Despite successive announcements about its institutional, entrepreneurial, and governmental adoption, Bitcoin remains stuck at around $100,000. Could this be linked to a discreet but persistent sell-off by large BTC holders?

Bitcoin: a major power shift underway

As summer approaches, Bitcoin is showing clear signs of a lack of volatility. This observation, made by many analysts, raises a number of questions, given the unprecedented institutional adoption that has accelerated significantly since the beginning of the year.

Bitcoin is now a popular asset in all traditional financial portfolios, to the point of becoming a strategic option for governments around the world. At the same time, the price of BTC has remained stuck below $110,000 since breaking through this decisive threshold at the end of last year.

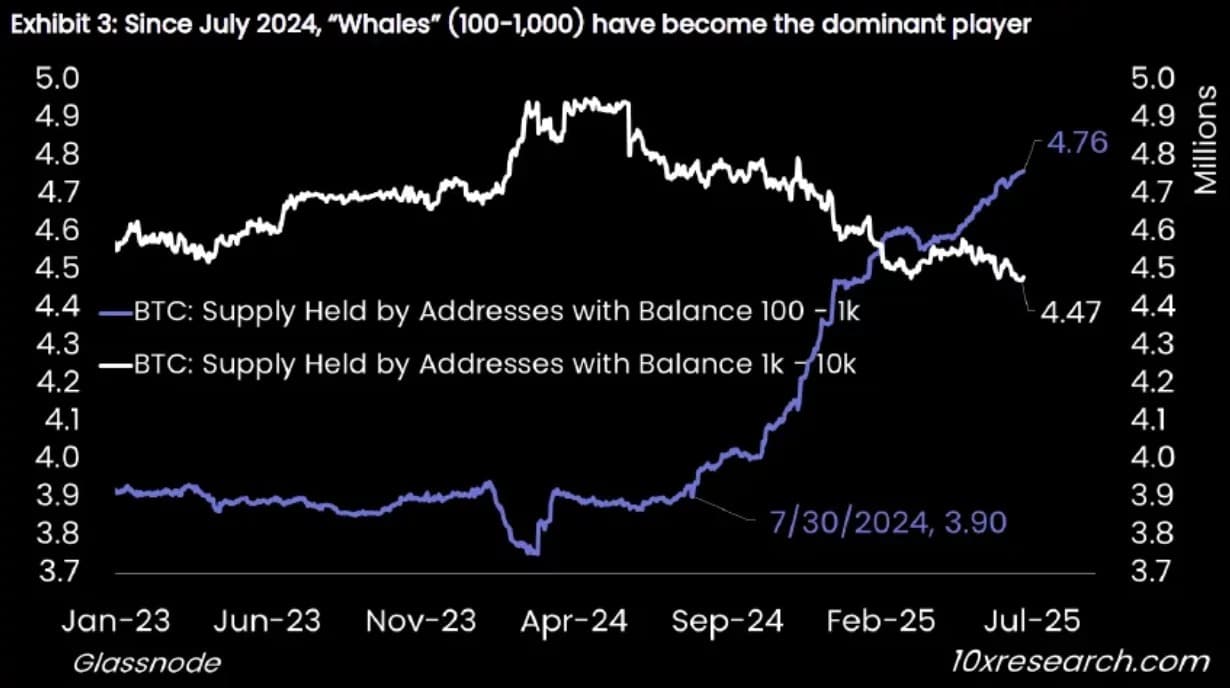

This paradoxical situation is highlighted in a Bloomberg article on what is identified as a “major power shift” within Bitcoin. And with good reason, because behind the media hype, a massive sell-off appears to be quietly taking place among large BTC holders, such as mining companies, offshore funds, and anonymous wallets known as whales.

Over the past year, Bitcoin whales have offloaded more than 500,000 BTC — worth more than $50 billion at current prices — according to data compiled by 10x Research. That’s roughly equal to the net inflows into spot ETFs in the US since their approval.

Bloomberg

Towards a reduction in BTC volatility

This activity appears to be unprecedented. Indeed, large BTC holders are no longer content with simply selling their funds. They are “converting their BTC into exposure to the stock market,” according to Parataxis Capital co-founder Edward Chin.

At the same time, institutions such as ETFs and Strategy now control around a quarter (4.8 million units) of all bitcoins in circulation. This is estimated to represent nearly 900,000 BTC absorbed over the past year, as historic whales turn to new horizons.

As a result, Rob Strebel, head of relations for trading firm DRW, speaks of a Bitcoin value that is “less aberrant and more established as a legitimate asset class.” But this comes at the obvious cost of a “compression of volatility” that is already well underway.

However, the stability gained through billions of dollars of institutional purchases could have a perverse effect. These transactions are currently allowing whales to find the long-awaited exit ramp for their digital fortunes. Nevertheless, this increases the risk for individual investors of having to bear the brunt of the next bear market alone.