Since its launch, BlackRock’s IBIT spot Bitcoin ETF has been an unprecedented success. This historic development now eclipses the revenues of its flagship fund dedicated to the S&P 500 index.

Spot Bitcoin ETF: BlackRock’s goose that lays the golden eggs

The approval of spot Bitcoin ETFs on the US stock market in January 2024 has definitively changed the game for the cryptocurrency sector… but also for traditional finance. Indeed, this regulatory validation has become the starting line for a massive influx of institutional investors and other publicly traded companies.

This paradigm shift has quickly established BlackRock, the world leader in asset management, at its center. Its iShares Bitcoin Trust (IBIT) fund is breaking all records in the field, becoming the fastest ETF to reach $70 billion in assets under management.

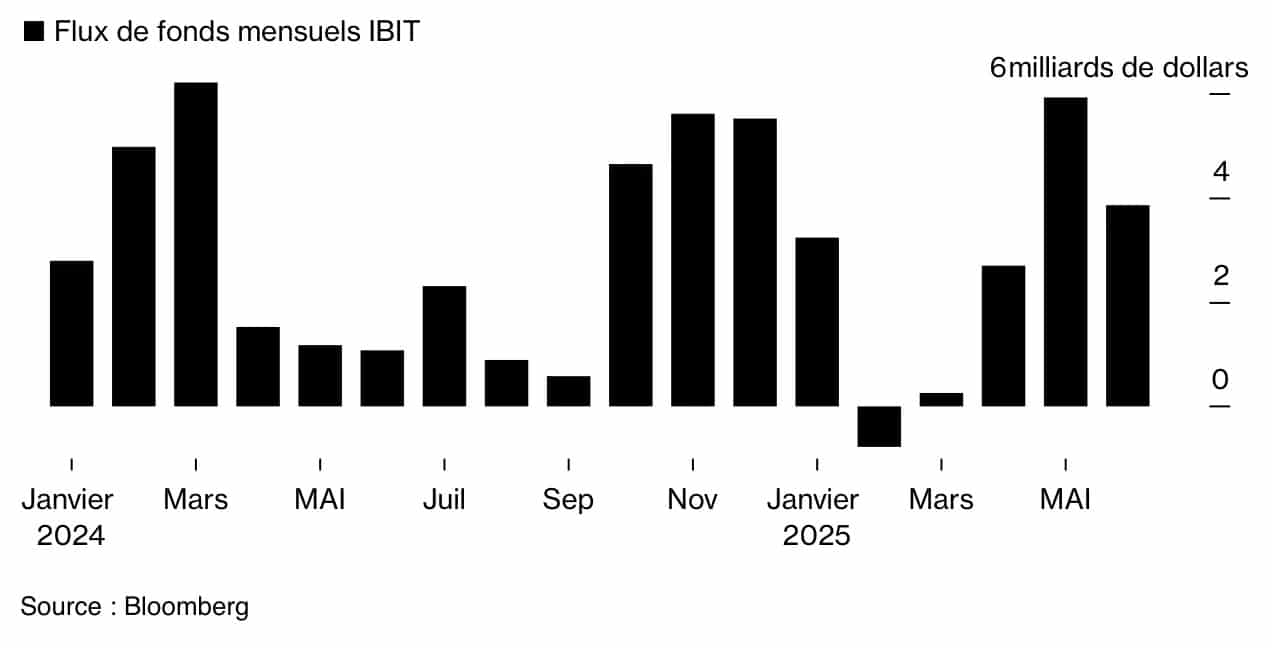

Since its launch a year and a half ago, the IBIT fund has recorded only one month of negative inflows, in February of this year. The rest of the time, its inflows have been in the billions of dollars, to the point where it alone accounts for almost 80% of the market share.

This situation was highlighted by Bloomberg in a detailed article on the subject. The reason for this renewed interest? BlackRock’s Bitcoin spot ETF has just set a new record, smashing the revenues of its flagship iShares Core S&P 500 (IVV) fund, the third largest ETF on the US market.

IBIT: more profitable than the S&P 500 (IVV) fund

The information comes from a calculation made by Bloomberg analysts on July 1. On the one hand, the IBIT fund generates approximately $187.2 million in annual fees for BlackRock, with fees of 0.25%. On the other hand, the iShares Core S&P 500 ETF (IVV) posted a slightly lower result of $187.1 million, but with total assets under management nine times higher ($624 billion) and ridiculously low fees of around 0.03%.

Bespoke Investment Group co-founder Paul Hickey explains this situation by the ETF’s ability to meet “pent-up demand” from investors. They can now gain direct exposure to BTC without having to find roundabout ways, such as investing in crypto companies, whose rise is increasingly worrying analysts.

This demonstrates the scale of pent-up demand from investors looking to add Bitcoin to their overall portfolio without having to open a separate account elsewhere. It also illustrates Bitcoin’s leadership in the cryptocurrency space, where its perceived utility as a store of value has left others far behind.

Paul Hickey

BlackRock’s iShares Bitcoin Trust (IBIT) is now among the top 20 ETFs by trading volume, according to Bloomberg Intelligence. This is a market with no fewer than 4,300 funds available on the US market. There is no reason to believe that this trend will reverse.