The BNB Chain has just broken a historic record with more than $311 billion traded in one month on its DEXs.

But behind this staggering figure lies a much murkier mechanism: artificially inflated volumes, traders with no real exposure, and an airdrop hunt orchestrated down to the smallest detail.

In the ultra-competitive world of the crypto industry, attention is key. Without it, even the most solid project risks going unnoticed. And in this context, impressive figures are a powerful lever for attracting attention. If there is one player that seems to have perfectly understood this logic, it is Binance — or more precisely, its blockchain: the BNB Chain.

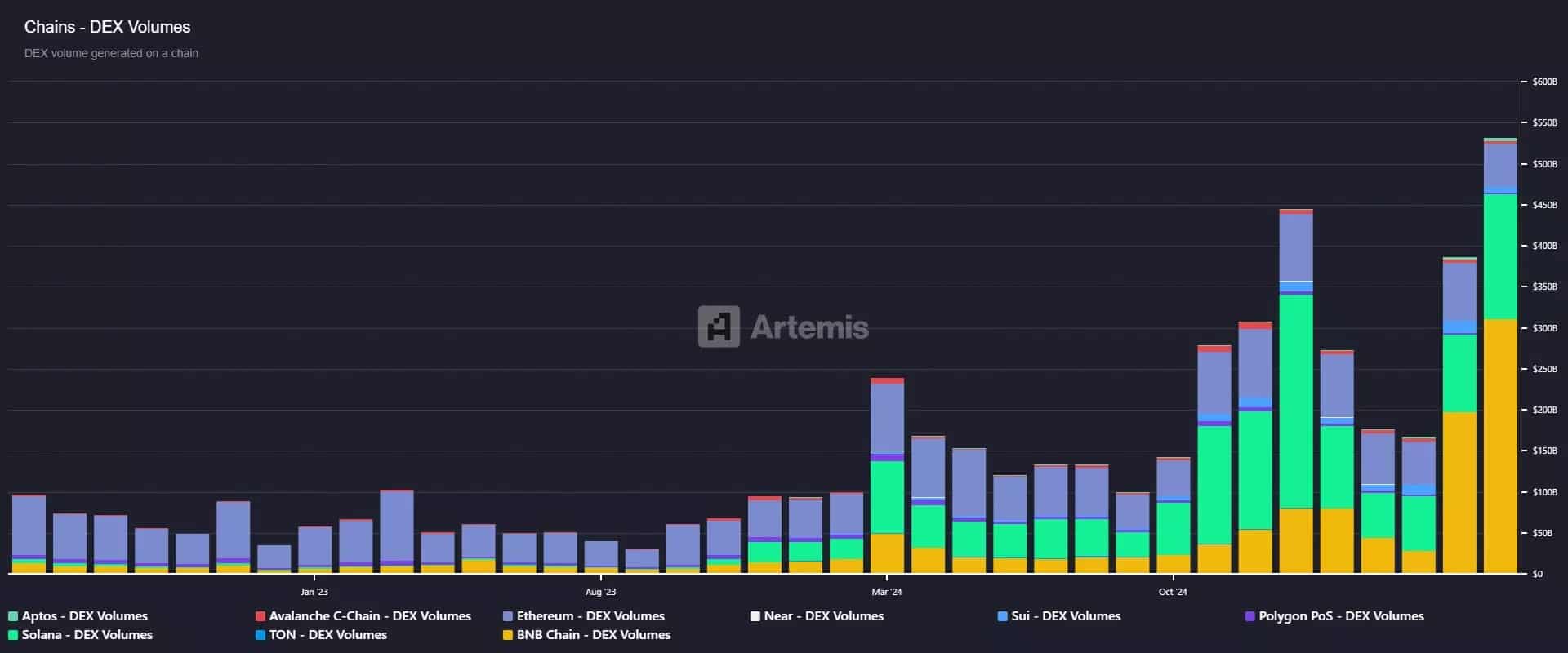

The BNB Chain has just broken a record—across all blockchains—by recording $311.6 billion in volume on its decentralized exchanges (DEX) in one month:

Even the Solana blockchain, which was at the center of the memecoin craze last January, had only reached “around” $260 billion in volume on its DEXs.

The BNB Chain’s flagship DEX, PancakeSwap, stands out with over $238 billion in volume over the same period (May 25 to June 25): once again, an all-time high. By comparison, Raydium, the leading DEX on Solana, peaked at $201.8 billion in volume last January:

Despite these staggering figures, it seems that these volumes are not organic. On the contrary, they appear to be ”artificial,” boosted by a financial incentive mechanism that is not sustainable in the long term.

Where do these confusing volumes come from?

As we mentioned at the beginning of this article, attention is key in the crypto industry. While Changpeng Zhao (the founder of Binance) attempted to shine the spotlight on the BNB Chain a few months ago by half-heartedly encouraging the launch of memecoins, the initiative had rather limited effects. Nevertheless, another initiative from Binance has borne fruit: Binance Alpha 2.0. While the first version required the use of the Binance wallet (non-custodial), the latest version is directly integrated into the interface of the famous exchange. This is a significant feature in terms of user experience for beginners. Binance Alpha allows trading on cryptocurrencies that are too small to be listed directly on Binance. Launched on March 18, the Binance Alpha program includes an airdrop mechanism and fees sponsored by the exchange (until September).

The principle behind this system is quite simple: earning Alpha points makes you eligible for airdrops. To earn Alpha points, you need to trade (i.e., generate volume) or simply hold certain assets. But as with many systems, there is a flaw. And some users have identified this flaw perfectly in order to exploit it.

The reality behind Binance Alpha

The explosion in volumes on the BNB Chain hides a reality that is more complex than the raw figures suggest. An in-depth analysis of on-chain data reveals unusual trading patterns that perfectly illustrate how some airdrop hunters are “hacking” the incentive systems.

The case of the Bedrock (BR) cryptocurrency is particularly telling. This token has become the most traded on PancakeSwap with over $3 billion in volume in 24 hours. But behind these impressive figures lies a well-oiled machine: analysis reveals simultaneous trading activity on both sides of the market (buying and selling), generating huge volume while maintaining a net exposure close to zero.

This situation is not the result of chance but of a deliberate strategy: executing trades that generate maximum volume while avoiding real exposure to the market.

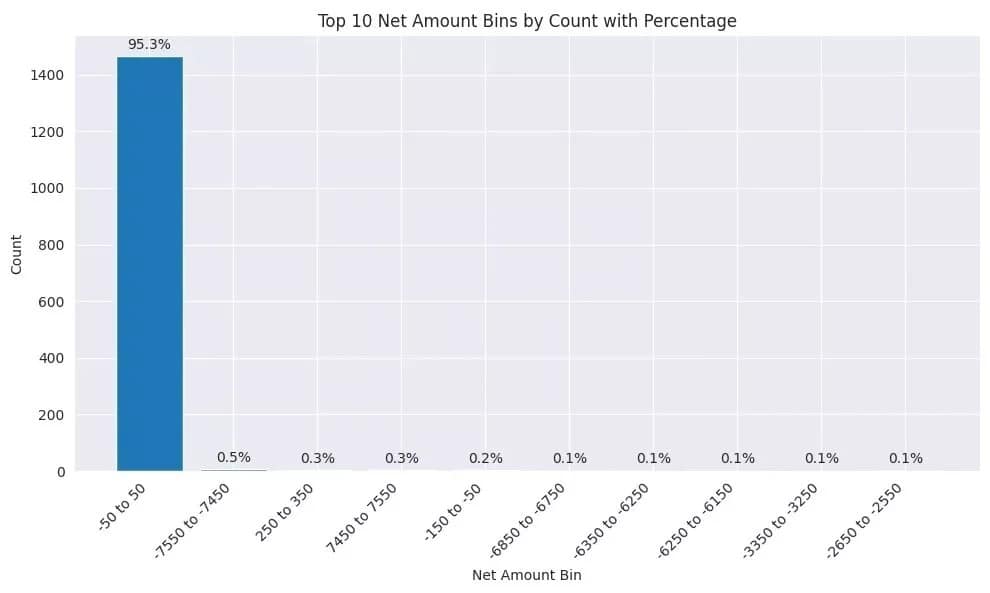

Even more revealing, more than 95% of the portfolios involved in trading this token have a net position close to zero. The objective was clearly to avoid any exposure while generating Alpha points:

The sophistication of this approach does not end there. Analysis reveals that almost all portfolios generated precisely between 14 and 20 Alpha points, never 13 or 21. This uniformity is not accidental; it suggests that airdrop hunters studied Binance Alpha’s documentation and identified an optimal threshold to achieve.

Furthermore, the cost of this strategy is remarkably low: approximately 5 to 10 cents per Alpha point generated. By executing trades in both directions, often in the same block or a few blocks apart, traders minimize their losses while maximizing their points.

Short- and long-term implications

This incentive engineering by Binance Alpha illustrates a fundamental principle: some users will always seek to “solve” the system to get the maximum rewards with minimal effort.

In the short term, this strategy generates the spectacular activity that BNB Chain is looking for, but it raises important questions about the quality and sustainability of this artificial liquidity.

The long-term risk is twofold: on the one hand, this activity can distort the ecosystem’s on-chain metrics, giving an impression of dynamism that does not reflect reality.

On the other hand, once the financial incentives are reduced or the airdrop opportunities are exhausted, this artificial volume is likely to collapse, revealing the true volumes of the BNB Chain.

For now, the volumes on the BNB Chain do not seem to be pushing its native cryptocurrency to new heights: the price of BNB has fallen by 5% over the last 30 days. The price of CAKE, the cryptocurrency of the PancakeSwap platform, is not faring any better, down 21% over the same period.