With the Ordinals protocol, a wave of new tokens poured into Bitcoin (BTC). These memecoins rose sharply in the space of a few days… Before correcting by several tens of percent today

Memecoins set Bitcoin ablaze

It’s hard to escape the new memecoin trend on Bitcoin (BTC). If you don’t understand that first sentence, don’t worry, we’ll set the scene together. It all began with the arrival of the Ordinals protocol, finalised in January 2023, the idea of which is to enable data to be written immutably on Bitcoin.

This opened up a vast field of possibilities, the first of which was the creation of non-fungible tokens (NFTs). More recently, it has also led to the creation of a new token standard, the BRC-20. Since then, a wave of new tokens has appeared on Bitcoin, most of them memecoins (based on a joke or on nothing tangible).

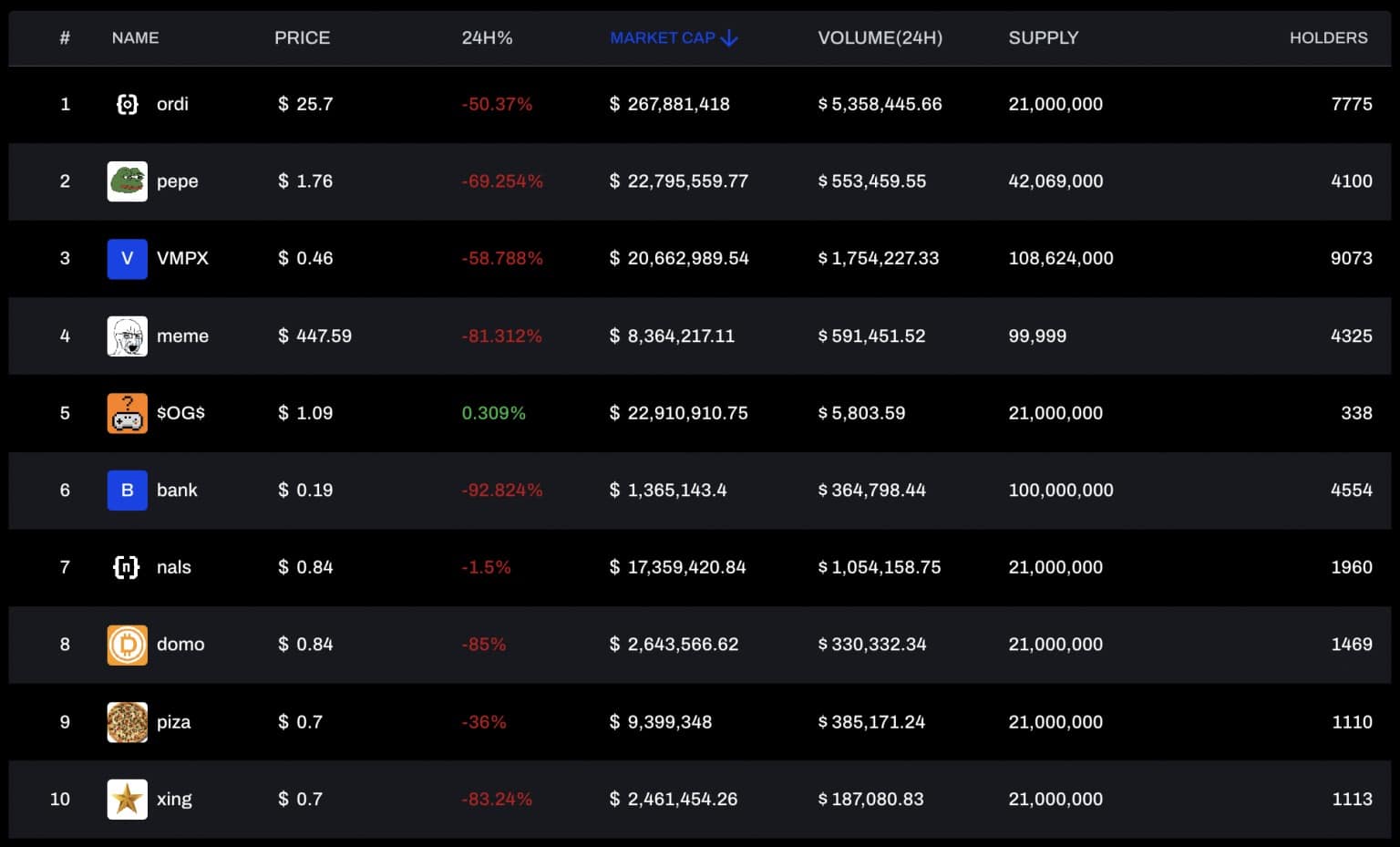

In the space of ten days or so, the trend set the community ablaze. According to data from the website Ordinals Analysis, the capitalisation of these tokens currently stands at $950 million. Some of the hottest tokens include ORDI, PEPE and MEME, whose prices have risen more than 100-fold since they were created a few days ago.

Nevertheless, the cryptocurrency market is a regular reminder that parabolic growth can last a very long time, but it always comes to an end. On Monday 8 May, the BRC-20 market corrected sharply, printing a drop of more than 50% in its capitalisation.

Major BRC-20 tokens fall on Bitcoin

A trend that’s dividing the Bitcoin community

While this meteoric trend has undoubtedly fired up memecoin enthusiasts, it has also sparked debate within the Bitcoin community. While some are warning of the risks associated with the Ordinals protocol and are even calling for a soft fork of the blockchain to ban it, others are pointing out the fundamental freedoms of Bitcoin.

In addition to the logical increase in the number of Bitcoin transactions, miners’ rewards have also risen drastically. This could be seen as bad news for regular users (fees are around $10 for a transaction). However, it also demonstrates the viability of the system as conceived by Satoshi, namely that the fees will offset the impact of halving.

As of 7 May, miners’ rewards reached 945 BTC, while fees represented 22% of this amount. For some blocks, they even surpassed the usual reward of 6.25 BTC. Whereas a block was worth around 6.5 BTC at the start of 2023, it is now worth between 9 and 12 BTC.

The sudden popularity of Ordinals has also led Binance to suspend BTC withdrawals. The platform suspended withdrawals twice in 12 hours due to a large volume of pending transactions. Still, we haven’t heard the last of Ordinals and BRC-20 on Bitcoin