GMX, a decentralised exchange operating on the Arbitrum (ARB) and Avalanche (AVAX) networks, is to integrate Chainlink’s (LINK) low-latency oracles to strengthen its structure. In return, Chainlink will receive 1.2% of the protocol fees generated on GMX.

GMX gets Chainlink’s oracles

Decentralised exchange (DEX) GMX, which operates on layer 2 Arbitrum (ARB) and Avalanche (AVAX), is to acquire Chainlink’s low-latency oracles (LINK) to improve its structure.

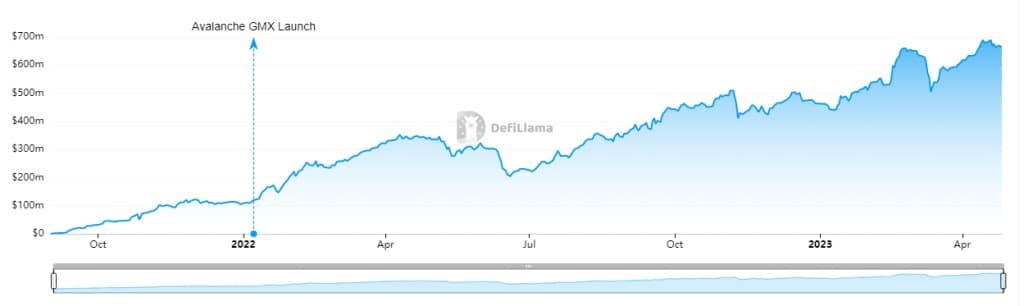

In exchange for its oracle network, Chainlink will receive 1.2% of the protocol fees generated on GMX. Currently, GMX is the protocol with the highest Total Locked Value (TVL) on Arbitrum, ahead of Uniswap V3 (UNI), Radiant (RDNT), Stargate (STG) and Aave V3 respectively.

Among other things, DEX offers spot and perpetual trading via a pool of several cryptocurrencies that pays its liquidity providers. This rather unusual process enables GMX to offer low fees and no impermanent loss. To find out more about GMX, read our tutorial dedicated to this DEX.

Evolution of the total value locked in on GMX from its launch to today

Chainlink’s oracles will support GMX’s long-term development, according to the governance proposal:

This proposal provides a key infrastructure solution and development partner to help GMX meet its critical oracle requirements. It directly aligns Chainlink with GMX’s requirements for low-latency asset-specific data flows, market metrics and coverage of new blockchains needed to fuel our growth. “

Low latency oracles particularly suited to DeFi

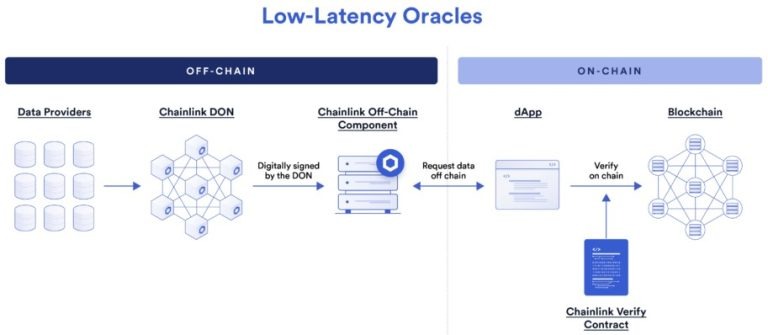

Designed to meet the needs of decentralised finance (DeFi), the low-latency oracles developed by Chainlink make it possible to meet the specific expectations of decentralised applications (dApps), in particular by providing high-frequency prices, always with on-chain verification.

Without going into the technical details, low-latency oracle networks ensure extreme speed, considerable energy efficiency and, above all, prevent arbitrage attempts.

Diagram of how Chainlink’s low-latency oracles work

For Johann Eid, Chainlink Labs’ vice president of go-to-market, this partnership paves the way for wider adoption of decentralised finance:

Chainlink Labs has been committed to supporting and growing DeFi since its inception. With this collaboration, we mark another milestone for the space and its race towards mass adoption. Low latency oracles will bring the industry closer to the level of performance that currently exists outside of it, while our economic alignment helps lay the foundation for a more sustainable ecosystem. We are excited to continue building this space with leading projects like GMX, one block at a time, until DeFi becomes a leading and secure global financial system.”