Bitcoin (BTC) and Ether (ETH) made remarkable bullish moves last week. Nevertheless, they seem to be showing early signs of slowing and a willingness to regain strength. A bearish retracement seems to be the preferred scenario at this stage. We take stock together to understand, and place accordingly.

Bitcoin (BTC) Technical Analysis

Last week, we mentioned the beginnings of a bullish move after a breakout from the top of the range. Since then, the Bitcoin (BTC) price has managed to make an impulsive upward move. Let’s now look at the potential for future moves, to find interesting entry and exit points.

The weekly view will give us little information compared to last week. Nevertheless, we can already see the return of this uptrend. Two points to note are:

- Resistance zone at $46,500: currently holding the price locally;

- $51,500 resistance zone: will play a pivotal role in whether or not we see a continuation of the uptrend.

Bitcoin (BTC) analysis in 1W

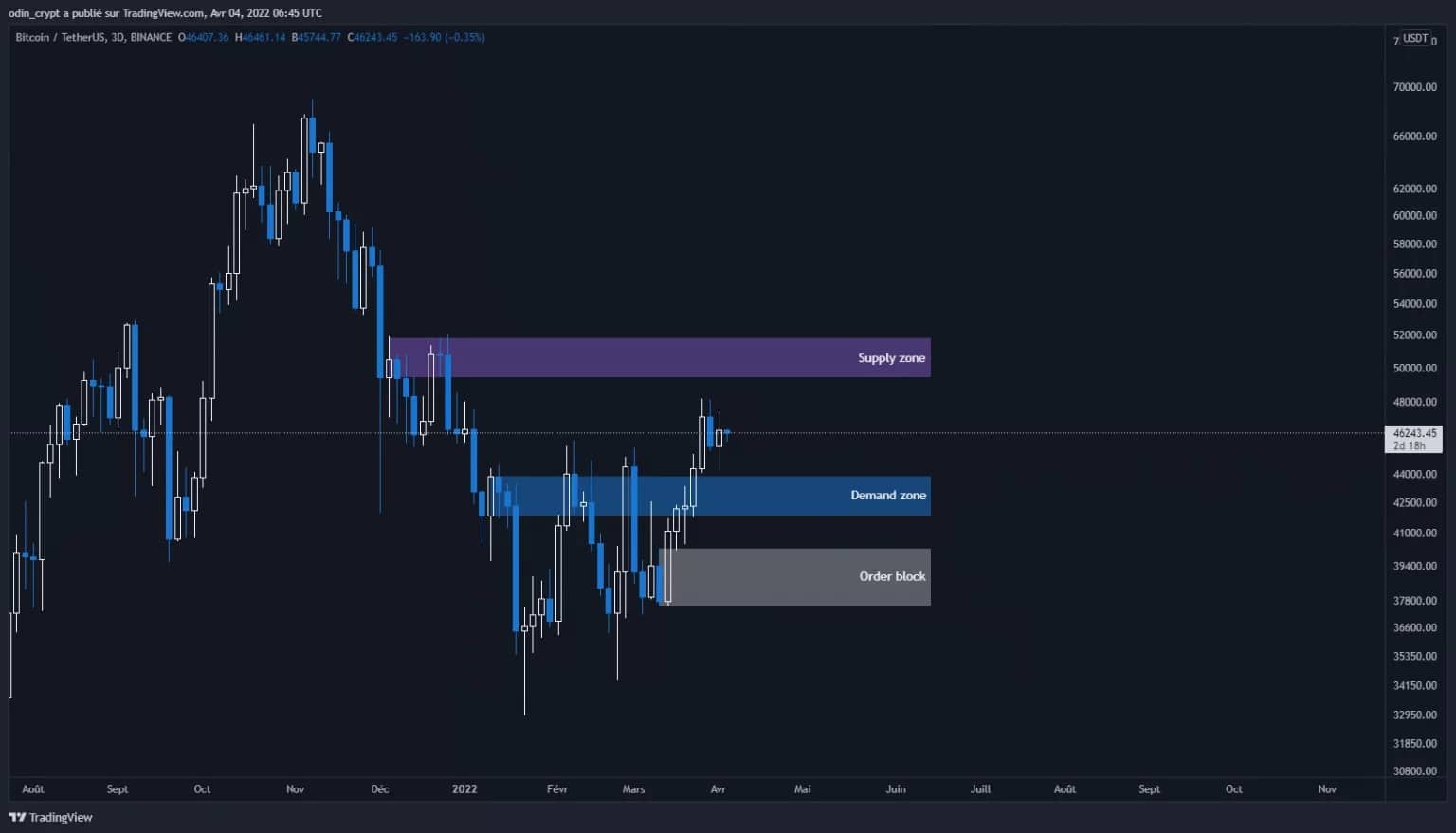

The daily view will show the current movement. On this time unit, the price is currently between two interest zones. The first is between $49,000 – $52,000, which is considered a sell zone. This zone will be important, as it will allow the price to continue its rise towards the ATH in case of a bullish breakout.

The second area is between $41,500 – $44,000. It corresponds to the former range top which, once broken, allowed the price to resume its upward path. This area will at least serve as a retracement point for the upward movement.

Personally, it is the third zone that will interest me. It is located at $37,500 – $40,000, and is the area where large portfolio orders are placed.

This zone can have many names, but it highlights an area that has been used as an impetus for a move, in this case a bullish move. So I expect to see a structural bounce between $38,500 and $39,000.

Bitcoin (BTC) 3D analysis

Let’s zoom in on the 4h view again. This view confirms the situation in which Bitcoin is evolving. The price is currently in its demand zone and seems to be starting a distribution. On the shorter time units (1h), the price is clearly on a local downtrend.

Indeed, the price has established a high and the price has started its distribution. This converges for the moment with the idea of a deeper correction on our order block area. Until the $47,700 is taken back to the upside, the price will remain in a bearish retracement pattern.

Bitcoin (BTC) analysis in 4H

Ether (ETH) technical analysis

The price of Ether (ETH), on the other hand, looks slightly different, although correlated. On the weekly view, the price also manages to break out of its range on the upside by starting an expansion phase.

Again, we can see 2 areas that will impact the price:

- The sell zone at $3,900 – $4,150,

- The regained zone at $3,400.

Macro remains bullish too, however, and seems to be punishing the last few entrants to create enough liquidity for a larger bullish rally.

Ether (ETH) analysis in 1W

On the daily view, the price is also bullish. We can see 3 interesting areas for further movement:

- The first one, a selling zone, is located at $3900 – 4150;

- The second, a buy zone, is between $2,900 – $3,100 and corresponds to the former range;

- And the third, a buy zone, takes place between $2,500 – $2,700 and corresponds to the beginning of the movement.

It is very likely that the price will make its next low on the third zone. Thus, it will have all the strength it needs for its next move.

Ether (ETH) 3D analysis

The 4h view will clarify our analysis. We find our supply area at the same place, and 3 new points will guide us on the next step.

The $3,000 indicates an interesting buying point corresponding to the last local high. The demand zone between $2,650 and $2,750 corresponds to the zone that contained the accumulation of the bullish movement. And finally, the $2,500 zone which remains the zone to hold in order not to lose this bullish structure.

So we have some interesting buying points to play with while controlling our risk.

Ether (ETH) analysis in 4h

Technical analysis of Dogecoin (DOGE)

Today I offer you an analysis of the king of them all, namely Dogecoin (DOGE). I am aware that many are actively trading it, and many have it in their portfolio. I will therefore focus today on the long term view, and not on its short term speculation.

On the daily view, the Dogecoin price is clearly in a downtrend. I have noted a number of elements on the chart. The yellow rectangles (imbalance) are areas of liquidity that the price will have to visit. This is due to the strength of the movements, regardless of their direction. Once visited, these areas are considered filled and no longer represent a valid indication. This imbalance is accompanied by an order block.

I can imagine a scenario where the price of Dogecoin returns to the orderblock zone at $0.057 – $0.067 before resuming the upward path to around $0.21 (+220%) and finally resuming the downward path to fill the lower zones at $0.0073 – $0.0089.

Once all of these areas have been visited, the price will be able to accumulate in this low area before actually resuming the upward path.

3D analysis of Dogecoin (DOGE)

Conclusion

Bitcoin (BTC) and Ether (ETH) continued to rise last week after breaking out of their range. Now the price has reached local selling areas which should allow the price to retrace the bullish excesses. It therefore seems logical that the price will start a local downtrend to the buy point.

For Dogecoin (DOGE), the price remains in a macro downtrend, and the price is approaching interesting buying zones for a medium-term move. On this basis, it is possible to make an initial purchase around $0.057 to follow this bearish retracement.