CCIP, Chainlink’s inter-blockchain communications protocol (LINK), is gradually being put to use in real-life conditions. Let’s take a closer look at the use cases for this solution, which is attempting to respond to some of the major challenges facing the ecosystem

Chainlink’s CCIP protocol (LINK) officially arrives in mainnet

Chainlink Cross-Chain Interoperability Protocol (CCIP) is the inter-blockchain communication solution from Oracle’s renowned supplier. Still in development, Chainlink has announced that projects that have already taken part in test phases will be able to start operating under real conditions with early access during the summer.

However, CCIP has already been integrated into mainnet solutions with players such as the Synthetix liquidity protocol (SNX), Aave through its governance module, and even SWIFT, in an institutional communication network between private and public blockchains involving BNP Paribas, BNY Mellon and Lloyds Banking Group.

At the same time, Chainlink’s inter-blockchain communication protocol will be open to all developers from 20 July, on the following testnets:

- Arbitrum Goerli;

- Avalanche Fuji ;

- Ethereum Sepolia ;

- Optimism Goerli ;

- Polygon Mumbai.

The need for blockchains to communicate with each other

With the explosion in the number of blockchains, including scaling solutions such as layer 2, communication between all these networks is one of the major challenges facing the ecosystem.

Numerous bridging solutions exist, experimenting with various technologies in an attempt to provide the best possible response to these challenges. Chainlink, for its part, seems well positioned, particularly with its proven Oracles solutions, on which CCIP relies:

CCIP is powered by Chainlink’s decentralised oracle networks, which have a proven track record of securing tens of billions of dollars and enabling over $8 trillion in blockchain transaction value. Because CCIP is built on the same foundation as existing Chainlink services, it requires little or no additional trust assumptions. “

The use cases for CCIP are varied, it can be used for example in lending and borrowing applications offering the possibility of depositing collateral on one blockchain in order to borrow on another. An application in account abstraction solutions would also make it possible to sign transactions on any blockchain from a single wallet.

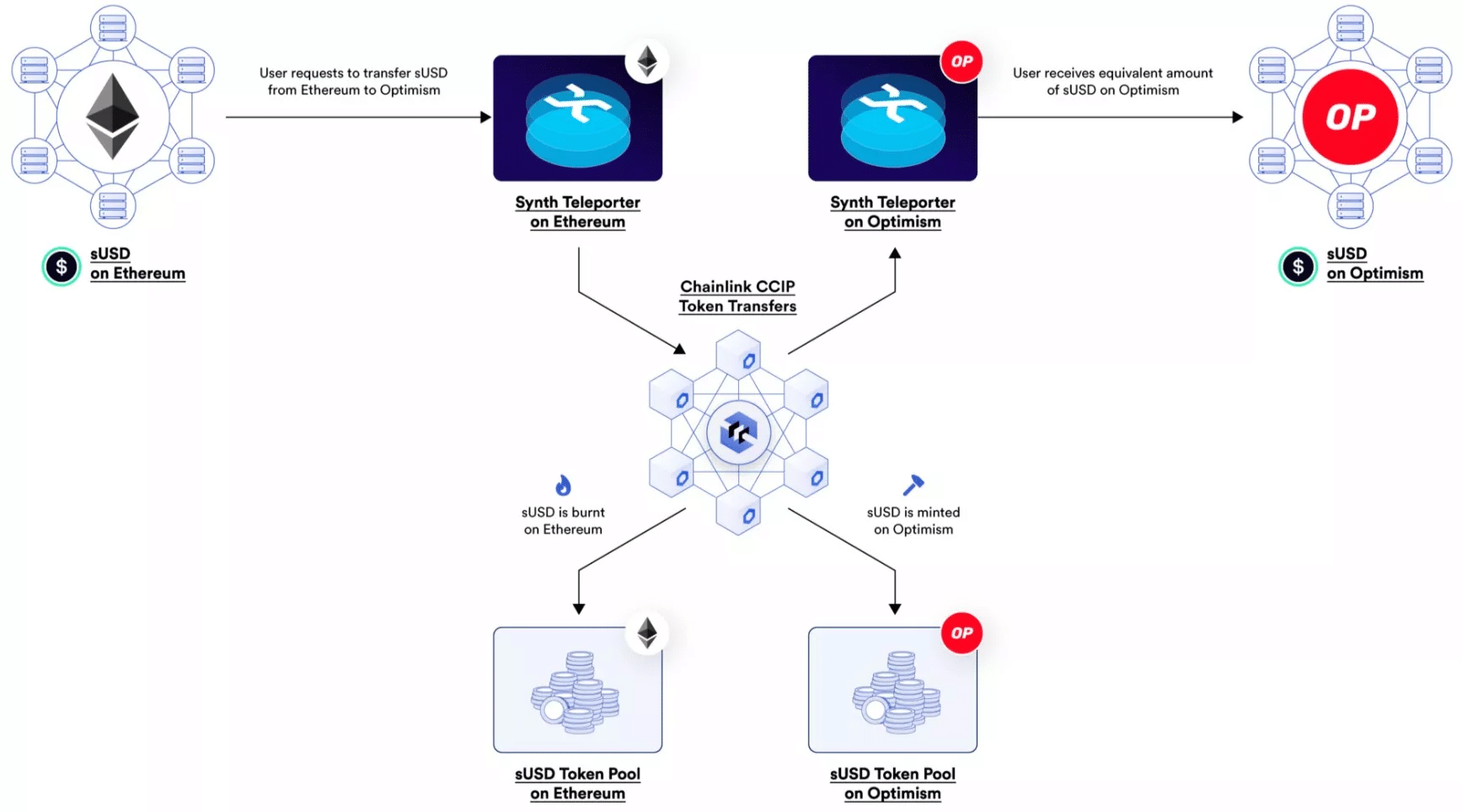

For its part, Synthetix uses CCIP to move cash efficiently between different networks. The illustration below shows a transfer of sUSD between Ethereum (ETH) and Optimism (OP), burning assets on one side and mining them on the other:

CCIP use case within Synthetix

As for the price of LINK, it has risen by around 10% in less than 24 hours at the time of writing, for an increase of just under 30% since the start of the year.