Exchange platform CoinFLEX has suspended withdrawals. Following the collapse of the cryptocurrency market, the exchange is facing a liquidity crisis. The ecosystem’s token and its dollar-indexed stablecoin have actually collapsed. Yet CoinFLEX has a plan to get its head above water.

Like Celsius, CoinFLEX is suspending withdrawals in the middle of the bear market

CoinFLEX, a Seychelles-based cryptocurrency exchange, recently suspended withdrawals. To justify this exceptional measure, the exchange pointed to “recent market volatility”. In a bear market environment, “a long-standing customer” of CoinFLEX is negative on the platform, the statement on the company’s blog said.

Normally, the exchange would not hesitate to liquidate the position. But in this case, the investor has a “non-liquidation remedy”. In concrete terms, the investor has agreed to “strict personal guarantees” in order to avoid liquidation. According to CoinFLEX, the investor failed to honour his debt, which exacerbated the platform’s liquidity shortage.

The company initially pledged to reactivate withdrawals on Thursday 30 June 2022. In the end, CoinFLEX was unable to deliver on its promise. At the time of writing, withdrawals are still suspended.

CoinFLEX is not the only player in the ecosystem to have frozen withdrawals. Since the market crash, Celsius Network has also blocked all withdrawals and transfers from its customers. This is also the case for Babel Finance, an Asian lending platform.

Roger Ver reportedly owes CoinFLEX a debt

The exchange initially did not disclose the identity of the investor. On his Twitter account, Mark Lamb, the company’s chief executive, revealed that it is Roger Ver, one of the first investors in Bitcoin

Roger Ver owes CoinFLEX $47 Million USDC. We have a written contract with him obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regularly. He has been in default of this agreement and we have served a notice of default.

– Mark Lamb (@MarkDavidLamb) June 28, 2022

According to Lamb, the notorious “Bitcoin Jesus” owes CoinFLEX “47 million USDC”. The official details the terms of the agreement between the investor and CoinFlex:

We have a written agreement with him to personally guarantee any negative balance in his CoinFLEX account and to regularly top up his margin. He has been in default of this agreement”.

Strongly against Roger Ver, Mark Lamb nevertheless claims that the multi-millionaire has so far complied with the terms of the agreement regarding margin increases.

Recently some rumors have been

spreading that I have defaulted on a

debt to a counter-party. These rumors

are false. Not only do I not have a debt

to this counter-party, but this counter-

party owes me a substantial sum of

money, and I am currently seeking the

return of my funds.– Roger Ver (@rogerkver) June 28, 2022

For his part, Roger Ver denied the comments of the CoinFLEX CEO, without ever mentioning the name of the exchange:

“Not only do I not owe this counterparty, but this counterparty owes me a substantial amount of money, and I am currently seeking the return of my funds.

Interviewed by CNBC, Lamb admits he “doesn’t know what’s going to happen next if he doesn’t pay it back. To get the money back, the executive pledges to continue negotiations with Roger Ver. In parallel, CoinFLEX will also “go through the appropriate legal channels”.

FlexUSD loses parity with the dollar

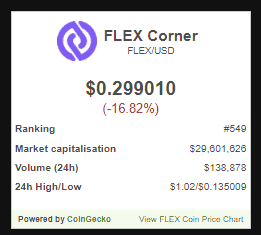

FLEX coin Price Chart

Following the suspension of withdrawals, the price of the FLEX Coin (FLEX) collapsed. Within hours, the token fell from $4.30 to less than $1.50. Subsequently, the currency contracted below the dollar threshold. The cryptocurrency allows you to earn interest and save trading fees on the platform.

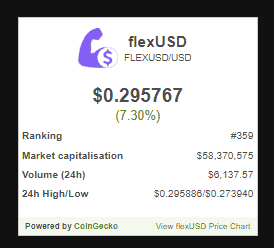

flexUSD Price Chart

A few days after the exchange’s actions, the FlexUSD stablecoin lost its parity with the US dollar. Like Terra’s UST and Tron’s USDD, the cryptocurrency has depegged from the US fiat currency. Currently, one FlexUSD is worth less than $0.30.

The CoinFLEX rescue plan

To bail itself out, CoinFLEX has announced an ambitious recovery plan. The company has issued a cryptocurrency called Recovery Value USD ( rvUSD) to raise the missing $47 million.

The currency attracts investors by promising a 20% interest rate. To pay this interest, the exchange will use the funds that will be repaid by Roger Ver plus a significant funding fee.

Despite the market environment, CoinFLEX’s project has attracted several traditional investment funds. Lamb is optimistic that these funds have significant capital. With this plan, the exchange hopes to revive withdrawals in the near future:

We continue to talk to investors interested in the rvUSD and commitments are increasing. Once the token sale is fully committed, we will be able to communicate a clear path to activating withdrawals, but until then, they will remain suspended.”