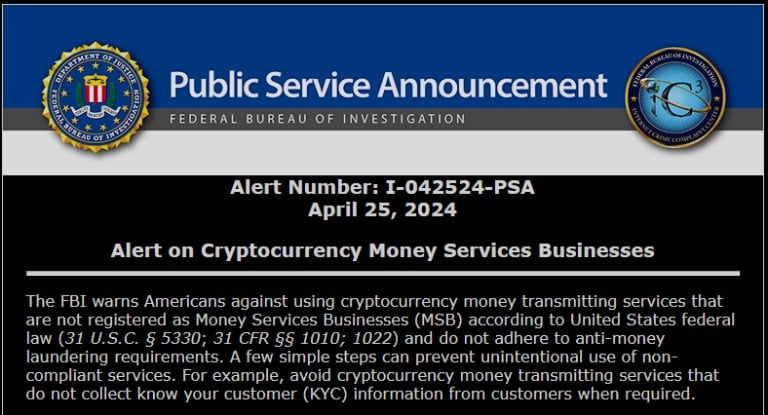

The Federal Bureau of Investigation (FBI) recently took aim at apps that don’t require identity verification (KYC), issuing a statement to warn US citizens of the dangers these platforms could represent.

Excerpt from the press release issued by the FBI

“The FBI is warning Americans against using cryptocurrency money transfer services that are not registered as money services businesses (MSBs) under U.S. federal law (31 U.S.C. § 5330; 31 CFR §§ 1010; 1022) and do not comply with anti-money laundering requirements. A few simple steps can prevent the unintentional use of non-compliant services. For example, avoid cryptocurrency money transfer services that fail to collect the necessary customer information (KYC) when required. “

It’s hard to know precisely which applications the FBI is referring to here. Indeed, by law, a company is obliged to collect information from its customers only if it takes custody of their funds, as is the case with Coinbase, which keeps the private keys to wallets for their customers.

However, many services and applications in the cryptocurrency world allow you to carry out operations similar to an exchange platform, but do not require identity verification (KYC), as they never take custodianship of funds.

For example, there are platforms for exchanging fiat currencies for cryptocurrencies that do not require KYC. Once the funds have been received, they are directly exchanged and sent to a non-custodial wallet, for which only the user holds the private key, as is the case with Relai app or Mt Pelerin.

Other on-chain apps, such as Uniswap or Aave, provide infrastructure on the blockchain without ever accessing the funds.

This warning could be a threat to non-custodial wallets

The most surprising thing about this FBI warning is that it seems to be aimed at exchange platforms, however, those that take custodial control of funds and don’t collect their customers’ personal information are already in an illegal situation.

For many members of the community, the warning, which came 24 hours after the arrest of the co-founders of Samouraï Wallet, seems to declare the start of an offensive by the authorities against Internet privacy solutions.

This move could even eventually lead to the banning of classic cryptocurrency wallets that operate solely with a phrase-seed.

It’s important to remember that, while some people use blockchains and their many applications to increase their privacy, using these technologies to launder money or participate in illegal activities is irrelevant because of the traceability that blockchains offer.

To put this into perspective, a study by Chainalysis reveals that, in 2023, cryptocurrencies involved in illicit activities accounted for $24.2 billion, while the Panama Papers scandal alone involved around $11.3 trillion.