Following in the footsteps of several Grayscale investment funds, the Solana-exposed GSOL (SOL) has recorded a significant premium. In fact, the asset is trading OTC at 10 times its real price

The price of Grayscale’s Solana fund explodes upwards

While we reported last week on the impressive premium that Grayscale’s Chainlink Trust (GLNK) was recording over its real price, one of their investment products is far surpassing it: the Solana Trust (GSOL).

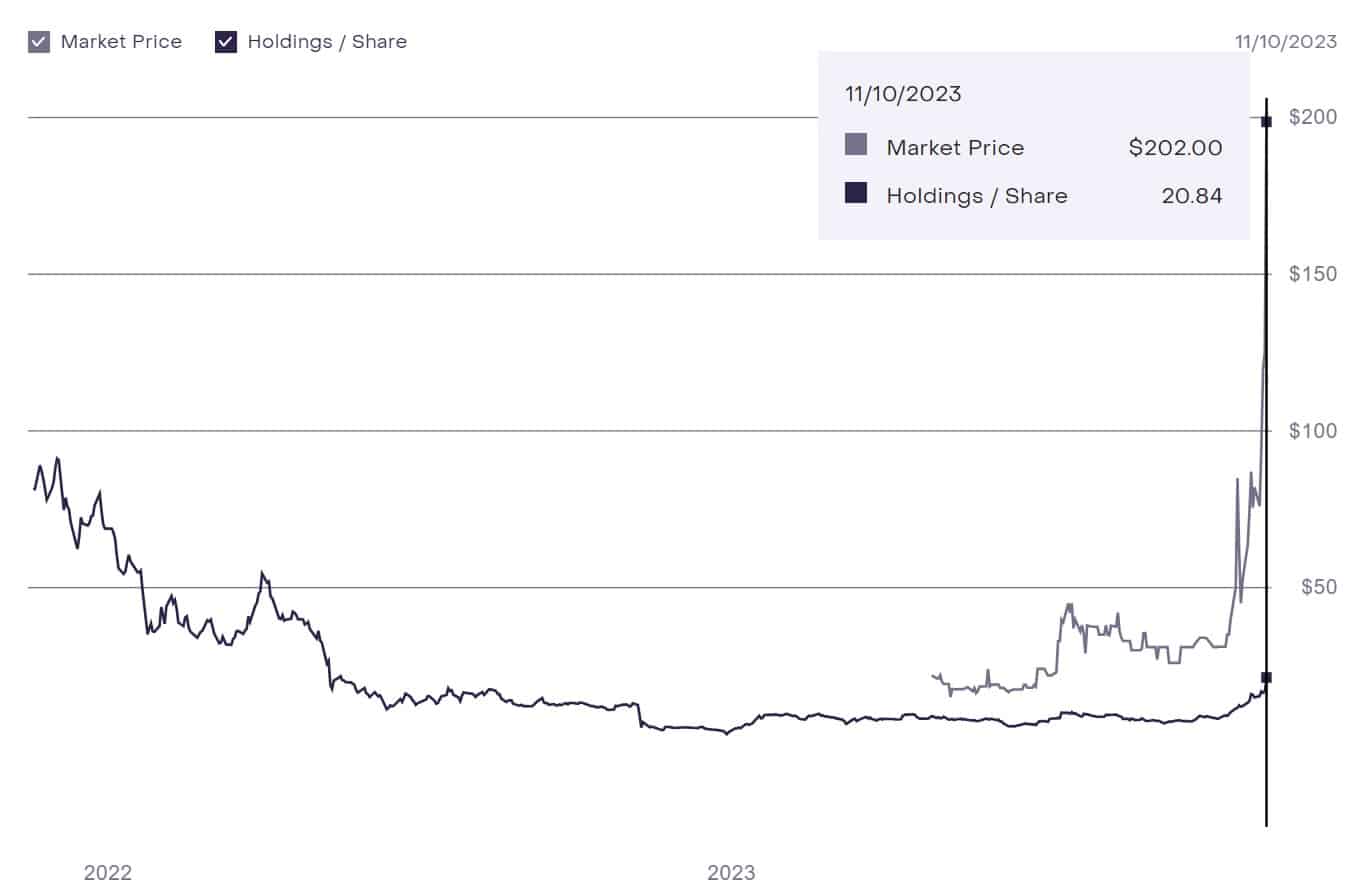

And with good reason: while a unit of this fund was valued at $20.8 per unit during Friday’s session, its over-the-counter (OTC) price was $202:

Comparison of a unit of Grayscale’s GSOL fund against its OTC price

Here again, we can find the same causes as for GLINK, namely lower liquidity and above all the fact that Grayscale is not buying back said contracts, which could lead to arbitrage opportunities on the OTC market. In terms of liquidity, GSOL currently has $6.34 million in assets under management.

Speaking more specifically of Solana’s SOL, if we note an 85% rise in one month just ten days ago, the asset has since risen a further 35%, and now trades at $57.9 per unit. SOL is now in 6th place in the CoinGecko ranking, with a capitalization of $24.46 billion.

This recent rise may have reawakened the appeal of SOL to institutional investors, who are choosing to gain exposure to it through Grayscale’s GSOL. However, it’s important to remember that, while this price lag can occur on the upside, the opposite effect is just as possible.

On this subject, GBTC continues to catch up, as the arrival of an ETF conversion becomes clearer. It is now trading at a 10.3% discount to OTC