The rise of DEX? Decentralised trading platforms saw their volumes increase during November, even if they did not reach the records set last spring. A look at the latest trends

Decentralised trading platform volumes have increased

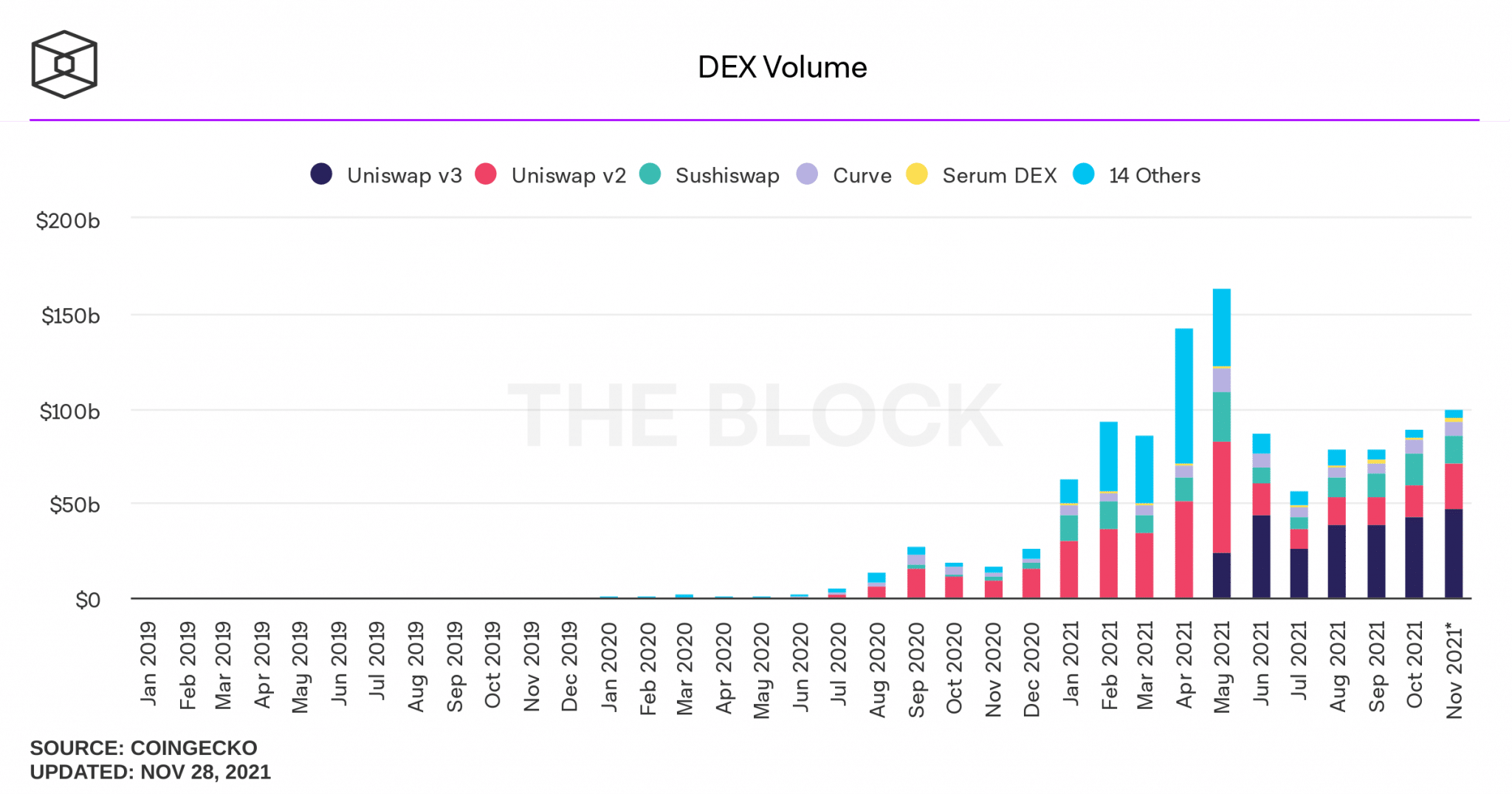

Decentralised trading platforms have the third highest monthly trading volume of the year, after increasing since June, according to data released by analytics platform The Block

Decentralised exchange platforms’ cumulative monthly volume (Source: The Block)

For November, the volume is close to $100 billion. The increase has been relatively steady, as the volume was $89 billion in October and $78 billion in September.

However, it has not yet reached the levels of April and May, when cryptocurrency prices showed particularly high volatility.

Uniswap still leading DEX by a wide margin

Unsurprisingly, Uniswap continues to lead the way, with almost half of November’s volume for its version 3 ($47 billion), and $24 billion for its version 2. The protocol alone therefore captures more than 70% of the volume that passes through decentralised exchange platforms.

It is followed by SushiSwap, which gathers nearly $15 billion in volume, and Curve, with $6 billion.

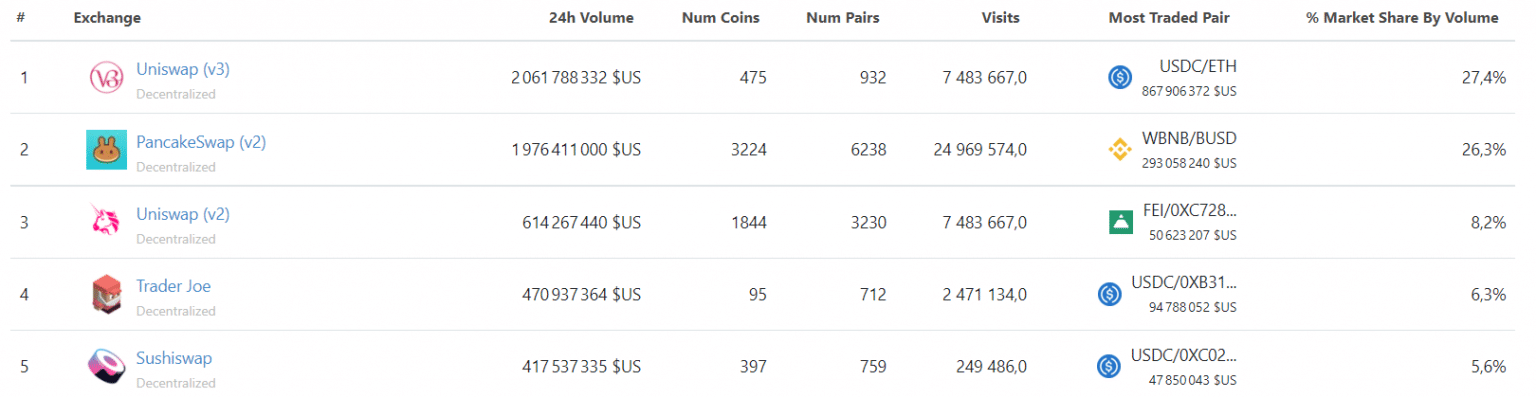

PancakeSwap has fallen off the list in recent months, as The Block considers the Binance Smart Chain platform not to be truly decentralised. However, the exchange still appears in some DEX lists that carry a significant volume of traffic. If we look at the data aggregator CoinGecko, PancakeSwap is ranked second in terms of daily volume

Daily volume of the main decentralised exchange platforms (Source: CoinGecko)

Decentralised exchange platforms are therefore gaining momentum, despite the recent fall in cryptocurrency prices. In any case, they stand out clearly from their centralized competitors, which have come under particularly close scrutiny from regulators in recent months.