On Wednesday, the DeFi Aave protocol teams presented V4 to the governance. With this new iteration scheduled for 2025, what new features can we expect?

V4 of Aave to be released in 2025

While Aave V3 has been in place for 2 years now, the renowned decentralized finance protocol (DeFi) presented its V4 yesterday.

According to the roadmap, this new iteration is currently only in its research phase, which is due to run until the end of the current quarter. After that, a development phase will begin, and an estimate of Q2 2025 is made for publication and auditing of the new code.

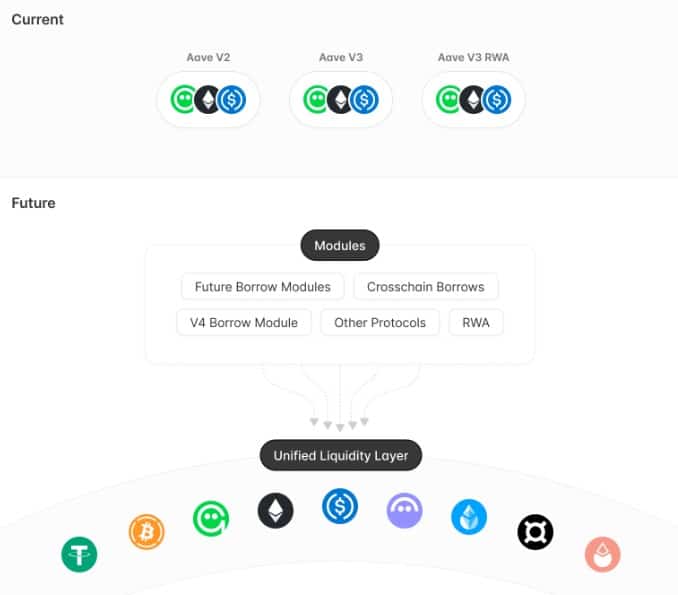

One of the new features we can expect to see is a unification of markets. For example, Aave V2 and Aave V3 are currently isolated from each other, which should change in the future.

Schematic of Aave V4 market unification

Interest rate adjustment should be automated, and Aave is currently working with Chainlink (LINK) to develop a powerful system:

“We are actively working with Chainlink to define a clear set of data flows required to implement the most capital-efficient interest rate models ever designed on-chain. “

On the borrowing side, these should be streamlined through the concept of “liquidity premiums”. In this way, each asset on the platform should be assigned a risk rating influenced by various factors, such as its centralization or market conditions. This will enable the cost of borrowing to be adjusted according to the nature of the asset and the collateral deposited:

“Thanks to refined risk management tools, liquidity premiums are able to further increase the capital efficiency of the protocol, bringing higher returns to providers and lower fees to borrowers who use the strongest collateral. “

These are just a few of the concepts under development, with further enhancements also on the way. Among this non-exhaustive list would be, for example, the arrival of programmable actions, such as the automatic borrowing or repayment of an asset should governance change its risk. Aave’s visual identity is also set to receive a fresh coat of paint.

As for the GHO stablecoin, several measures should also be taken to accelerate its adoption, while the liquidation engine should be optimized.