Another success for Yuga Labs: all non-fungible tokens (NFTs) for its upcoming “Otherside” metaverse were sold in just 3 hours, generating over $318 million in the first sale. However, the Ethereum network (ETH) became congested, and buyers faced exorbitant transaction fees.

The colossal success of NFTs “Otherside “

This weekend saw the sale of non-fungible tokens (NFTs) representing parcels of the Bored Ape Yacht Club’s (BAYC) future metaverse, “Otherside”.

As with all of the projects developed by Yuga Labs (the creators of the BAYC) so far, it has been a great success. A total of 55,000 NFTs were mined at a single price of 305 ApeCoin (APE). The price of the ApeCoin was around $19 at the time, so a parcel was worth around $5,800 when the sale started.

Buyers did not delay: all the plots were sold in just 3 hours.

It should be noted that in order to be eligible to purchase a plot, prospective buyers were required to complete a “Know Your Customer” (KYC) procedure to verify their identity and have their portfolio approved.

The sale alone raised a whopping $318.7 million for Yuga Labs. At the time of writing, the secondary market for this new collection has already generated over $328 million.

In other words, adding up the initial sale and the secondary market sales, the operation has generated over $560 million over 24 hours.

Also, after the mint which took place this weekend, BAYC and Mutant Ape Yacht Club (MAYC) holders will be able to receive one parcel completely free of charge, 45,000 of the total 100,000. A reward in line with all those obtained in the past for all lucky BAYC holders: a loyalty and reward model that works.

An Ethereum network saturated and fees exploding

However, the sale of these plots has literally blown up the usually high transaction fee counters due to the number of simultaneous transactions.

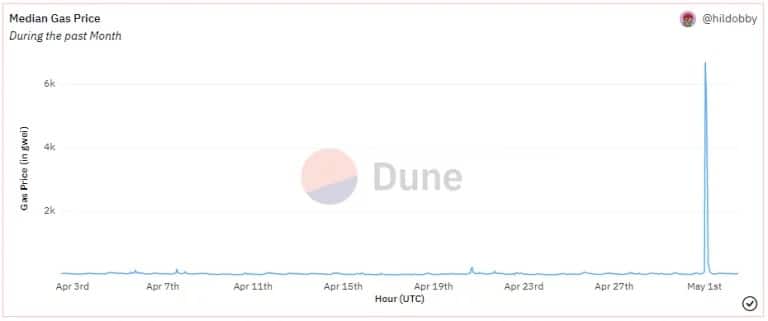

Average transaction fees on Ethereum, 30 day period

This phenomenon, called “gas war”, occurs on blockchains running on Proof of Work (PoW) consensus like Ethereum, when a sudden and considerable increase in the number of transactions occurs. Transaction costs increase mechanically as a result of the network overload.

The average price during long hours after the mint was above 6,000 gwei (the name of the gas on Ethereum), which is 100 to 200 times higher than in normal times. Users reported extremely high transaction fees, sometimes as high as $14,000.

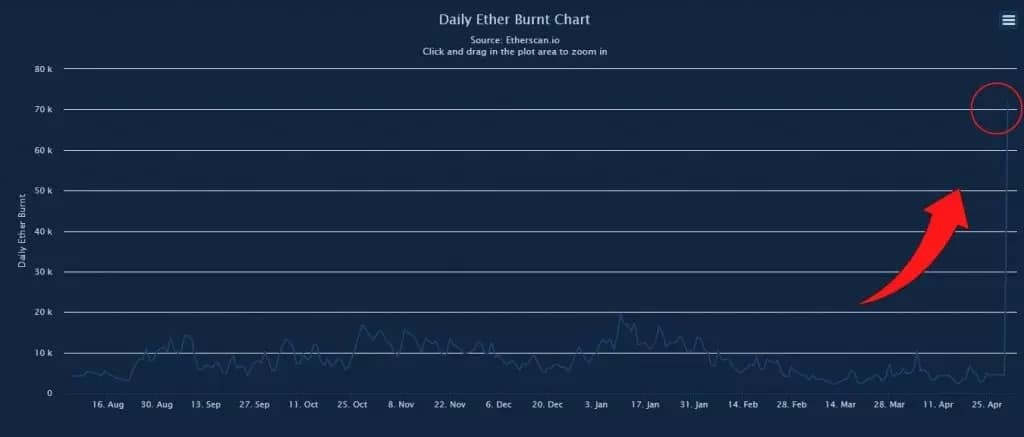

In total, according to on-chain data, the sale of parcels in the Otherside metaverse would have cost more than 71,000 ETH in transaction fees alone, or nearly $200 million. This is as much ETH that has been burned, and permanently removed from the network’s liquidity.

Ethers burned daily

Reactions were not long in coming

Following the exorbitant transaction fees, many buyers complained about the situation. According to Will Papper, the co-founder of SyndicateDAO, a very large part of the transaction fees could have been saved with a few “simple” measures

Nearly $100M has been spent on gas for the BAYC land sale in one hour. This is money that could have gone to Yuga or stayed in user’s pockets.

The contract had nearly zero gas optimizations. I’ll explain a few gas optimization tricks that could have saved many millions below pic.twitter.com/CsYvWdEQKc

– Will Papper ✺ (@WillPapper) May 1, 2022

Some of the affected users complained about the high fees and slow network during the sale, while others criticised the writing of the smart contract or the mint policy.

For Vitalik Buterin, the co-founder of Ethereum, a different writing of the contract would not have changed anything though:

I don’t think optimising the contract is useful. Whatever the details of the contract, the transaction fees increase until the listing price + transaction fees = the market price. If gas consumption per purchase had decreased by 2x, the equilibrium gas price would have been just ☻12000 gwei instead of 6000. “

In any case, Yuga Labs admitted its mistake and said that the optimal solution for the future of the project would be to have its own blockchain :

” This is the largest NFT mint in history in many ways, yet the gas used during the mint shows that the demand far exceeded the wildest expectations. The scale of this mint was such that Etherscan crashed. It seems quite clear that ApeCoin will have to migrate to its own chain in order to scale properly. We would like to encourage the DAO to start thinking in this direction. “

Without specifying how, the Yuga Labs team indicated that all transaction fees would be refunded to those impacted by this inconvenience.