To make the complex world of decentralized finance (DeFi) more accessible and enjoyable to use, DeFi Saver is emerging as an essential aggregation solution, offering simplified and efficient management of the cryptocurrencies placed in this ecosystem. This all-in-one, non-custodial and trustless application presents itself as an essential tool for interacting with the main DeFi protocols from a single interface. Zoom in on DeFi Saver’s unique features

What is DeFi Saver?

Navigating the world of decentralized finance (DeFi) can be complex, especially for beginners. With a multitude of concepts such as staking, liquid staking, lending and yield farming, it’s very easy to get lost among the different protocols and tools available.

To simplify the user experience, a number of DeFi service aggregation solutions have emerged. DeFi Saver stands out as a platform for simple, comprehensive cash management.

This all-in-one, non-custodial and trustless application facilitates asset and position management in decentralized finance protocols.

DeFi Saver adapts to a variety of user profiles, whether they are familiar with cryptocurrencies or not. It offers access to several lending and borrowing protocols, such as Aave, decentralized exchanges (DEX) like Uniswap, bridges between blockchains, as well as a variety of return strategies.

Optimize your strategies with DeFi Saver

How to improve your trading experience

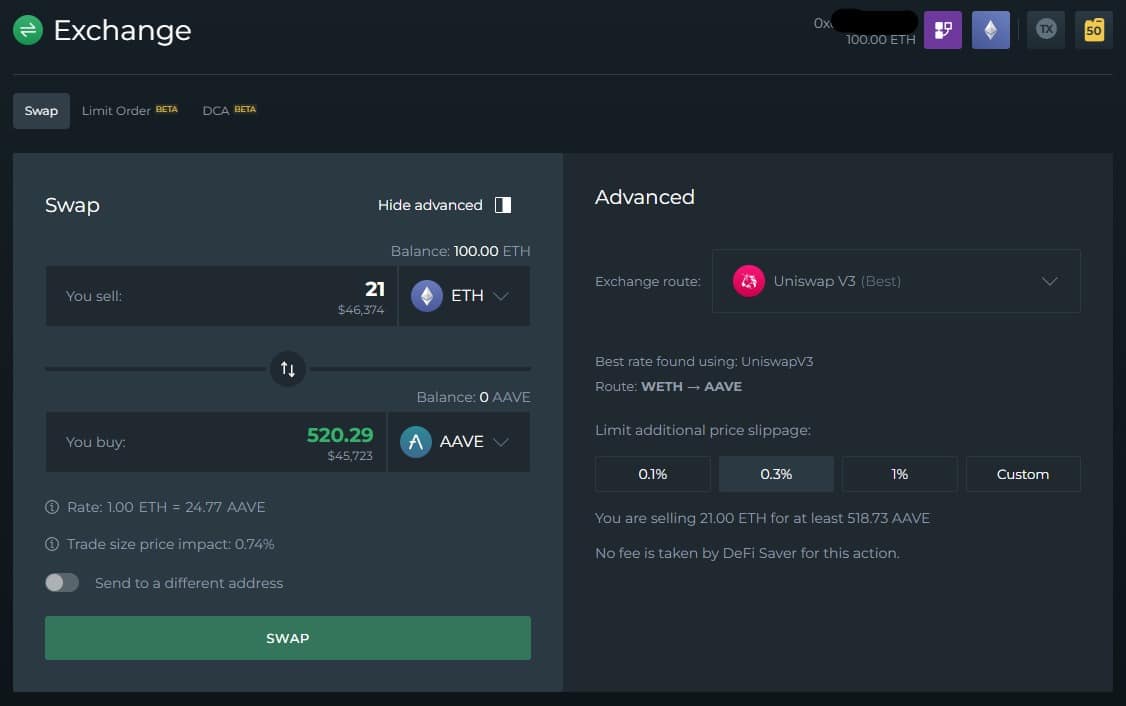

If cryptocurrency trading via DEX is part of your daily routine, DeFi Saver’s swap aggregator could prove invaluable.

In addition to enabling you to swap your tokens at the best rates, by giving you an overview of the exchange rates offered by various DEXs such as Uniswap and Balancer, DeFi Saver’s Smart Exchange also offers the possibility of:

- Multiple exchanges between different sets of tokens;

- Configure limit orders to set a price that triggers buying or selling;

- Create a recurring investment plan, known as Dollar Cost Averaging (DCA).

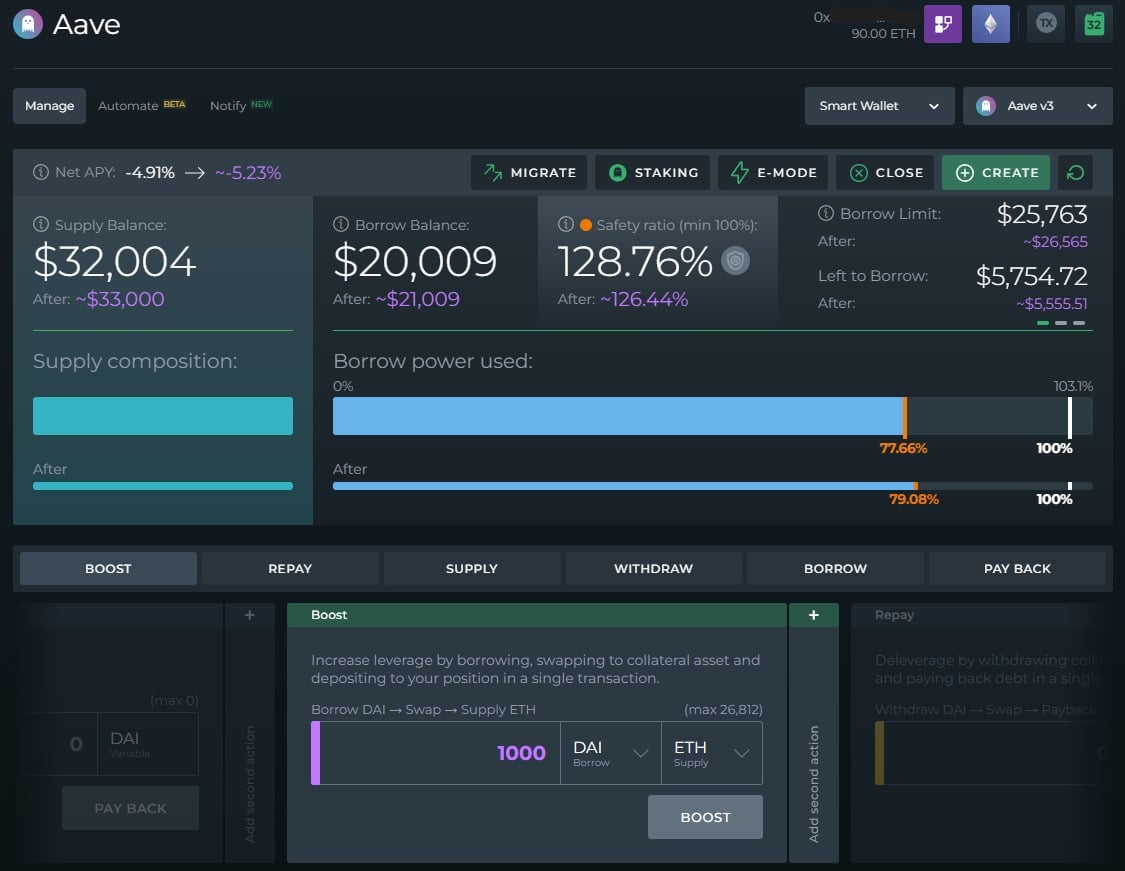

How to simplify the use of lending and borrowing protocols

Whether you’re using lending and borrowing protocols to collect interest or to create a leveraged position, DeFi Saver enables seamless interaction with various protocols via a single interface. So far, 8 protocols are available, including MakerDAO, Compound, Aave, Spark, Reflexer, Liquity, Curve and Morpho Blue.

The use of all these applications in one place makes transactions faster and allows automated management of your liquidity placed in the DeFi.

How to improve the management of your assets with the automation function?

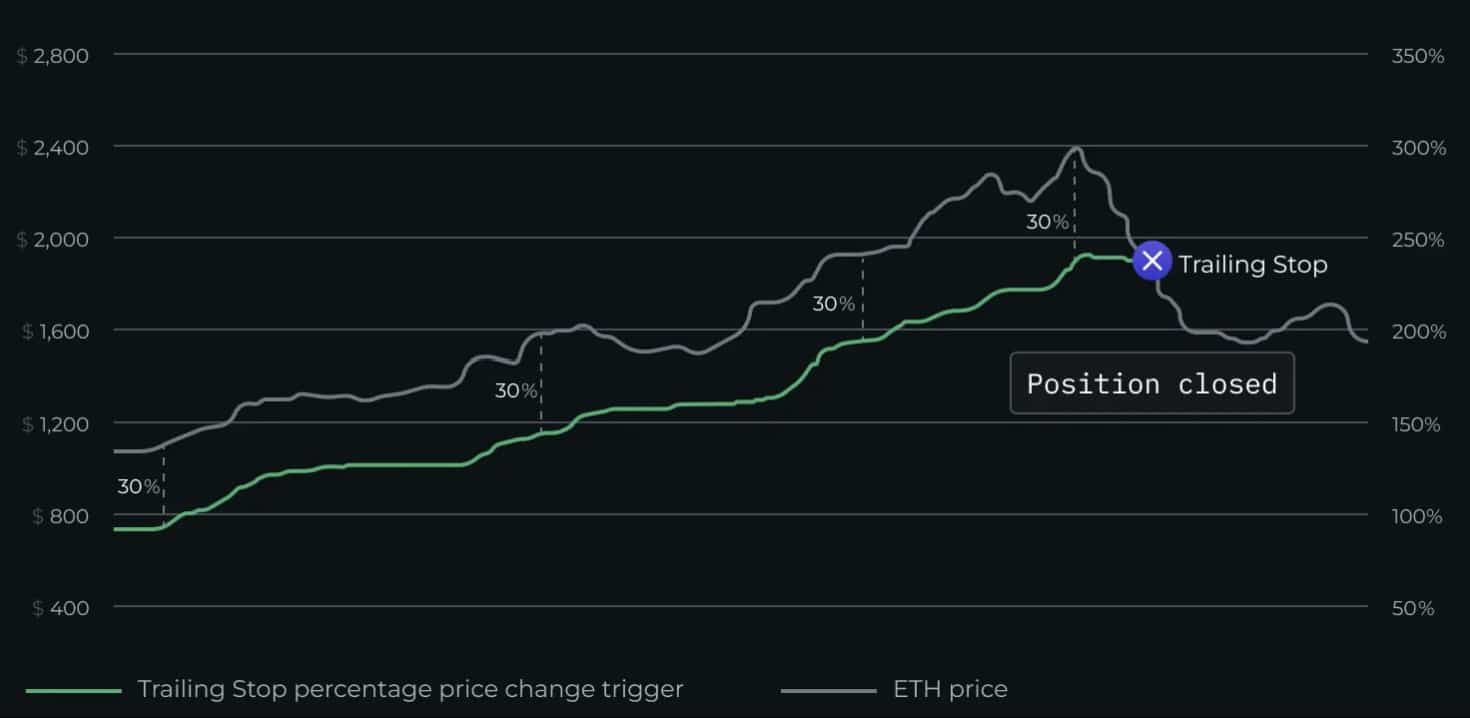

DeFi Saver’s automation feature is a system for protecting and managing your collateral assets deposited on DeFi’s protocols. In short, it’s a series of transactions executed simultaneously when certain conditions are met.

This feature allows you to schedule actions such as the sale, purchase or transfer of cryptocurrencies, triggered when an asset reaches a certain price. These automated actions, specially designed to prevent liquidations, represent DeFi Saver’s flagship feature, which is sought after by all DeFi enthusiasts.

DeFi Saver’s most frequently used automation option is the one dedicated to collateral asset management. It enables automatic management of your loan-to-value ratio on DeFi protocols, adjusting your position if the value of collateral comes dangerously close to your liquidation threshold. Conversely, if the value of your collateral becomes too high in relation to your borrowing, this option can proceed to automatic borrowing without any intervention on your part.

What’s more, the stop-loss and take-profit option gives you the ability to set a target price for the total closure of your position. This not only acts as a shield against liquidation, but also helps reduce losses.

The trailing stop option is designed to activate a specific action when the price of an asset varies by a defined percentage.

To optimize returns in DeFi while protecting against liquidations, DeFi Saver’s Savings Liquidation Protection feature is ideal. It allows you to recover your interest-bearing assets in order to repay your debts if the value of the collateral falls too sharply.

Finally, the automation offered by DeFi Saver is particularly well suited to DAI collateral management on MakerDAO and bond management on Liquity.

How to use leverage like a professional

For experienced users, DeFi Saver greatly simplifies the creation of long and short leveraged positions through lending and borrowing protocols. What’s more, the Boost option lets you amplify these positions, while the Repay option offers the possibility of reducing them, allowing you to adjust the size of your loan and borrowing with a single click.

The Boost and Repay options are currently available for the following protocols: Maker DAO, Compound, Aave, Spark, Curve, and Liquity.

How to switch between different protocols with a single click?

If you want to optimize your returns quickly, DeFi Saver’s Loan Shifter feature lets you transfer collateral and loans from one protocol to another with a single click.

Without this feature, every closing and reopening transaction would have to be carried out manually, which would not only be time-consuming, but also more costly in transaction fees.

How to perform several complex actions with a single click?

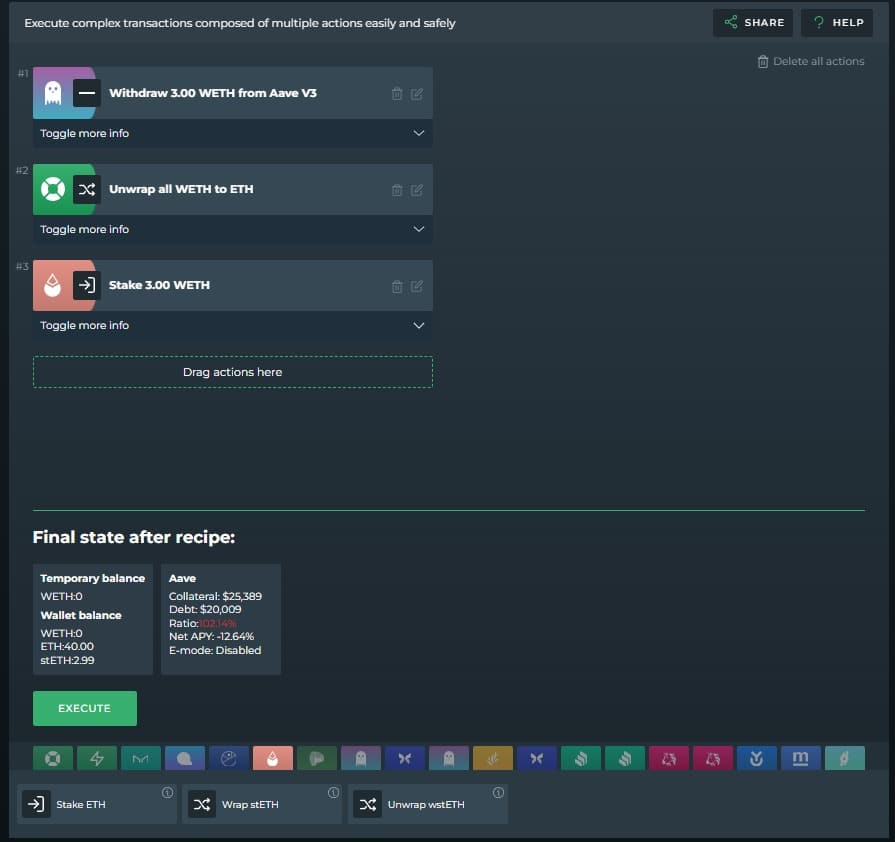

DeFi Saver’s Recipe Creator lets you design transaction packages specifically to suit your needs. This feature integrates a variety of transaction types, such as wrap, buy, sell, withdraw, deposit, refund, borrow, and even cryptocurrency staking.

The Recipe Creator transforms the DeFi into a modular building set in the style of Lego bricks, where it is possible to make a recipe that can allow you to withdraw, unwrap, then staker Ethers (ETH) in a single click.

How to test your DeFi strategies without risk?

All the above-mentioned features can be tested and explored in DeFi Saver’s Simulation mode, a fictitious environment that simulates the application before carrying out complex transactions with real cryptocurrencies.

This mode works like a sandbox, allowing you to experiment with all the decentralized finance protocols and features that DeFi Saver offers, without requiring connection to a real wallet.

This simulation mode provides an in-depth understanding of the application and allows you to examine all its features before using it to the full.

Conclusion on the DeFi Saver tool

DeFi Saver is an all-in-one platform ideal for managing assets placed in decentralized finance (DeFi) protocols.

It simplifies and automates operations such as lending, borrowing and trading, appealing to novices and experts alike. Its automation offers protection against liquidations and helps manage lending/borrowing ratios.

For experienced traders, DeFi Saver simplifies the development of yield strategies and the creation of leveraged positions. Thanks to its innovative features, it makes initially complex activities, such as using the Loan Shifter and Recipe Creator, accessible even to beginners.

DeFi Saver is a major ally in making decentralized finance accessible to all. The platform assists DeFi enthusiasts in managing their positions, eliminating the need for daily monitoring.