The Bitcoin price surprisingly avoided a sell-off on Wednesday following the release of US inflation figures (CPI) for March. How is BTC coping with rising market interest rates and the risk of a second wave of inflation?

The market no longer has any faith in 3 rate cuts by the FED this year

The US CPI consumer inflation figure for March was eagerly awaited on Wednesday, and came in above expectations in both its underlying (most important) and nominal versions. There is clearly a debate about this CPI measure, which has been overheated since the start of the year, as it gives a representation of inflation that seems out of step with inflation observed in real time by far more direct sources.

For example, inflation in real estate rents is still at 5.7% in the CPI, whereas real estate websites and real estate indexes that give the price of rents observed in real time say that the rate of inflation in rents is already below 2%. Real estate accounts for 40% of the CPI calculation, so this discrepancy between CPI and real-time data is not an insignificant fact, and can be explained by the delay (several months) for data at a given point in time to be fed back into the CPI

There’s also this inflation in services which is rebounding in the CPI (due to a sharp rise in the price of car insurance) whereas direct sources (such as the Truflation application) in real time of the price of a wide spectrum of services describe the continuing disinflation in the price of services.

On the other hand, let’s not forget that the Federal Reserve (FED) uses the PCE price index to track inflation (and not CPI), and that the underlying PCE continues its downward trend according to the latest update.

In short, these multiple discrepancies may also be linked to an update in the CPI calculation methodology.

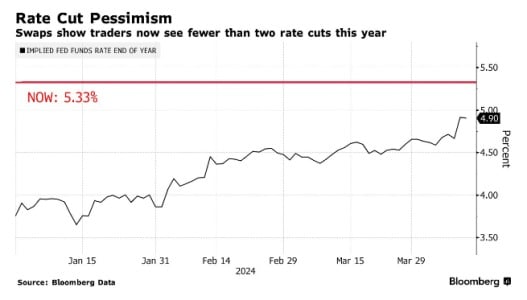

Ultimately, high finance is losing hope that the Fed will cut rates 3 times this year. According to the latest market expectations, only 2 FED rate cuts (at best) are expected in 2024.

Graph proposed by Bloomberg revealing the expectations of high finance regarding the evolution of the FED funds rate between now and the end of the year

Bitcoin shows surprising resilience to the fundamentals of traditional finance

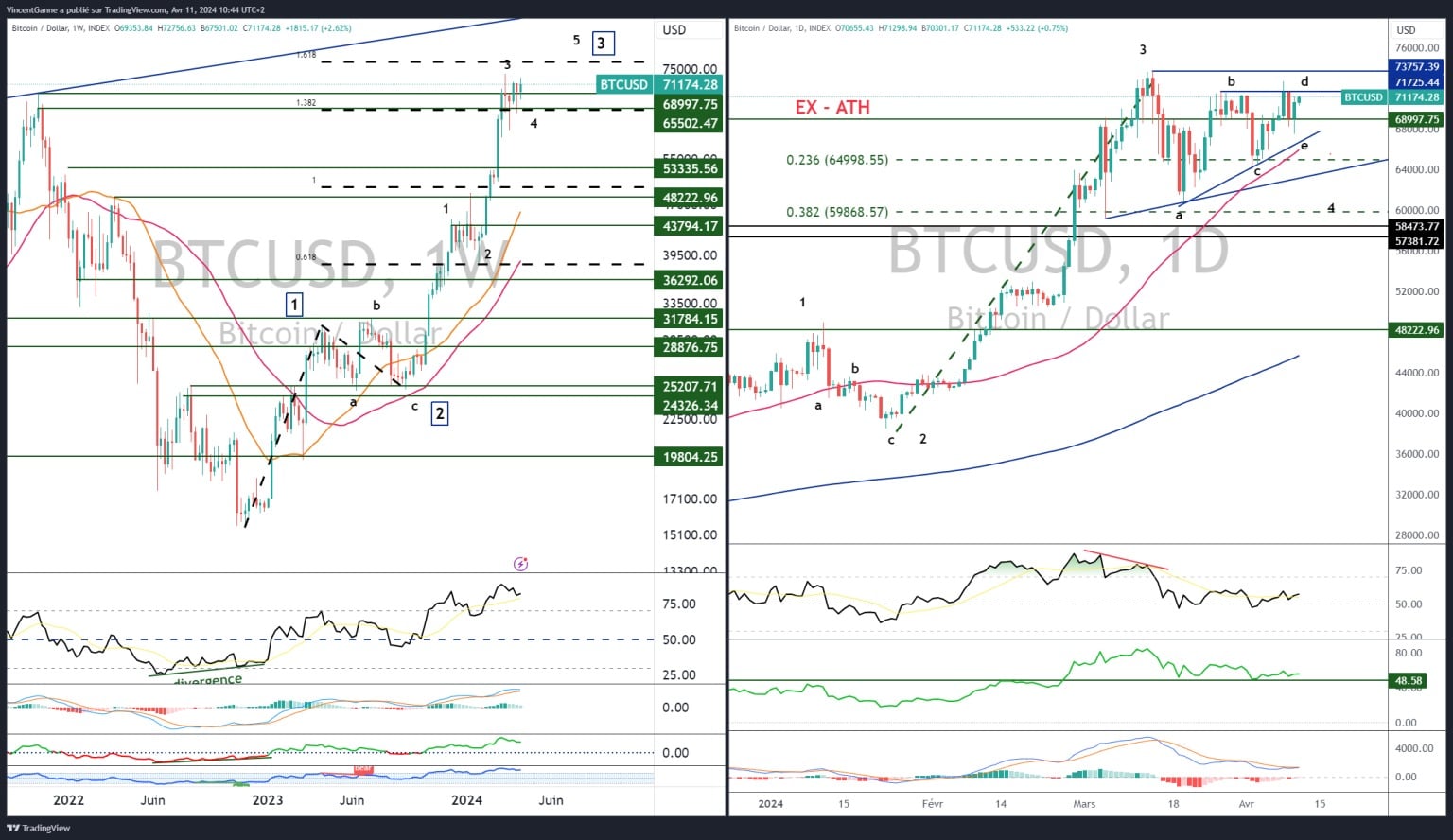

In terms of technical analysis, the technical analysis of the bitcoin price remains unchanged, with the market in a phase of lateral transition since March 15. This period of pause consolidates the vertical uptrend developed between late January and mid-March, and can take several forms and have several amplitudes before allowing a continuation of the underlying uptrend.

Chart created with TradingView showing weekly and daily Japanese candlesticks for BTC/USD