Bitcoin shows sudden vigor, surpassing $47,000 after a week of stagnation. This surge, of 4.5% in 24 hours, takes the cryptocurrency back towards the resistance encountered when Bitcoin spot ETFs were launched in the United States. With signs of slowing Grayscale exits and minor selling, the path seems to be clearing towards $50,000.

Bitcoin returns to the $47,000 mark

After a week of lethargy, the Bitcoin price has suddenly awakened to surpass $47,000, recording a 4.5% rise over the last 24 hours. It’s worth noting that most of the most highly capitalized altcoins are still lagging behind, with only a 1% or 2% rise over the same period.

With a return above $47,000, Bitcoin is back to testing the resistance it encountered when spot ETFs were launched on the US market on January 11. At that time, its price had fallen by almost $5,000 in 24 hours, before hovering around $42,700.

Bitcoin price evolution from the end of December 2023 to today

Since their launch, Bitcoin spot ETFs have attracted over $8 billion in capital, while Grayscale has seen $6 billion flow out of its famous GBTC. In fact, this is the first encouraging sign of a new upswing for Bitcoin: while Grayscale used to sell massive amounts of Bitcoin daily in response to these outflows, they seem to be running out of steam and now account for less than $100 million a day, compared with almost $700 million in the early days.

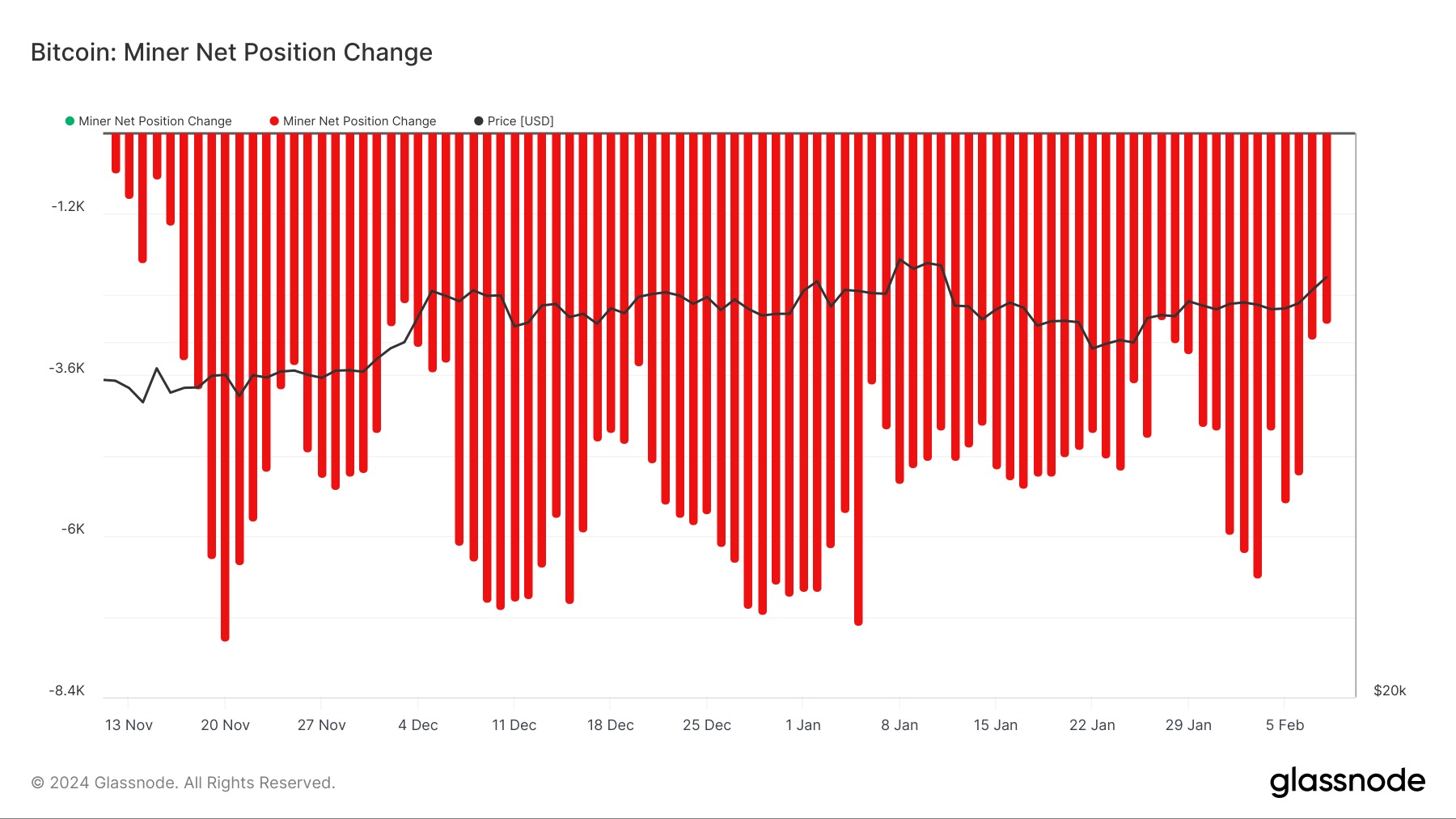

Next, we can observe that the proportion of Bitcoins sold by miners in recent days has dropped considerably. As CryptoQuant pointed out in a recent report, daily sales by Bitcoin miners have fallen from 800 BTC during November and December to 300 today.

Evolution of Bitcoin supply held on addresses associated with miners

The combination of these events sets the stage for a possible rise towards $50,000, as our analyst Tagado pointed out this morning. It’s also worth noting that even though activity on the Bitcoin network has dropped considerably (due to registrations), and therefore miners’ revenues have also fallen at the same time, miners seem to prefer to hold on to their BTC.

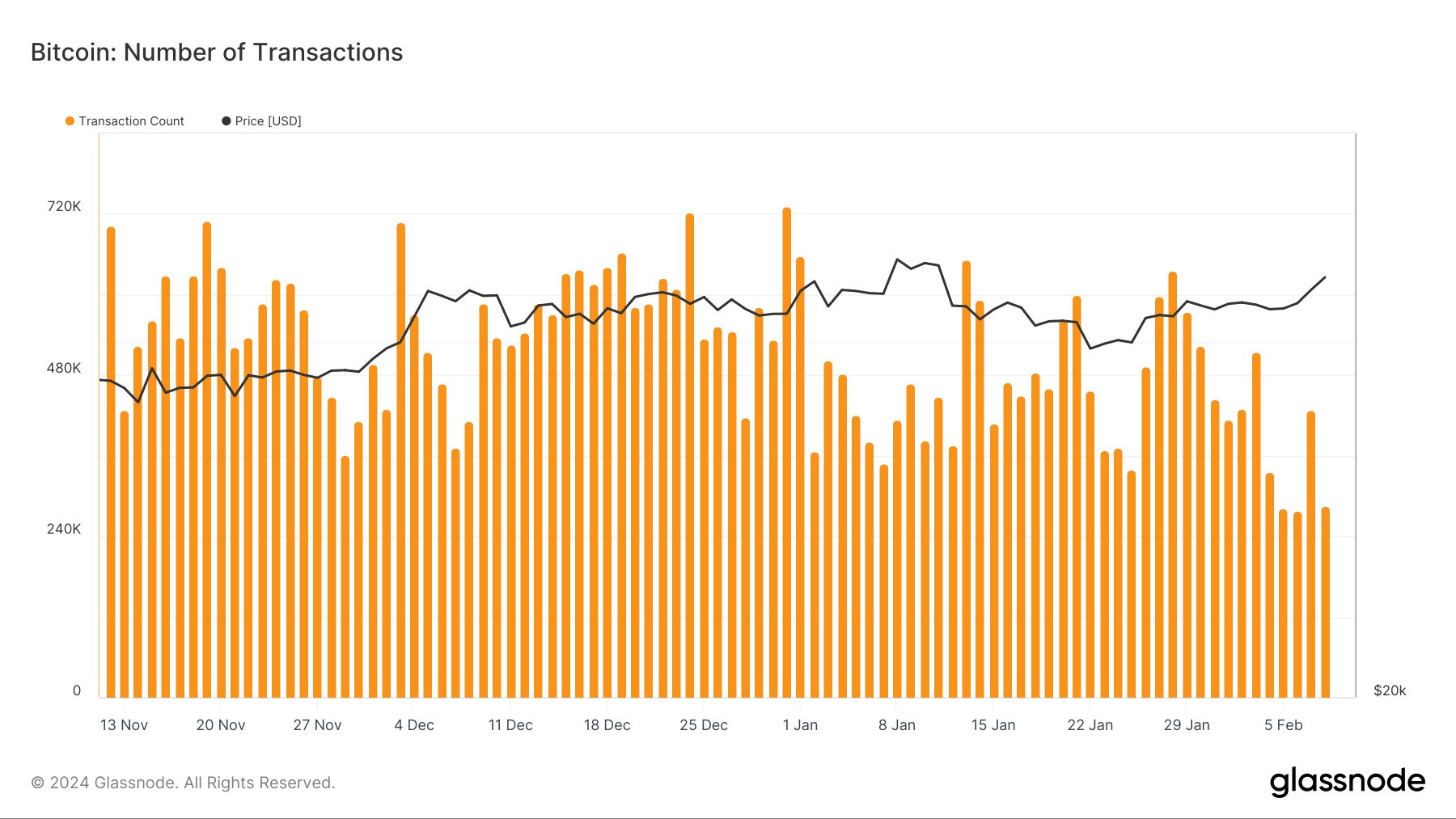

Number of daily transactions on the Bitcoin network (over the last 3 months)

While the number of Bitcoin transactions peaked at over 731,000 on December 31, 2023, this number has fallen below 300,000 for several days now.

On the liquidation side, $137 million worth of positions have been wiped out over the past 24 hours, according to Coinglass data.

As our analyst Vincent Ganne noted earlier today, Bitcoin’s recent rise coincided with the new record set by the S&P 500, which surpassed 5,000 points for the very first time.